Analysis of gold as a product

Gold is far more complicated and entrenched in the world than it might seem. Gold is money , and so much more.

This article is the first in a three part series that explores gold and bitcoin in detail as products, including who the customers are for gold and bitcoin, what jobs gold and bitcoin do for them, and a perspective on the future markets for gold and bitcoin.

What everybody ought to know about gold and bitcoin

- Part 1: Gold as a product (this post)

- Part 2: Bitcoin as a product

- Part 3: The future for gold and Bitcoin

Gold is money. Everything else is credit.

-J.P. Morgan

Last weekend bitcoin was above $10,000 for the third time in its history. At this price, Bitcoin’s market cap is just over $180 billion. That’s roughly the value of McDonalds Corporation. Or the GDP of Kazhakstan.

Is this just a speculative bubble? Or is something more fundamental happening?

A common explanation is that Bitcoin is “digital gold.”

But what does that really mean?

Is digital gold something good? Is digital gold better than regular gold? Does the world need better gold? Is gold money? Is bitcoin money? Will software eat gold?

In today’s world, how well do we actually understand gold?

Gold

People have been obsessed with gold for thousands of years. Peter Bernstein writes in The Power of Gold:

Gold has motivated entire societies, torn economies to shreds, determined the fate of kings and emperors, inspired the most beautiful works of art, provoked horrible acts by one people against another, and driven men to endure intense hardship in the hope of finding instant wealth and annihilating uncertainty.

The history of gold shows that people believe it to be a safe haven. Until it is taken seriously. Then—it becomes a curse. Bernstein continues:

Whether it is Jason in search of the Golden Fleece, the Jews dancing around the golden calf, Croesus fingering his golden coins, Crassus murdered by molten gold poured down his throat, Basil Bulgaroctonus with over two hundred thousand pounds of gold, Pizarro surrounded by gold when slain by his henchmen, Sutter whose millstream launched the California gold rush, or modern leaders such as Charles de Gaulle who deluded themselves with a vision of an economy made stable, sure, and superior by the ownership of gold—they all had gold, but the gold had them all…

Nations have scoured the earth for gold in order to control others only to find that gold has controlled their own fate. The gold at the end of the rainbow is ultimate happiness, but the gold at the bottom of the mine emerges from hell. Gold has inspired some of humanity’s greatest achievements and provoked some of its worst crimes.

Understanding the history and fundamentals of gold is important to have perspective on what “digital gold” might be or how you might value it.

Gold itself is neither bad nor good.

So what makes people so obsessed with gold?

Why is gold so special?

Gold’s radiance lasts forever

Gold is chemically inert. Unlike most materials that rust or rot, an object fashioned out of gold 4,000 years ago remains virtually identical today.

Gold can be made into virtually anything

Gold is extremely dense and malleable. You can make an ounce of gold into a wire fifty miles long, or beat it into a sheet covering one hundred square feet.

Gold is imperishable

No matter what you do to gold, you cannot make it disappear or convert it into something else. Almost all gold ever mined is still here—unlike any other element on earth.

Gold has a very limited supply

The World Gold Council estimates that the total above ground stock of gold at the end of 2017 was 190,040 tonnes. Below ground reserves were estimated at 54,000 tonnes.

Gold is extremely hard to get

Every year, global mining adds 2,500 to 3,000 tonnes to the stock of above ground gold. China was the largest producer in 2018, followed by Australia, Russia and the United States (in that order). There are various ways of mining gold. None could be described as easy or good. As Bernstein says:

Finding and producing gold demands immense effort relative to the amount of glittering yellow metal that makes its appearance at the end of the process…

Today, in the great gold mines of South Africa, the shafts reach down as far as 12,000 feet and the temperature reaches 130 F. As one source describes it, "To produce one ounce of fine gold requires 38 man-hours, 1,400 gallons of water, electricity to run a large house for 10 days, 282 to 565 cubic feet of air under straining pressure, and quantities of chemicals including cyanide, acids, lead, borax, and lime." The labour force employed in the South African mines exceeds 400,000 men, about 90 per cent of whom are black.

With this context for what makes gold unique, let’s look at who the customers are for gold and the jobs gold does for them.

