What everybody ought to know about money

A simple framework to understand how different types of money emerged and how they interrelate.

Money seems so simple. We use it every day.

But where does money come from? Who decides what is money? And what happens when what is money changes?

To understand how software is eating money and the potential impact of changes in today's monetary landscape, we need to understand how different monies emerged and how they interrelate. Today we're going to talk about a new framework that makes thinking about money clear and simple.

In 1892, Carl Menger, founder of the Austrian School of economics, published On the Origins of Money. His observation is that money naturally emerges in society based on the comparative saleability of commodities. Meaning, when planning to go to market, people willingly and actively try to exchange commodities until they're holding the commodity that can most quickly and universally be exchanged for full economic value.

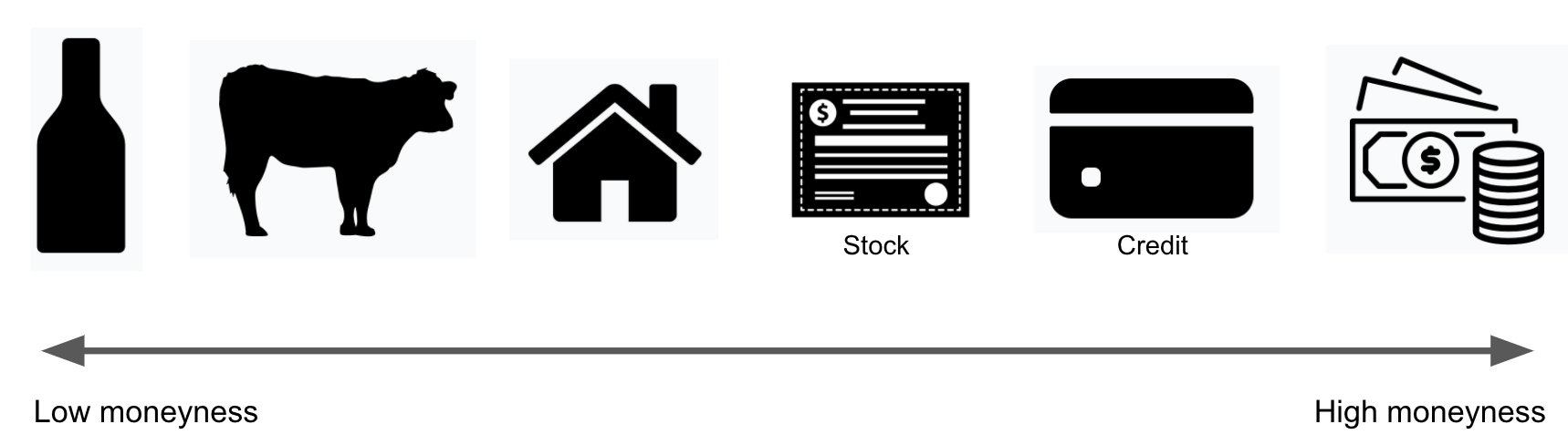

To understand this, it's important to realize that money is not binary. Something is not either money or not money. Instead, goods exist on a continuum from best money to worst money. This is an object's moneyness.

Consequently, money is not generated by law. As Menger says "in its origin it is a social, and not a state institution."

Throughout history, the moneyness of goods has constantly shifted to reflect an ever changing comparative saleability of commodities. And the accommodation of new commodities. But how do you map a monetary system simply and clearly so it can be compared across time and space?

Our one dimensional moneyness map does not help. Neither does the Bank of International Settlement's money flower that we introduced when we talked about the internet of money. We need something better.

Nik Bhatia, an economics and business school professor at USC, has offered us exactly this in an excellent book named Layered Money that was published January 18, 2021. The book is short, engaging and well worth reading.

Layered Money was inspired by the Inherent Hierarchy of Money which Perry Mehrling, a professor of economics at Boston University, published in 2012. Layered Money simplifies and refreshes Perry's monetary system pyramid framework and applies it across the history of money to demonstrate Perry's assertion that:

Always and everywhere, monetary systems are hierarchical.

