Why Bitcoin will be bigger than you think

What if thinking about bitcoin in the context of gold is like thinking about Uber in the context of taxis? Bitcoin's competition is not gold. It is non-consumption.

This article is the third in a three part series that explores gold and bitcoin in detail as products, including who the customers are for gold and bitcoin, what jobs gold and bitcoin do for them, and a perspective on the future markets for gold and bitcoin.

What everybody ought to know about gold and bitcoin

- Part 1: Gold as a product

- Part 2: Bitcoin as a product

- Part 3: The future for gold and Bitcoin (this post)

On July 1, 1979, SONY released the Walkman. Initial sales were disappointing, and the industry laughed at it because the sound quality was so poor compared to high-end speaker systems. But Walkman went on to be one of Sony's most successful brands of all time, selling almost 400 million portable music players. Walkman was never intended for the small number of people buying high-end speakers. Walkman enabled a much larger number of people to listen to music in places they never could have previously. In other words, Walkman's competition was never high-end speakers, it was non-consumption.

On January 9, 2007, Steve Jobs announced the iPhone. There was no app store at the time, and people forget how many negative reviews it received. Because it was such a poor actual phone, many early adopters actually carried an iPhone in addition to their regular cell phone. Steve Ballmer said "There’s no chance that the iPhone is going to get any significant market share." So how did iPhone become Apple's most successful product ever, selling 2.2 billion units as of November 1, 2018, and extracting much of the profit from the wireless value chain that previously went to carriers? When iPhone launched, there were no smartphones that had web browsing and media consumption that people could actually use. The real competition for iPhone was non-consumption.

Uber was founded in 2009. When they were first raising money, many investors passed because they didn't think that the taxi market was big enough. But that was the wrong way to think about it. Uber's primary competition was not taxis, but non-consumption. And Uber ended up massively expanding the total market for rides.

What does all this have to do with gold and Bitcoin?

Similar to the products above, there have been no shortage of Bitcoin detractors since its launch on January 3, 2009. Bitcoin has no intrinsic value. It does not have alternative uses like jewelry or industrial applications. And gold has had thousands of years to entrench its position in the world. How could bitcoin ever replace gold?

But what if this bitcoin versus gold debate is a false dichotomy?

What if the "bitcoin is digital gold" narrative is incomplete or misleading? What if thinking about bitcoin in the context of gold is like thinking about Uber in the context of taxis?

Bitcoin enables a larger group of people than ever before to protect their savings and purchasing power. It does not do everything gold does. It doesn't need to.

Bitcoin's main competition is not gold. It is non-consumption.

Walkman, iPhone and Uber all seemed like toys when they were first launched. And though they may have been "inferior" products, that didn't matter because they were being sold to different customers. Over time, each product got better and better, and people began to trade down because the product was good enough and saved them money. In time, the new "inferior" products actually became better than the incumbents. And the incumbents shrank or disappeared.

But does this apply to Bitcoin? Is Bitcoin getting better? Isn't it the same now as when it launched in 2009?