Gold as a product

There are four primary customers for gold today:

- Investors (bars, coins, and financial instruments representing bars and coins)

- Central banks

- Individuals (in the form of jewelry and adornment)

- Industrial Users

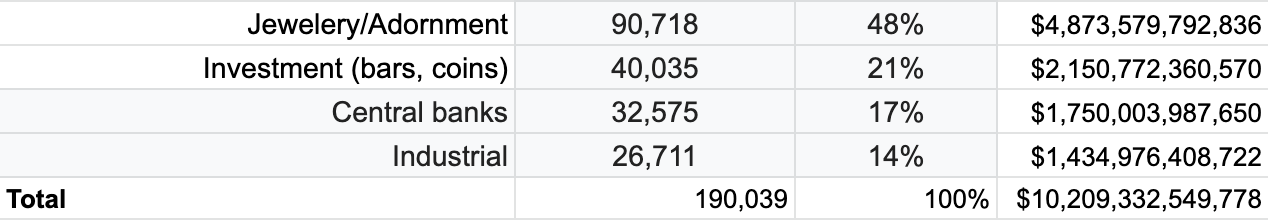

According to the World Gold Council, 48% of gold is privately owned as jewelry and adornment, 21% is owned privately for investment, 17% is owned by central banks, and 14% is used in industrial applications. The current value of all gold worldwide is over ten trillion dollars (with a Jan 17, 2020 price of $1,523 per oz). This makes the market for Bitcoin at a price of $10,000 only 5% the size of the market for gold.

Let’s look at the jobs to be done by gold for each customer type.

Investors as customers of gold

Investors own roughly $2.2 trillion (21%) of the world’s gold. Although many investors buy gold, gold is not actually an investment.

An investment is putting capital at risk in return for the promise of dividends, interest or appreciation. But since the capital is at risk, it’s possible to get back less than you invested—or nothing at all.

As J.P. Morgan said, “Gold is money.”

It is very important to understand this.

If you buy gold bars or coins (or paper currency for that matter) and lock it in a vault, you are not investing it. You don’t receive any interest or dividends. You are simply storing it.

The gold bullion you store is no one else’s liability or promise of performance, so there is no counter-party risk. If you remove your gold from storage, there is no risk that you receive less physical gold than you started with.