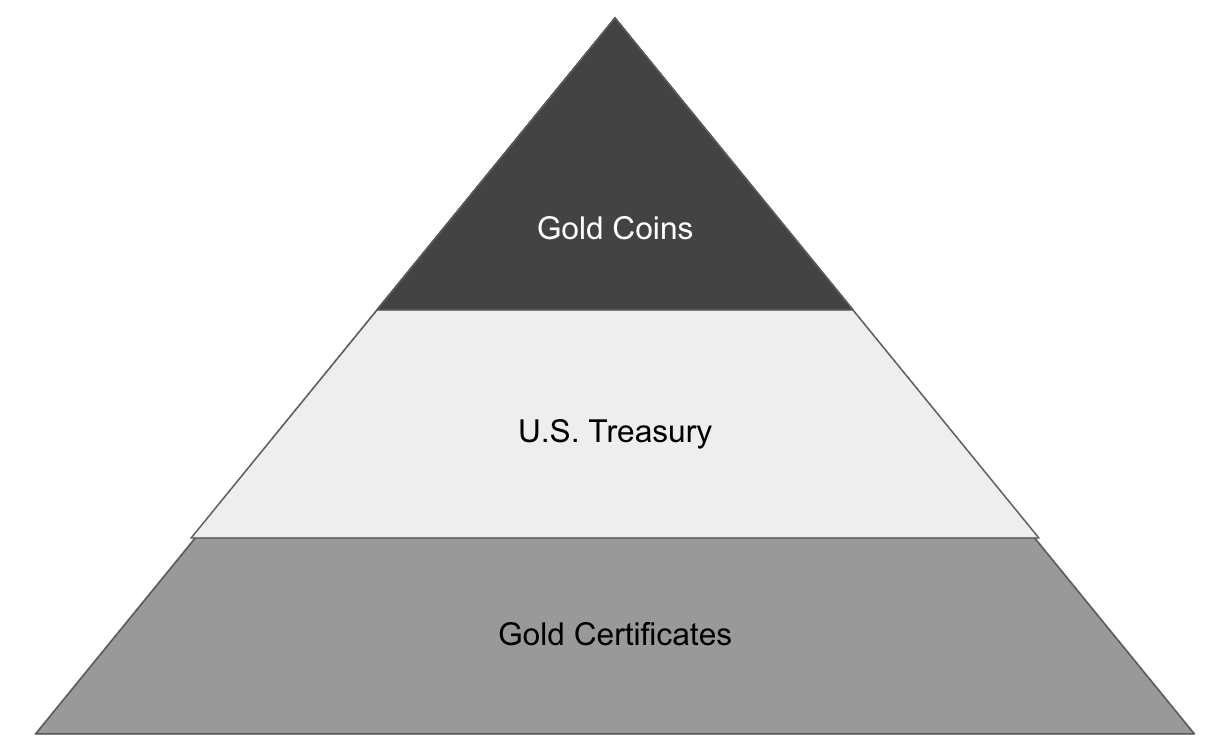

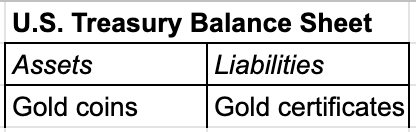

Layered Money starts with the relationship between gold coins and gold certificates in the U.S. in 1928 as a simple illustration of the concept of layered money.

Gold coins are first layer money. They are kept in a vault, and have no counter-party risk. They are not a liability on anyone's balance sheet.

With gold coins in its vaults and as an asset on its balance sheet, the U.S. Treasury printed gold certificates to circulate in place of the coins. The certificate is a promise by the U.S. treasury to pay the bearer the specified amount of gold on demand. It is a liability on the balance sheet of the U.S. Treasury, and is therefore second layer money. Both the coins and the certificates are forms of money, but they differ in quality. There is a hierarchy, with gold coins being more valuable than gold certificates.