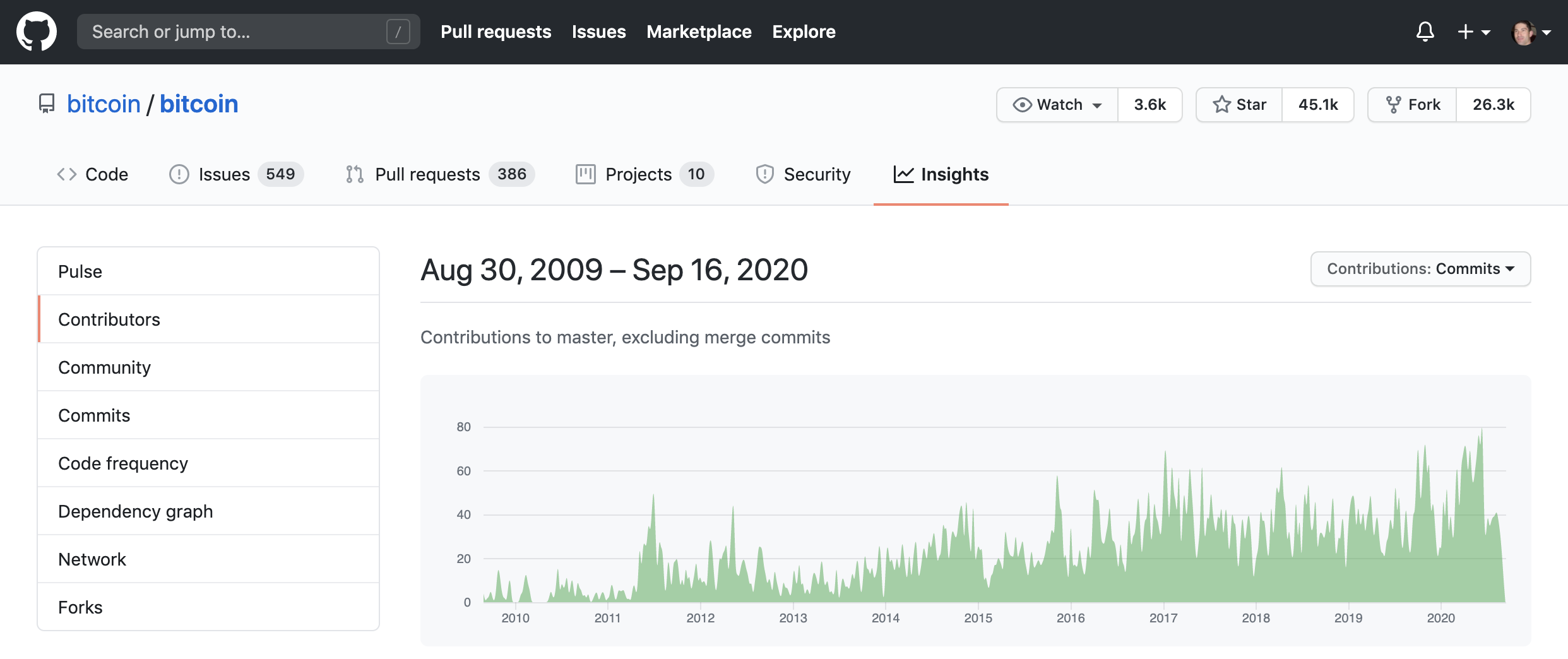

Looking at the Bitcoin software project on Github we can see that it receives thousands of additions and deletions each week, and has received a steadily increasing number of contributions to master from 2010 to 2020.

Why is Bitcoin constantly being worked on and improved, even though it has no parent organization like Sony, Apple or Uber to push it forward?

Bitcoin works because it is a special kind of product. It's a multi-sided network.

Interaction between participants in the network creates incentives that drive the project forward. These network effects are why we see contributions to the Bitcoin project on Github growing at an increasing rate.

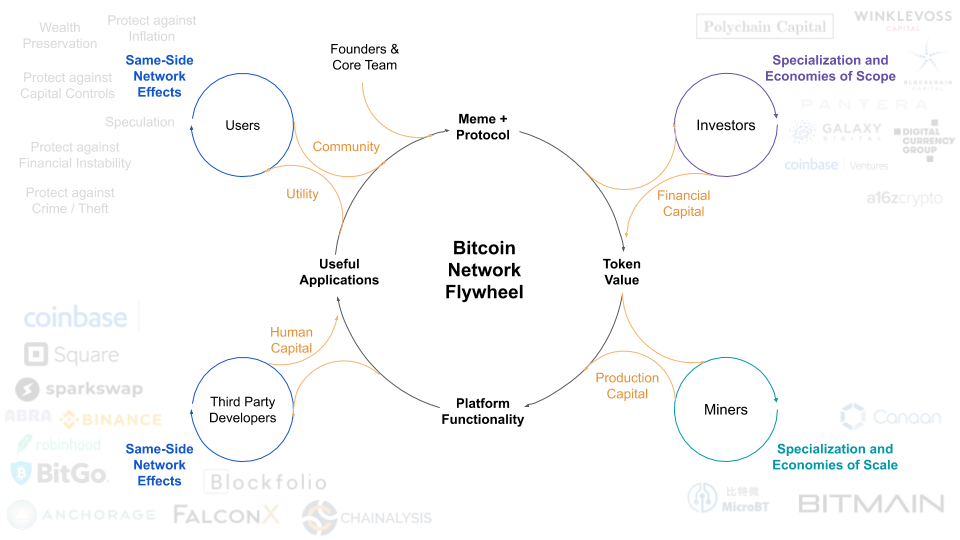

Let's map out the network flywheel¹ for Bitcoin and drop in the jobs to be done we identified in Part 2.