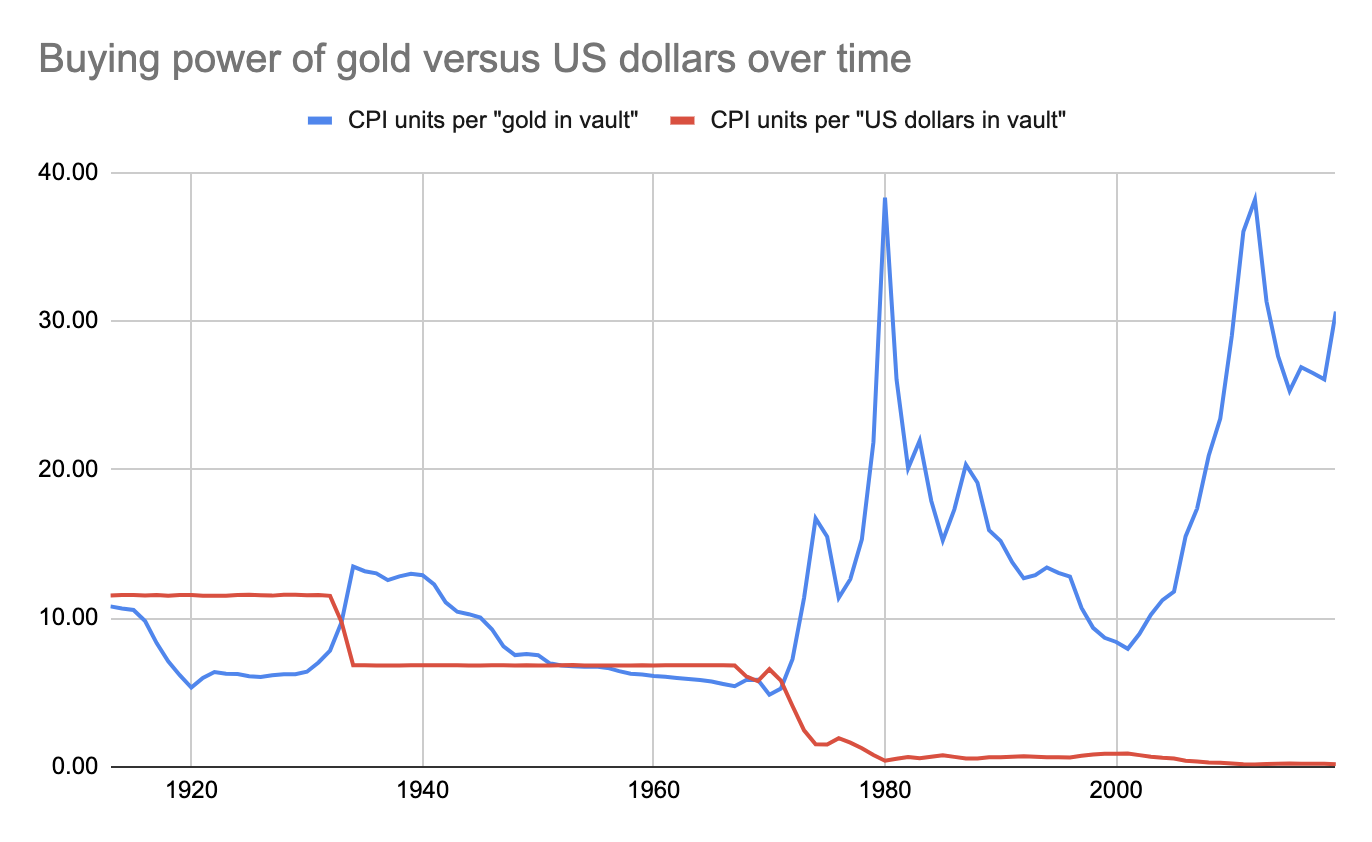

The difference between storing physical gold and physical paper currency is that the purchasing power of gold has tended to increase over time whereas the purchasing power of paper currency has tended to decrease over time due to inflation.

