Why we must choose to go to the moon

How popular stories that go viral can affect economic outcomes, and why it's time to choose to do the hard things.

A man is always a teller of tales, he lives surrounded by his stories and the stories of others, he sees everything that happens to him through them; and he tries to live his life as if he were recounting it. -Jean Paul Sartre

The stories people tell—whether about financial confidence or panic, stock market booms, or Bitcoin—can go viral and have a powerful impact on an economy.

This is ignored by most in economics and finance, because these narratives seem anecdotal or unscientific.

But the stories we tell ourselves about the world drive our behavior—and the world itself, if enough people buy into them.

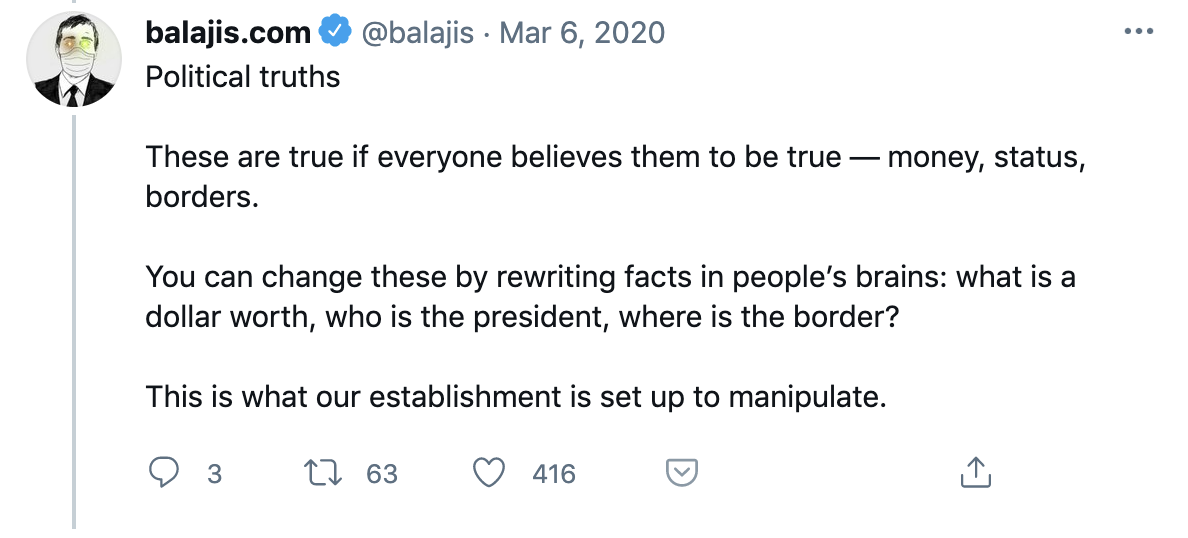

Balaji Srinivasan, former partner at Andreessen Horowitz and former CTO of Coinbase, draws a distinction between political truths and technical truths.

Political truths are true if everyone believes them to be true—money, borders and status. These can be changed by rewriting facts in people's brains. We see this increasingly everywhere in politics. And we see this daily on Twitter and Facebook by way of meme culture.