The multi-sided network for Bitcoin begins with Satoshi Nakamoto's vision for sound digital money and other early contributors to the open source project and network. Once the network began to grow, specialized investors emerged to provide the financial capital necessary to develop the network. These investors typically hail from Silicon Valley or Wall Street, often co-invest on deals, and typically focus exclusively on cryptocurrency. Bitcoin mining operations developed, and these companies started building their own custom ASICs for mining, earning billions of dollars per year. Third party developers emerged to provide user-facing on-ramps and off-ramps to the Bitcoin network, as well as a wide range of infrastructure, analysis, trading and custodian services. Each layer of improvement to the network brought more users. Including more users, which itself brought more users.

The Bitcoin network exhibits increasing returns, which means that the more people who participate in the network, the more valuable the network is to every participant. This generates a natural monopoly and starts an exponential growth curve.

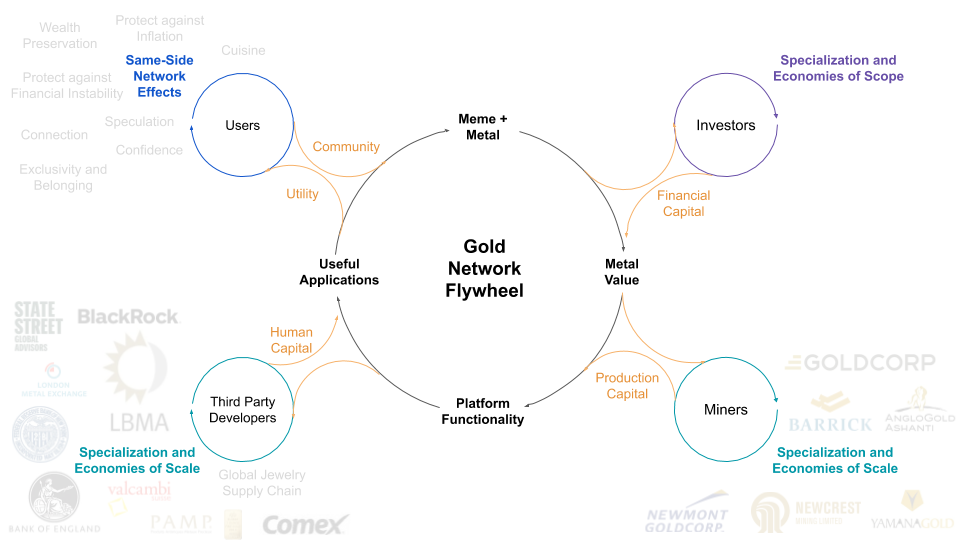

Gold is also a multi-sided network, but has weaker network effects.

The multi-sided network of gold begins with the metal itself and the memes behind why gold has been obsessed over for thousands of years. We discussed this in detail in Part 1 of the series.

From here we move to investors, who have been putting financial capital to work developing new technologies and applications for gold for millennia. Today, the gold value chain is very mature, and even the promise of AI in the exploration process seems likely only to yield incremental results.

Incentivized by the value of gold, miners perform the costly and time consuming process of locating gold deposits and producing doré, a metallic alloy containing between 60-90% gold. The steps in this process are exploration (1-10 years), development (1-5 years), operation (10-30 years), decommissioning (1-5 years) and reclamation.

The doré that gold miners produce is then the basis for a complex ecosystem of third parties that add value and create useful applications from gold. Refiners like Valcambi, PAMP, and Heraeus convert doré into semi-fabricated metals and alloys for use in the industrial and jewelry sectors and investment grade bullion and coins. Gold bullion is then accredited by the LBMA for good delivery and then stored in vaults like the New York Federal Reserve and the Bank of England before being traded over the counter in London and Zurich or on exchanges like the London Mercantile Exchange. Gold futures are most often traded on COMEX in New York, and companies like State Street Global Advisors and Blackrock have built financial products like gold ETFs that have claims on gold bullion.

The products produced by this third party ecosystem are bought by consumers as jewelry, investors as bars/coins or financial products with claims to bars/coins, central banks and industrial users. For consumers, investors and central banks, gold is valuable because other people find it valuable. And the more people who find it valuable and will accept it in exchange for goods and services, the more valuable it is to all. This is the primary network effect in the gold network.

Bitcoin has a similar network effect. It too is valuable because other people find it to be valuable. And the more people who find it valuable and will accept it in exchange for goods and services, the more valuable it is to all.

But Bitcoin's network effect is different, because gold is physical and Bitcoin is digital. The software eats the world hypothesis says that any product or service in any field that can become software, will become software. We see these dynamics play out in industry after industry, and the field of hard money and wealth preservation is no exception.