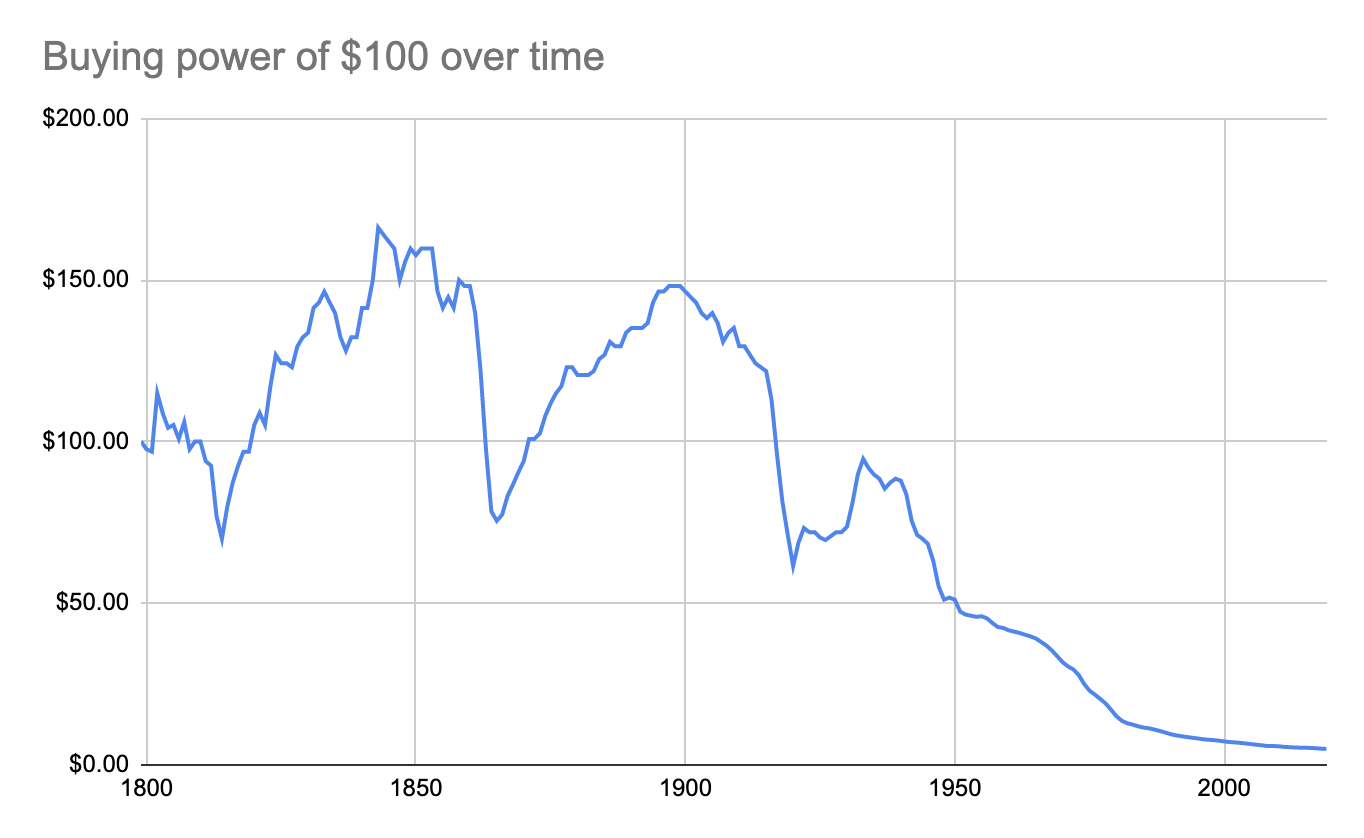

As an example, if you locked $100 in a vault in 1799 and took it out to spend in 2019, instead of it buying you the $100 worth of goods and services it bought you in 1799, it would only buy you the goods and services that $4.81 would have bought you in 1799. This is a loss in value of more than 95%.

Alternatively, if in 1799 you bought $100 worth of gold, locked it in a vault, and then took it out to spend in 2019, it would buy you far more goods and services than the same amount of gold bought in 1799.

There has been a long term overall upward trend in the purchasing power of gold—particularly after 1971 when the US went off the gold standard and the price of gold was allowed to float. There has been a long term, steady and continuous downward trend in purchasing power of the US dollar—something seen with all fiat money. The above example uses the US consumer price index, but the same results in purchasing power are seen across the board, including with homes, cars, food, oil, etc.

Investors buy gold for the value gold provides as money. Investors use gold to diversify portfolios, hedge risk, and to preserve wealth.

Gold has historically had a negative correlation to stocks and other financial instruments, making it an important portfolio diversifier. If there is a stock market crash and you have a 5% allocation of gold, not only could your gold increase in value, but gold might now represent 10% or more of your portfolio. So you can re-balance your portfolio by selling gold at a high price and buying equities at a very low price.

Unlike fiat money, gold is money that bankers and politicians cannot contract or expand. This makes it a valuable hedge against inflation (or deflation)—effectively portfolio insurance against disaster or failed government policies. Gold can be taken out of storage at any time and converted into an investment that earns a stream of interest or dividends.

Central Banks as customers of gold

Central banks own roughly $1.8 trillion (17%) of the world’s gold.

According to the 2019 Central Bank Gold Reserve Survey, central bank motivations for holding gold differ somewhat between the central banks of advanced economies and emerging/developing economies. Here are the top motivations that were classified as highly relevant or somewhat relevant for each:

Central banks of advanced economies

- Historical position (legacy of Bretton Woods): 100%

- Long term store of value: 67%

- Effective portfolio diversifier: 44%

- Performance during times of crisis: 44%

Central banks of emerging/developing economies

- Long term store of value: 83%

- No default risk: 74%

- Historical position (legacy of Bretton Woods): 70%

- Effective portfolio diversifier: 70%

Central banks list gold on their balance sheets along with other official foreign reserve currencies. Why do central banks hold monetary reserves? To balance payments of the country, to influence the foreign exchange rate of its currency, to maintain confidence in financial markets, and to maintain stability and liquidity during times of crisis.