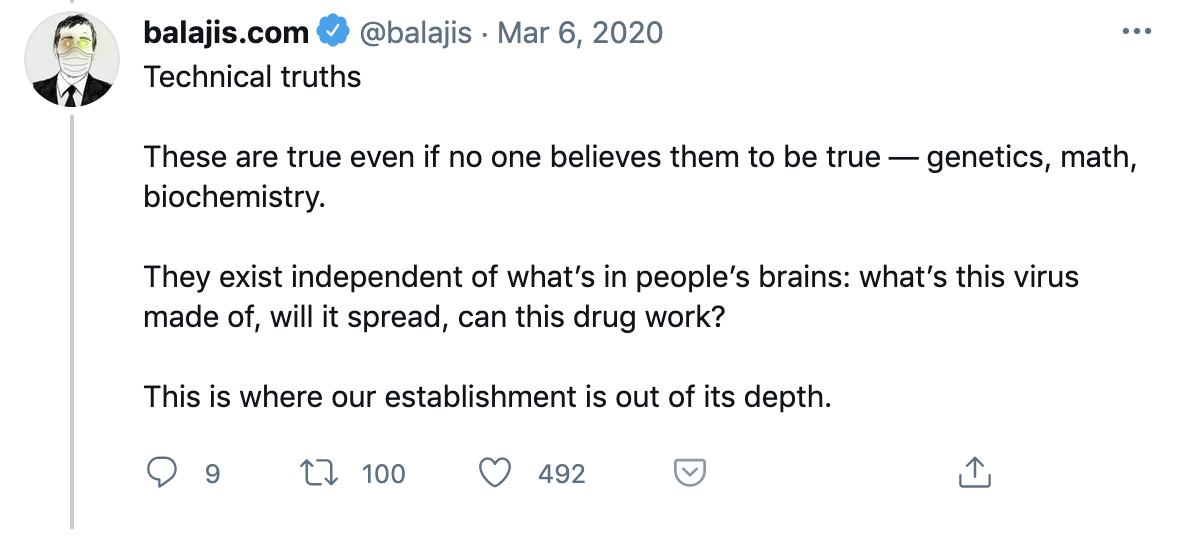

Technical truths are true even if no one believes them to be true—math, biochemistry, genetics. They exist independent of what's in people's brains.

Many of the things we believe are political truths, not technical truths. A popular narrative that goes viral can change them, with real economic consequences.

This said, political truths cannot change technical truths. No matter how hard you try. This can be surprising to those who don't anticipate the second or third order economic consequences (technical truths) of new political truths.

Robert Shiller, in his 2019 book Narrative Economics, says that an economic narrative "reminds people of facts they might have forgotten, offers an explanation about how things work in the economy, and affects how people think about the justification or purpose of economic actions."

Today we're going to talk about a number of popular narratives, why they are going viral, and how their spread is creating long term impact on our economy and financial system.

The bitcoin narratives

Bitcoin has been a series of surprises for most people. It's also an example of a successful economic narrative that has been highly contagious and has resulted in significant economic changes across the world.

Bitcoin is fueled by a constellation of stories about:

- anarchism and human interest

- fear of inequality

- fear that computers are taking over

- the idea that people on the cutting edge get rich

- membership in an autonomous and transcendent economy

Jesse Walden, former partner at Andreessen Horowitz, unpacks this as:

Bitcoin's affiliation with anarchy is intertwined with a human interest story about its pseudonymous creator, Satoshi Nakamoto, who remained cloaked to avoid scrutiny by world governments.

Satoshi's very first transaction on the Bitcoin blockchain embedded the London Times headline: "Chancellor on brink of second bailout for banks" This signaled about the risks of governmental abuse of power to reward the rich and powerful.

This made Bitcoin's early narrative not only anti-establishment, but also intertwined with individual economic empowerment. Outsiders benefited from BTC's first major price gains in 2011, a time when economic inequality advanced rapidly & the Occupy Movement was birthed.

This dovetailed with "software eating the world" or the story of computers playing a greater role in people's lives Bitcoin offers a way to benefit from the rise of computers— to participate in history, even if only superficially (without having to master computer science.)

Then came the stories of how investors got rich simply by being on the cutting edge of "what's next." This is the lure of VC and startups in general, and it is reinforced by repetition of founder and early investor glory stories.

With Bitcoin, anyone could participate in cutting edge wealth creation, even if you don't understand how it works. Remember the guy who sold a pizza for BTC who's now a billionaire? Participation by Regular Joes multiplies the repetition of glory stories on the cutting edge.

Then there is the narrative of BTC as membership in a global, autonomous economy, free of the perennial problems of government incompetence and corruption. Both technically and psychologically, Bitcoin offers an escape hatch from increasing distrust in traditional institutions.

One other that I'll add is the narrative around fixed supply: the sacred 21M. The fixed supply narrative is reinforced by the "money printer go brrrr" narrative. And also by the recurring halvening (the pre-scheduled decrease in the supply that can be mined into circulation)

Bitcoin's surprising success is actually not surprising at all when thought of in the context of how the human mind works, the math behind viral feedback loops, and the perennial narratives in history that the bitcoin narrative taps into.