Why is digital different? Digital products can take advantage of zero marginal costs and universality of compute, attributes that a non-digital substitute cannot compete with. Bitcoin is ten times better than gold on a few very important factors that dramatically improve its usability and accessibility compared to gold for the average person. Bitcoin can be instantly transmitted anywhere in the world, it is easily and instantly divisible in a way that gold is not, it is trivial to carry (no matter the quantity), and it is hard to seize.

These benefits effectively expand the market for Bitcoin to a much larger number of network participants compared to gold. And Metcalfe's law projects that the value of a network is proportional to the square of its number of nodes.

And unlike gold, this is not where Bitcoin's network effects end. Because bitcoin is software, it is steadily getting better, whereas gold remains unchanged. We have already shown above the increasing rate at which contributions are being made by Bitcoin network participants to bitcoin itself. Bitcoin has the advantage of Moore's law with respect to compute and storage cost, and because trust is built into the network itself, third party developers typically open source all their code so there is a same-side network effect among third party developers who borrow each other's code and best practices. This adds an incredible accelerant to the Bitcoin network and stands in contrast to gold's well developed but opaque and closed third party ecosystem.

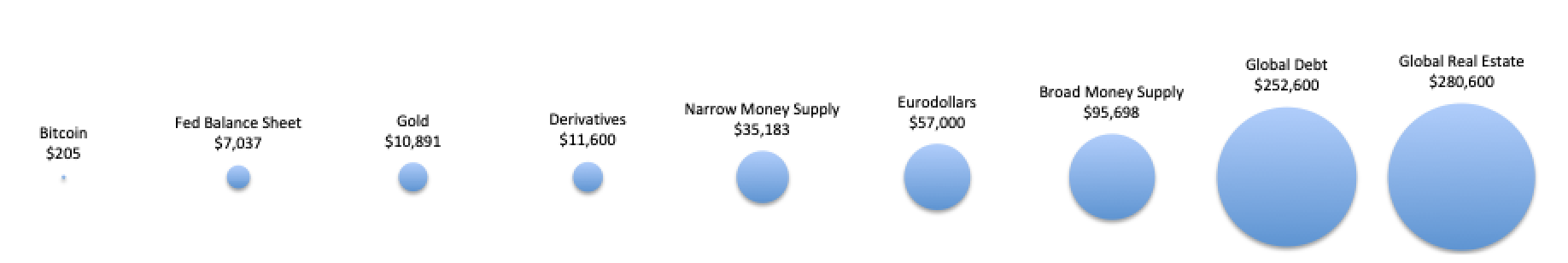

That said, bitcoin still has a long way to go relative to other global assets².

But the fact that there is no intrinsic value for bitcoin the way industrial applications and jewelry provide intrinsic value for gold simply does not matter.

The key takeaway is that bitcoin is not really for people who buy gold today. It's primarily for people who don't buy gold today. Over time, as bitcoin improves, many of the people who do buy gold today will begin to buy bitcoin. And the market for bitcoin will grow faster and faster.

Does this mean gold is going away? No. Gold will continue to be valuable. There are many jobs it does, like promoting connection (wedding bands), projecting confidence and exclusivity (jewelry and monuments) and industrial applications that Bitcoin does not do.

In the same way it was wrong to look at the market size for taxis and conclude that this was the market opportunity for Uber, it is probably wrong to look at gold's $11 trillion global market size and think that this is the market opportunity for bitcoin.

Bitcoin does not compete with gold, just as the Walkman did not compete with high-end speaker systems. Bitcoin competes with non-consumption, and therefore its true market opportunity is probably much bigger than gold.

Did you like this article? Subscribe now to get content like this delivered free to your inbox. Learn more about what I do: https://andyjagoe.com/services/

What everybody ought to know about gold and bitcoin

- Part 1: Gold as a product

- Part 2: Bitcoin as a product

- Part 3: The future for gold and Bitcoin (this post)

Photo: Greg Rakozy

¹ Credit to Ali Yahya for his generic crypto network flywheel template.

² Source - Bitcoin: Messari, Sept 19, 2020; Fed's Balance Sheet: U.S.Federal Reserve, July 2020; Gold: World Gold Council, May 2020; Derivatives (Market Value): BIS (Dec 2019); Narrow Money Supply: CIA Factbook; Eurodollars: BIS, World Bank, Rabo Bank; Broad Money Supply: CIA Factbook; Global Debt: IIF Debt Monitor; Global Real Estate: Savills Global Research, 2018

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, Software Eats Money has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.