The US dollar is by far the most popular reserve currency of central banks, comprising between 60 and 70 percent of all central bank foreign reserves between 1995 and 2018. The world’s need for dollars has allowed Americans and the US Government to borrow at much lower costs, giving the United States an advantage that’s estimated to be worth $100 billion per year.

That said, central banks hold gold reserves for much the same reason investors do. Gold bullion is no one else’s liability or promise of performance. Gold cannot be expanded or contracted by bankers or politicians, and gold’s purchasing power is relatively stable whereas the purchasing power of even hard currencies has decreased over time due to inflation.

Individuals as customers of gold

Individuals own roughly $4.9 trillion (48%) of the world’s gold as jewelry or adornment. This is twice the amount of gold owned by investors, and three times the amount owned by central banks. You might think that the majority of gold is owned by investors and central banks, but this is not true.

The story of individuals as customers for gold has a long history and is more nuanced than for gold’s other customers. It’s a story of the interaction of gold as money and gold as jewelry and adornment in a mutually reinforcing cycle.

You could argue that the only reason that investors and central banks are customers of gold is because of the millenia old global obsession with gold by individuals, and that the value that individuals collectively put in gold is the root of its value.

What jobs does gold do for individuals?

Store of value

Individuals know that gold has held its value well over the long term. As a store of value, gold does a similar job for individuals as it does for investors. It preserves wealth by hedging against inflation or deflation and provides insurance against disaster.

So what distinguishes an “individual” from an “investor” in our classification? An individual holds their gold in the form of jewelry or adornment, whereas an investor holds their gold in the form of bars, coins or financial instruments.

Exclusivity and belonging

Gold in the form of jewelry is used to signal belonging and exclusivity. Since gold is very expensive, it’s only possible to have if you’re wealthy. Thus, the job gold does for an individual in this situation is signaling converted into status.

The ability to literally wear your money is somewhat unique to gold. You cannot wear your Bitcoin, and people have not made a habit of fashioning clothes or jewelry out of paper money (for obvious reasons).

Using gold as a signal for status varies between cultures—though most do it. It’s interesting to note that 24% of the world’s individually owned gold in the form of jewelry and adornment (22,000 tonnes) is in India.

Connection

When given as a gift, the job gold does for an individual is one of connection. One of the most common examples of this is the tradition of gold wedding bands. Buying an expensive and beautiful ring is a demonstration of what one person is willing to give up for another. It is a constant reminder to you of your connection to your spouse—and it is a reminder to your spouse (and all others) of your connection to him or her.

A simple wedding band costs about $1000 and the US has roughly 2 million weddings per year. This is $4B per year in wedding rings. If the US is 4% of the global population and we assume people get married at the same rate everywhere, there are potentially 47 million weddings each year that need wedding rings.

While this job of connection is most obvious in wedding rings, it also holds true with a wide range of jewelry or adornment given as a gift—and sometimes even for jewelry purchased for oneself.

Confidence

Throughout history, another job gold has done is to signal confidence, power and devotion. Whether it’s Jason and the Golden Fleece, Egyptian pharaohs, the papal altar in St Peter’s Basilica in the Vatican, the gates of Versailles (shown below) or the many ancient and modern buildings worldwide that are literally made of gold, gold has been used to project power and confidence in a way that other materials cannot match.

Industrial customers of gold

Many products use gold as a component of the finished product. Gold in industrial products accounts for roughly $1.4 trillion (14%) of the world’s gold.

When gold is used in an industrial application, it is because of a specific need for one of gold’s unique attributes. Gold is too expensive to use if there is any other alternative. The number of industrial applications for gold has been steadily increasing over time. Let’s look at some jobs gold does in industrial applications.