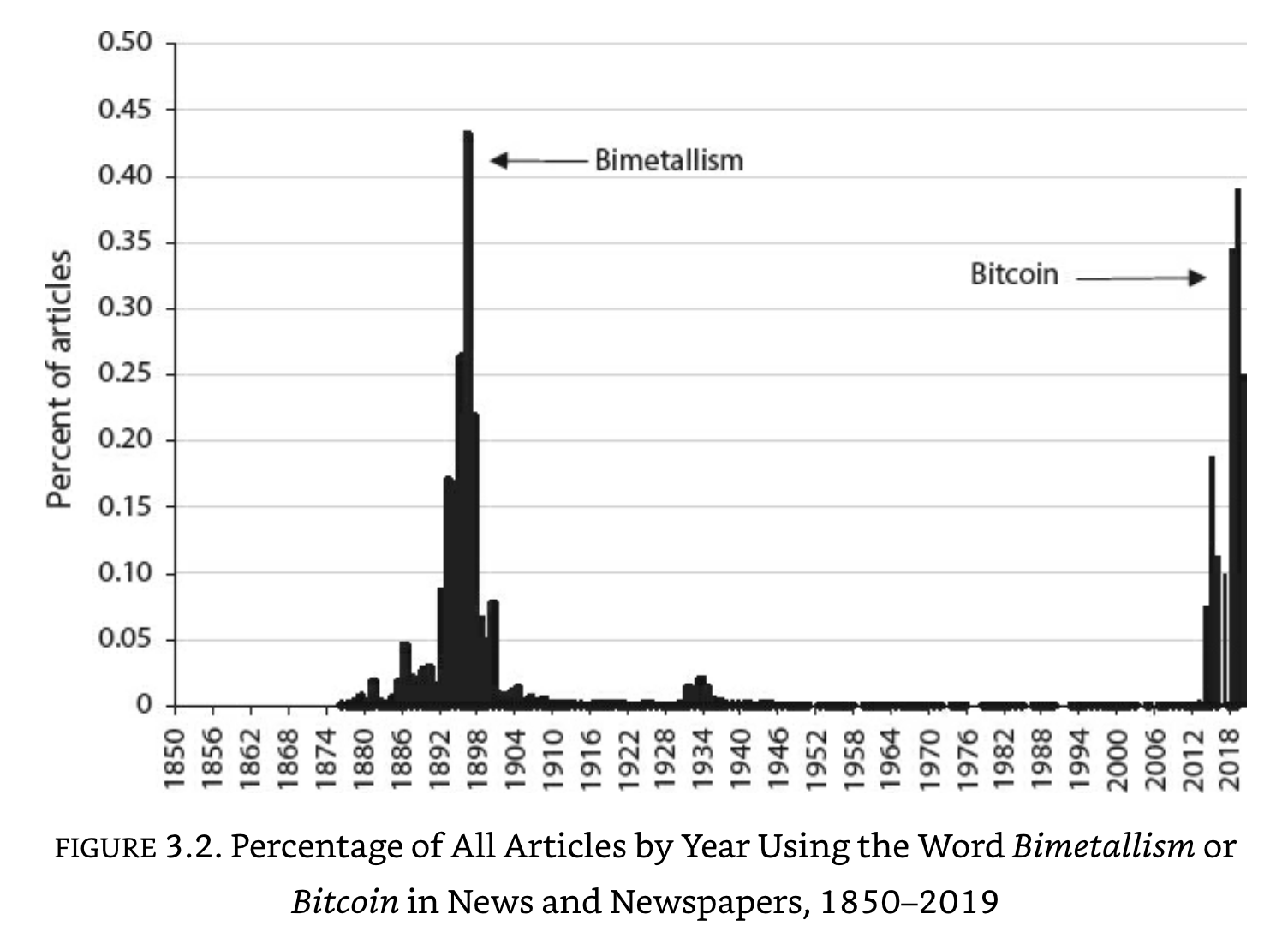

One such recurring narrative involves the gold standard. Prior to 1873, the United States was on a bimetallic standard, with the price of silver fixed to gold at a ratio of 16:1. The Coinage Act of 1873 was part of an international standardization of currencies on the gold standard. It demonetized silver.