Electronics

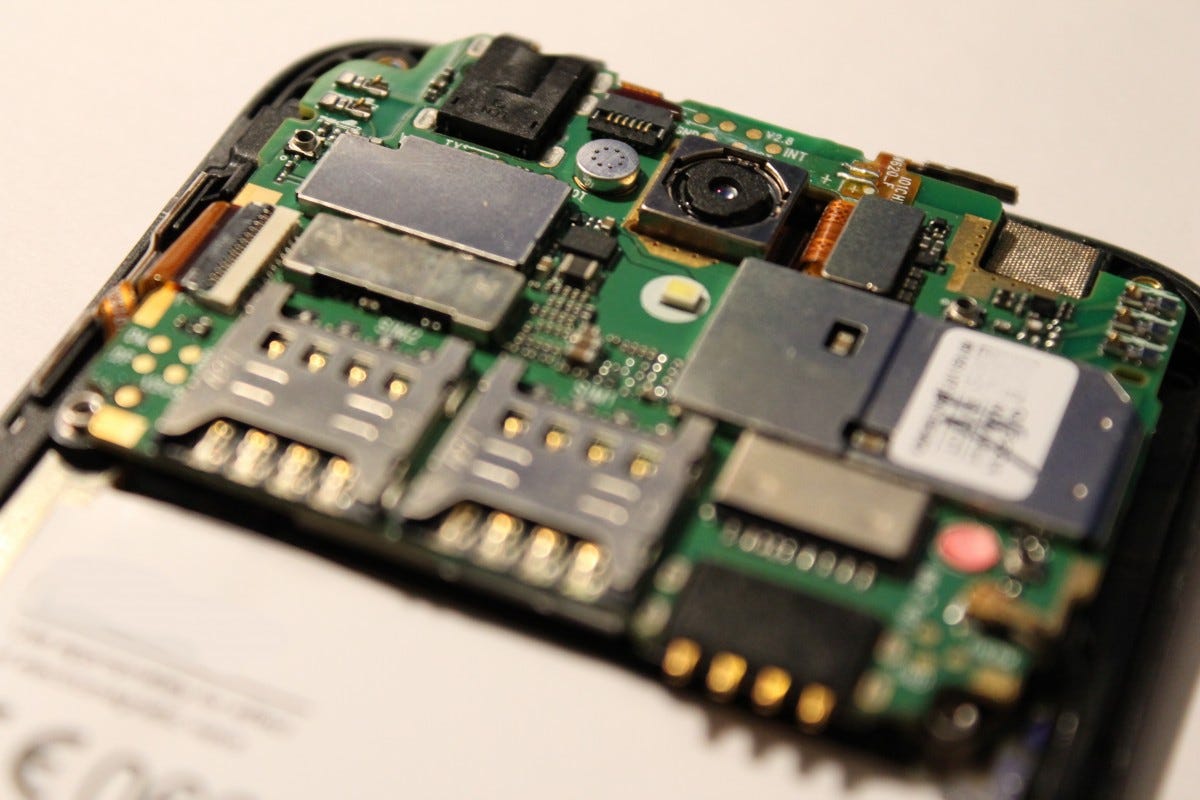

Gold is used for electrical connectors in a wide range of electronics products, including cell phones, computers, tablets and calculators. Gold provides excellent conductivity and is generally resistant to oxidation and corrosion—unlike alternatives. Gold is also used to connect semiconductor devices to their packages and in the connectors of a wide variety of higher end cables, such as audio, video and USB cables.

The amount of gold used in cell phones is very large in aggregate. Trevor Keel, Head of Technology for the World Council estimates that there are 25 milligrams of gold in each cell phone. At $1500 per troy ounce, this is worth about $1.20. When you multiply this by the 1.5 billion smartphones now produced each year (and many not recycled), this adds up to billions and billions of dollars in gold.

Medicine and Dentistry

Gold is used for a wide range of medical applications, including the treatment of cancer and rheumatoid arthritis, rapid diagnostic tests, and HIV/AIDS detection. Gold is also used in some electronic medical equipment, surgical instruments and life-support devices. The use of gold in dentistry has been declining, but it is still used for fillings, bridges, crowns and orthodontic appliances. The first evidence of gold being used in dentistry was by the Etruscans in 700 B.C.

Glassmaking

Gold is used in some glasses to reflect solar radiation outward, allowing a building to remain cool in the summer. In winter, the gold treatment on glass reflects internal heat, keeping the building warmer. If you’ve ever wondered why the visor of an astronauts helmet is gold colored—it’s because the visor has a thin film of gold to reflect solar radiation that they may encounter in space.