The 1870s-1890s was a period of significant deflation, which impoverished many farmers who had bought their farms with a mortgage, by lowering the price they could sell their crops and at the same time increasing the real cost of their debts. The deflation was blamed on the adoption of the gold standard, and the result was moral outrage and public support for a return to bimetallism.

Shiller describes bimetallism and bitcoin as "radical ideas for the transformation of the monetary standard, with alleged miraculous benefits to the economy." As indicated by public attention, both ideas seem to have a similar infection rate:

By the 1890s, bimetallism had gained enormous traction. The free market price of silver to gold was 30:1, so bimetallism would have effectively allowed debtors to cut their debts in half by choosing to pay in silver rather than gold.

Advocates of bimetallism were known as Silverites, as though they were a political party. Advocates of the gold standard thought of themselves as upholders of truth and honesty. The belief in bimetallism began to take strong geographic and class dimensions. Shiller writes:

Eastern intellectuals favored the gold standard, while westerners, who were more likely to be farmers, favored bimetallism. Supporters of the gold standard tended to appreciate symphony performances, while Silverites liked to watch boxing matches. By some accounts, Silverites tended to be hypermasculine and warmongering.

Those who opposed the gold standard emphasized unjust inequality. Milford Wriarson Howard in his 1895 book The America Plutocracy, said the “The greatest struggle of all the ages is the one now going on between these two classes” and viewed the moral value attached to the gold standard as a conspiracy of established leaders to justify the robbery of working people.

The situation peaked in 1896, when William Jennings Bryan, bimetallism's Satoshi Nakamoto, gave his famous Cross of Gold speech at the Democratic National Convention, and was very nearly elected president:

Having behind us the commercial interests and the laboring interests and all the toiling masses, we shall answer their demands for a gold standard by saying to them, you shall not press down upon the brow of labor this crown of thorns. You shall not crucify mankind upon a cross of gold.

To underscore just how impactful these narratives are, it's important to note that the entire episode has been forever memorialized in L. Frank Baum's The Wonderful Wizard of Oz, which we still read to our children and for which there has been a stream of movies, musicals and remakes. Shiller writes:

the yellow brick road is the gold standard, the silver slippers are the Free Silver movement, the Wizard of Oz is President McKinley, and the Cowardly Lion is William Jennings Bryan. Oz itself is the abbreviation for ounce, the usual unit of measurement for gold or silver.

It is ironic, to say the least, that the argument in favor of bitcoin as a populist response to corrupt and incompetent politicians worldwide is the exact reverse of the populist argument in favor of bimetallism.

From a monetary policy point of view, there is little difference between a gold standard and a bitcoin standard. They are effectively the same. But in the 1890s, it was the wealthy and the elite who wanted the truth and honesty of a gold standard. But today, it is enlightened populists who want the truth and honesty of a bitcoin standard? Does this make sense?

Perhaps neither argument is really about truth and honesty.

Maybe it's about something deeper.