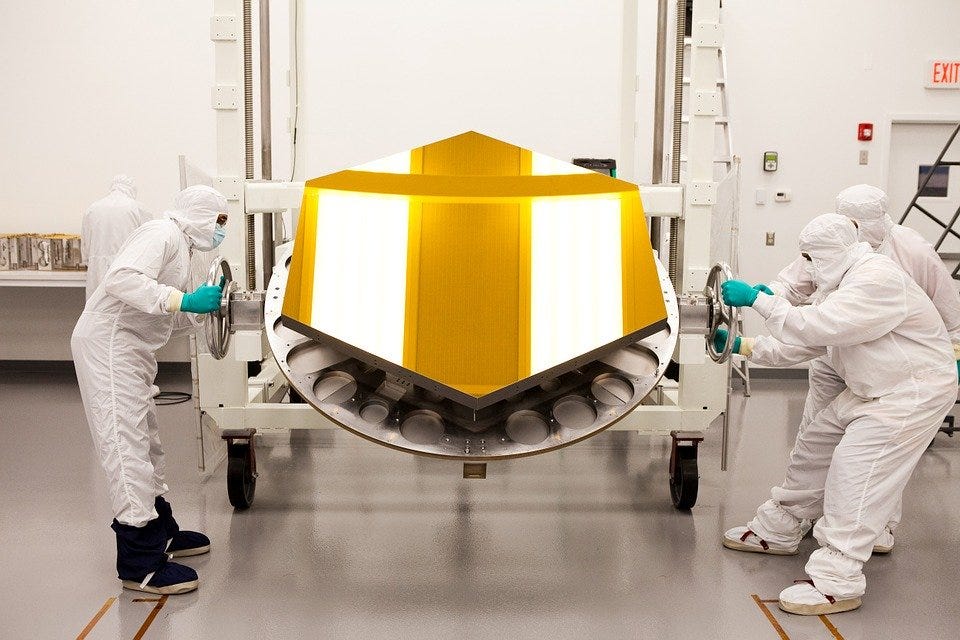

Aerospace

Gold is used extensively in satellites and space vehicles because it is extremely dependable. There is almost no opportunity for maintenance or repair once these vehicles are in space. Gold is used for circuitry and as a lubricant between mechanical parts. Many external components are also covered with a thin gold film to reflect infrared radiation and keep these components from getting too hot.

Cuisine

Gold is biologically inert and safe to eat so long as it is at least 22k. It is tasteless and passes through the digestive process unabsorbed. In the EU, gold is E175 which means it is specifically authorized for use in food as a food coloring.

Gold leaf, flake, or dust is often used in food as decoration, and gold flakes are an ingredient in a number of drinks, including Goldschläger and Goldwasser.

Gold is also used in many other applications beyond just those mentioned here.

Conclusion

Humanity’s passion for gold has been constant for thousands of years, and gold is deeply woven into the fabric of the world. The value of gold is rooted in the interplay of its beauty, scarcity and unique characteristics.

Gold stands alone in its ubiquitous appeal and the fact that the largest customer segment for gold by far is individuals—what the financial services industry calls “retail.”

Gold is far more complicated and entrenched in the world than it might seem.

No one controls gold—and no one can make more of it.

Gold is money—and so much more.

But gold isn’t perfect. Some jobs that gold does could be done better.

We’ll take a look at these in Part 2 where we focus on Bitcoin as a product. Who are Bitcoin’s customers? What jobs does bitcoin do? How well does digital gold describe bitcoin? Is digital gold better than physical gold? Do we need better gold? And is bitcoin money?

Did you like this article? Subscribe now to get content like this delivered free to your inbox. Learn more about what I do: https://andyjagoe.com/services/

What everybody ought to know about gold and Bitcoin

- Part 1: Gold as a product (this post)

- Part 2: Bitcoin as a product

- Part 3: The future for gold and bitcoin

—

Photos: Steve Webel, FIFTY, Bank of England, Kinnari Kurani, [email protected], Annette Schuman, skeeze, Toukou Sousui

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, Software Eats Money has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.