Inequality and disillusionment

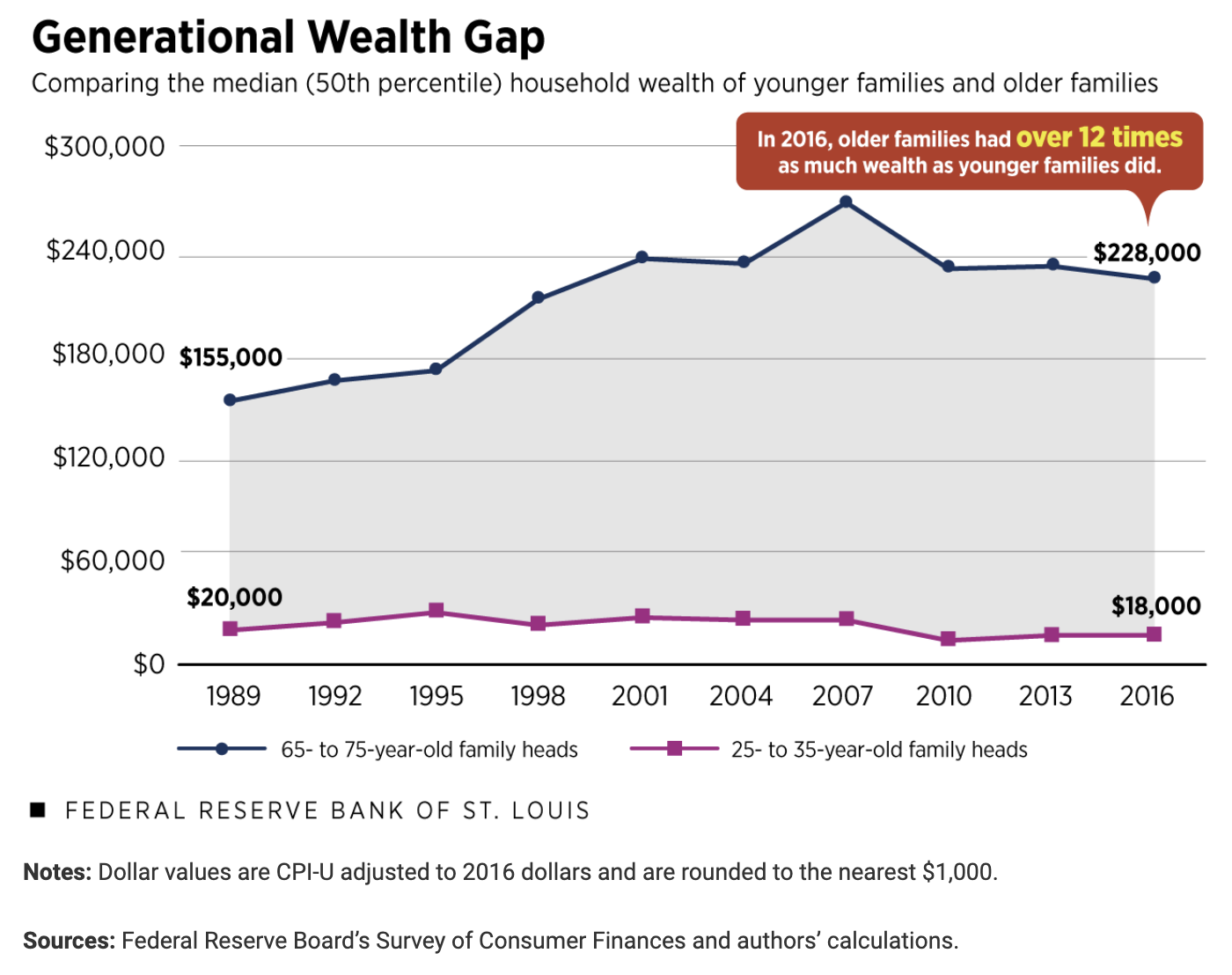

Over the last 30 years, the wealth gap between old and young families has increased by 55% in real terms. The average older family is 50% better off today than a similar older family in 1989, but the average young family is 10% worse off today in real terms than the average young family in 1989:

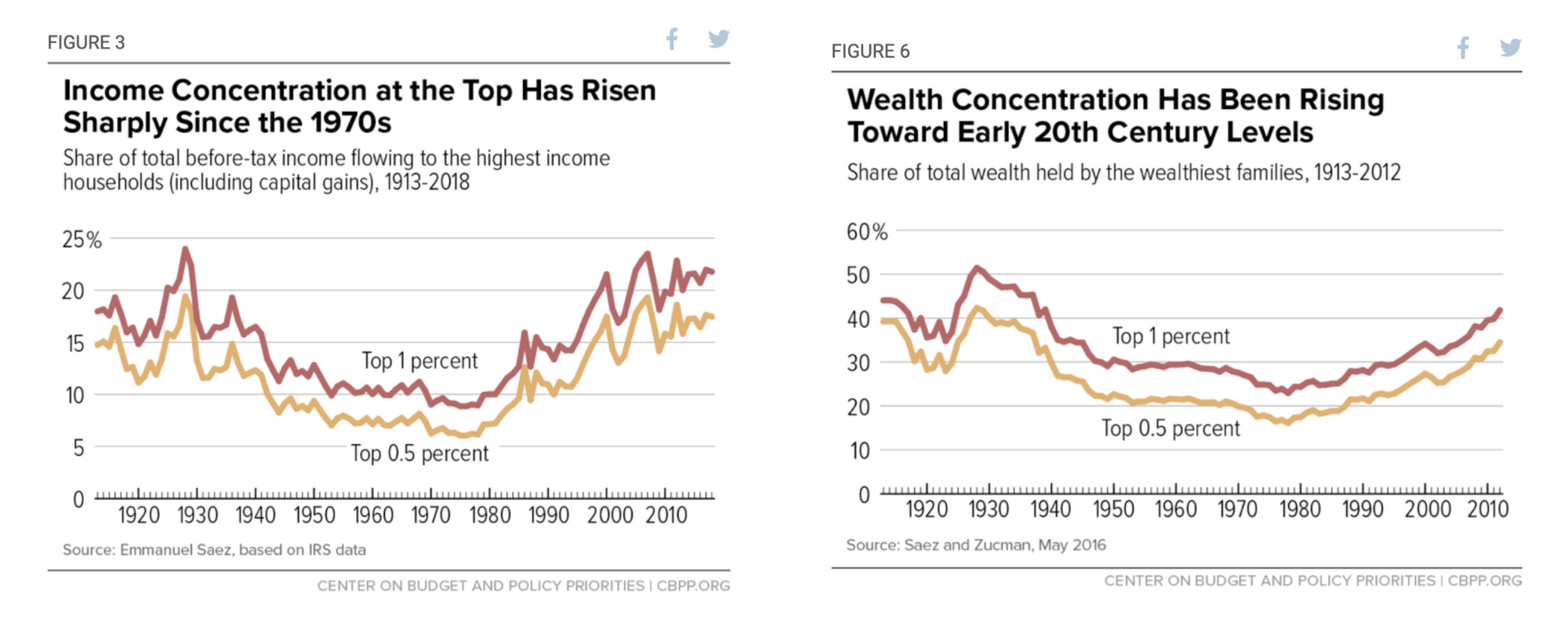

Income concentration at the top is as high as it's been in 100 years, and wealth concentration is also rising up to early 20th century levels:

This is the situation younger generations face today. David Hoffman, Founder of Bankless, a crypto-focused media company, describes the way younger generations feel:

The social institutions that are supposed to be vehicles of wealth generation are actually only generating wealth for the older generations that have captured them.

Younger generations are not benefiting from these institutions. The institutions have rejected them, so in turn, they reject institutions.

This is creating a societal crisis that is causing younger generations to be pessimistic about their future, and they are succumbing to massive compromises in their well-being; compromises that their parents never had to ever make...

Societal institutions are entrenched. Wealth isn’t circulating. Attempts to climb the social ladder and achieve the ‘American Dream’ are thwarted. Millennials are the first generation in history to believe that they are going to be worse off than their parents. Home-ownership in young people is down. Inflation-adjusted income is down. Debt is up; both in student loans and credit cards.

A young person’s positive beliefs about the future are at all-time lows.

The recent pandemic has only exacerbated the situation, with young and low income people suffering disproportionately. People feel like the game is rigged, and they have nothing to lose. It should be no surprise we have seen a surge in retail speculation, exemplified by /r/wallstreetbets. Young people stuck at home YOLO into trades as if they're playing online casino games.

A recent CNBC article reported on a survey done for Deutsche Bank that found half of respondents between 25 and 34 years old who had an investment account planned to spend 50% of their recent stimulus payment on stocks. 18 to 24 year olds planned to spend 40%.

This state of disillusionment is ripe kindling for the bitcoin narratives, just as the farmer's disillusionment with the deflation of the 1890s was ripe kindling for the bimetallism narratives.

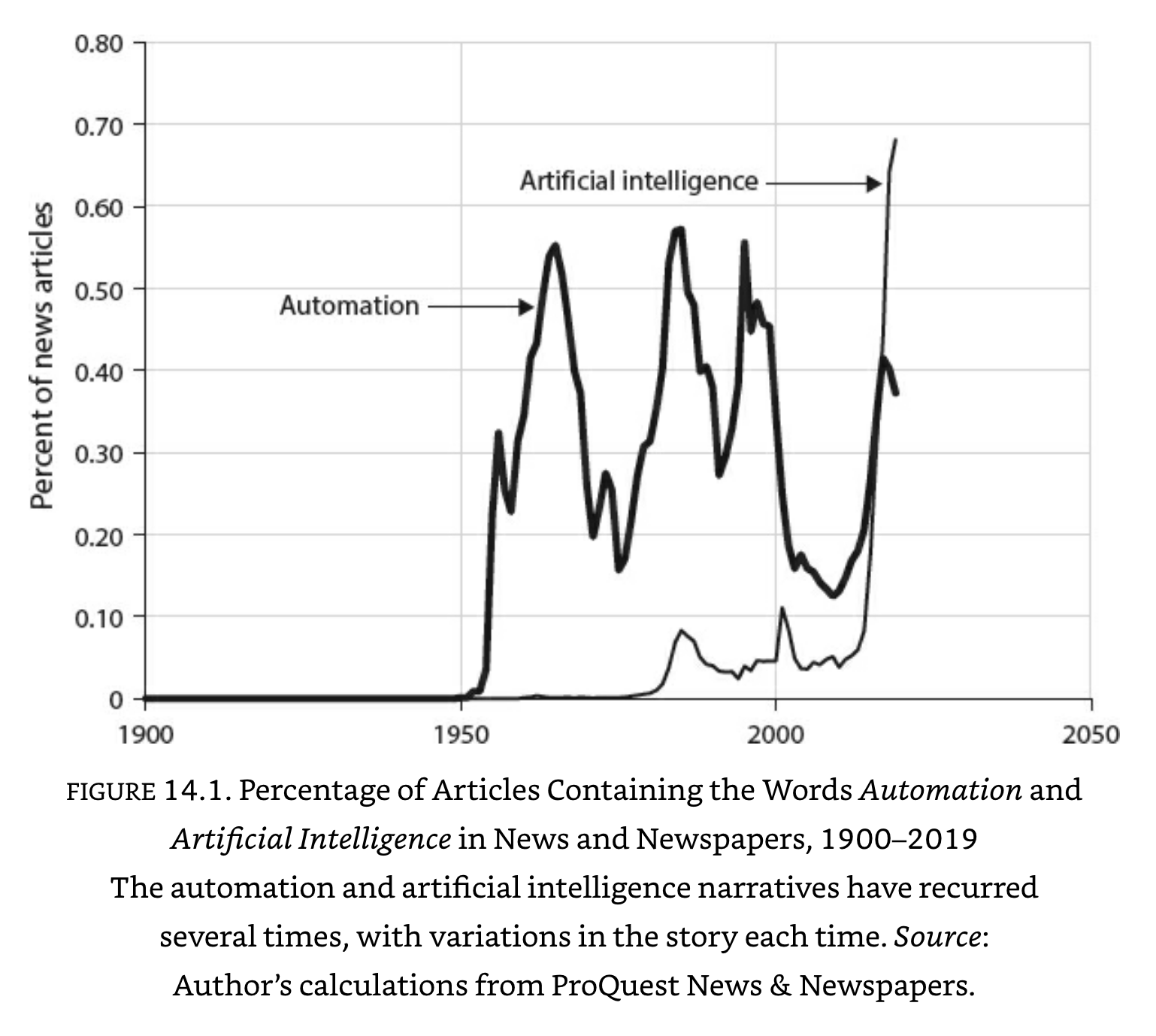

Meanwhile, another perennial meta-narrative peaking right now is the narrative that automation and AI will replace almost all jobs:

Sam Altman, CEO of OpenAI and former President of Y Combinator, describes the situation in his recent essay, Moore's Law for Everything:

My work at OpenAI reminds me every day about the magnitude of the socioeconomic change that is coming sooner than most people believe. Software that can think and learn will do more and more of the work that people now do. Even more power will shift from labor to capital. If public policy doesn’t adapt accordingly, most people will end up worse off than they are today.

It is the constellation of all these narratives together that propel bitcoin forward. But, as in the case of the poor farmers and bimetallism, if the problem is actually inequality of income, wealth and opportunity, is the best solution really to redistribute wealth by changing the money?

Or does this have second and third order consequences—technical truths—that most bitcoin advocates have never even considered? I've talked about a few. And at the same time, why bitcoin will be bigger than you think.

My hope is that, just because we have a hammer, we don't now think everything looks like a nail.

The road ahead

Fear about the future and the inequality of wealth, income and opportunity are not going to be solved by adopting bitcoin. These problems need creative new thinking, bold solutions, and must be addressed directly.

One idea is time arbitrage. Few people take a truly long term view in today's world, and the market richly rewards those who do. What if the federal government set aside $3,000 for every child at birth for retirement, available tax free at age 65? $3,000 invested at a 7% real return for 65 years is $250,000. Today's average retirement savings is $250k, and the median is $65k. With 4 million babies born in the U.S. each year, a plan like this would cost $12 billion per year and would alone bring every single person up to today's average.

Compare this to Social Security, which must be funded annually, and costs $1,000 billion every single year to pay an average of $12,000 to 45 million Americans. $250,000 in retirement savings can pay the same amount—$12,000 per year from age 65 to age 85—if it earns 5% per year during retirement.

Why is it that we can spend thousands of billions of dollars in emergency rescue packages, but we can't make smart, forward thinking decisions our children and grandchildren depend on? If popular stories that go viral can affect economic outcomes, why today are we short the great stories of our past, stories that bring people together, stories that give people hope? What happened to choosing to do the hard things?

We choose to go to the Moon. We choose to go to the Moon... We choose to go to the Moon in this decade and do the other things, not because they are easy, but because they are hard; because that goal will serve to organize and measure the best of our energies and skills, because that challenge is one that we are willing to accept, one we are unwilling to postpone, and one we intend to win, and the others, too.

—John F. Kennedy

Inequality, disillusionment and a constellation of narratives fuels heated competition over political truths. It fuels bitcoin, whose advocates propel it through a campaign of information insurgency.

But as incredible an innovation as Bitcoin is, it is neither sacred cow, nor miracle worker. It cannot undo technical truths, and it does not solve endemic problems of inequality and stagnation. You may believe, as I did, that we don't have flying cars today because it's not practical. The truth, however, is closer to we lack the will and imagination.

In 2013, China surpassed the US in GDP in terms of purchasing power parity, and today it's 25% greater. In 2008, India moved past Japan to the #3 spot, and today it's twice that of Japan and half that of the US.

It's time we choose to go to the moon. Choose to make the hard choices and to work on the hard problems. To fix the root causes that drive people to casino-like speculation and radical beliefs, like the only solution is opting out. Or changing the money.

Sam Altman's Moore's Law for Everything is a great starting point for concrete suggestions on how to address the future we face. Looking at the road ahead, it's worth remembering his conclusion:

A great future isn’t complicated: we need technology to create more wealth, and policy to fairly distribute it. Everything necessary will be cheap, and everyone will have enough money to be able to afford it. As this system will be enormously popular, policymakers who embrace it early will be rewarded: they will themselves become enormously popular...

The changes coming are unstoppable. If we embrace them and plan for them, we can use them to create a much fairer, happier, and more prosperous society. The future can be almost unimaginably great.

Did you like this article? Subscribe now to get content like this delivered free to your inbox. Learn more about what I do: https://andyjagoe.com/services/

- Cover photo by NASA

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, Software Eats Money has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.