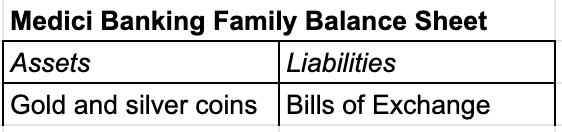

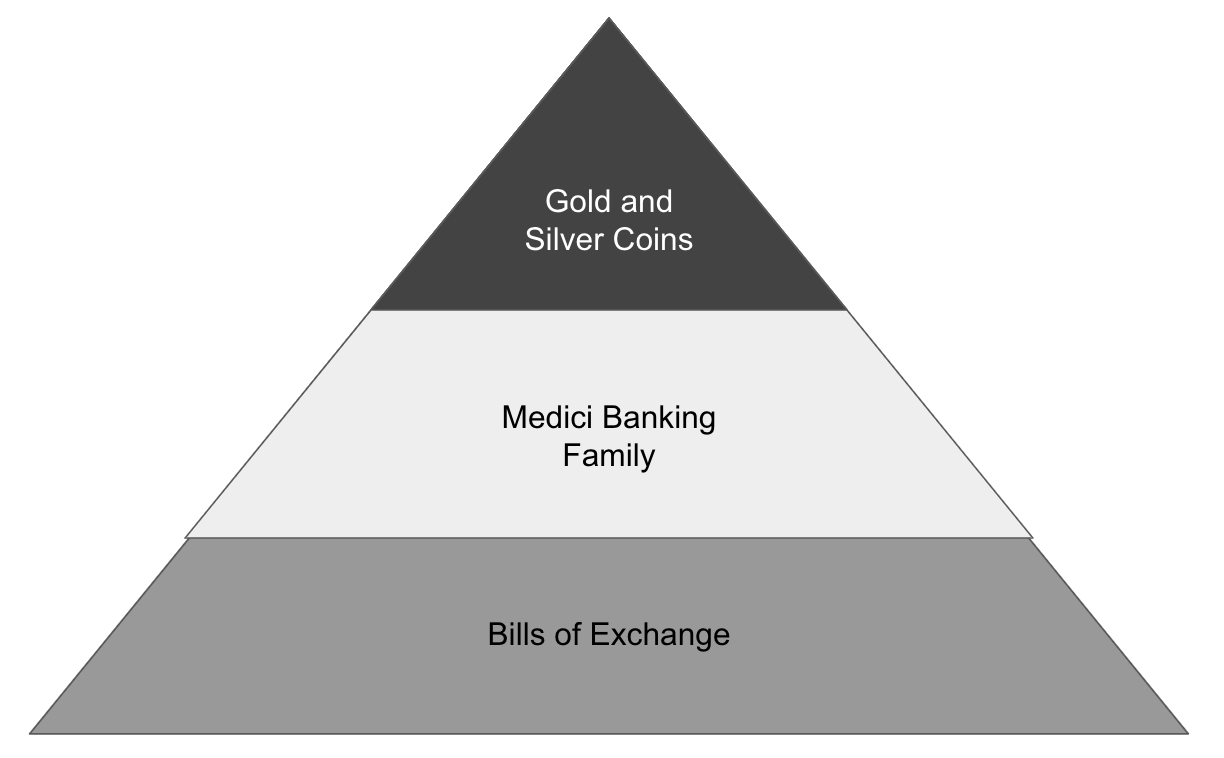

Using this basic framework, Layered Money takes the reader on a clarifying tour of monetary history. The first stop is 15th century Florence, where the Medici banking family was one of the earliest examples of layered money.

Early precious metal coins were plagued by governments continuously reducing purities. The gold florin changed this, maintaining 3.5 grams of constant purity for 400 years. Using Menger's framework, this made florins a more saleable commodity than competing gold coins and contributed to the development of the Medici Bank which, having florins (a layer 1 money) as assets, was able to create bills of exchange (a second layer money). A bill of exchange was a letter written by a banker promising payment and was a way to send money from one place to another while also converting it to the recipient's desired currency.

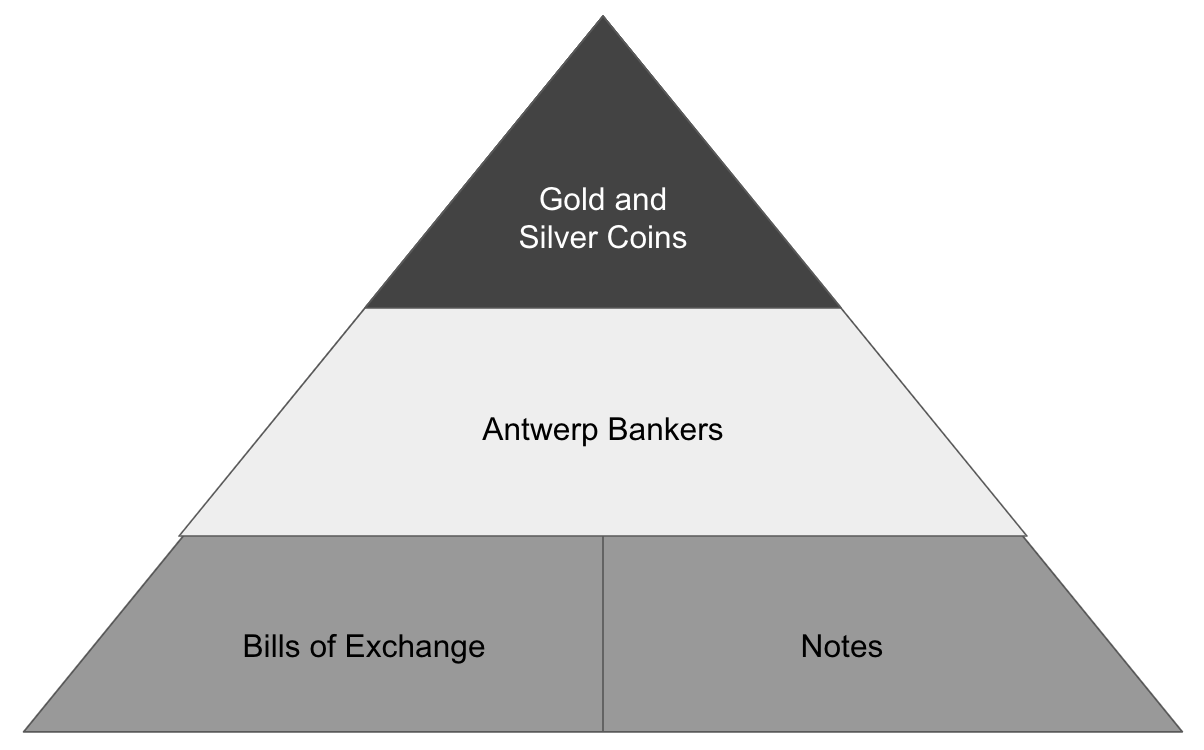

While layered money solved a number of problems with coin-based money, there was a new problem: all forms of second layer money were different and difficult to exchange. But this was soon solved in 16th century Antwerp when a market dedicated just to trading second layer money emerged. In recognition of the time value of money, Antwerp bankers also created a new form of secondary money called promissory notes or notes. Thus a bill from a banker for $100 payable in 1 month might be sold for $95. You get $95 today and the banker gets $100 in a month. Unlike previous versions of second layer money that had a person's name on it, these notes did not and were freely traded, similar to currency notes or what we call cash today.

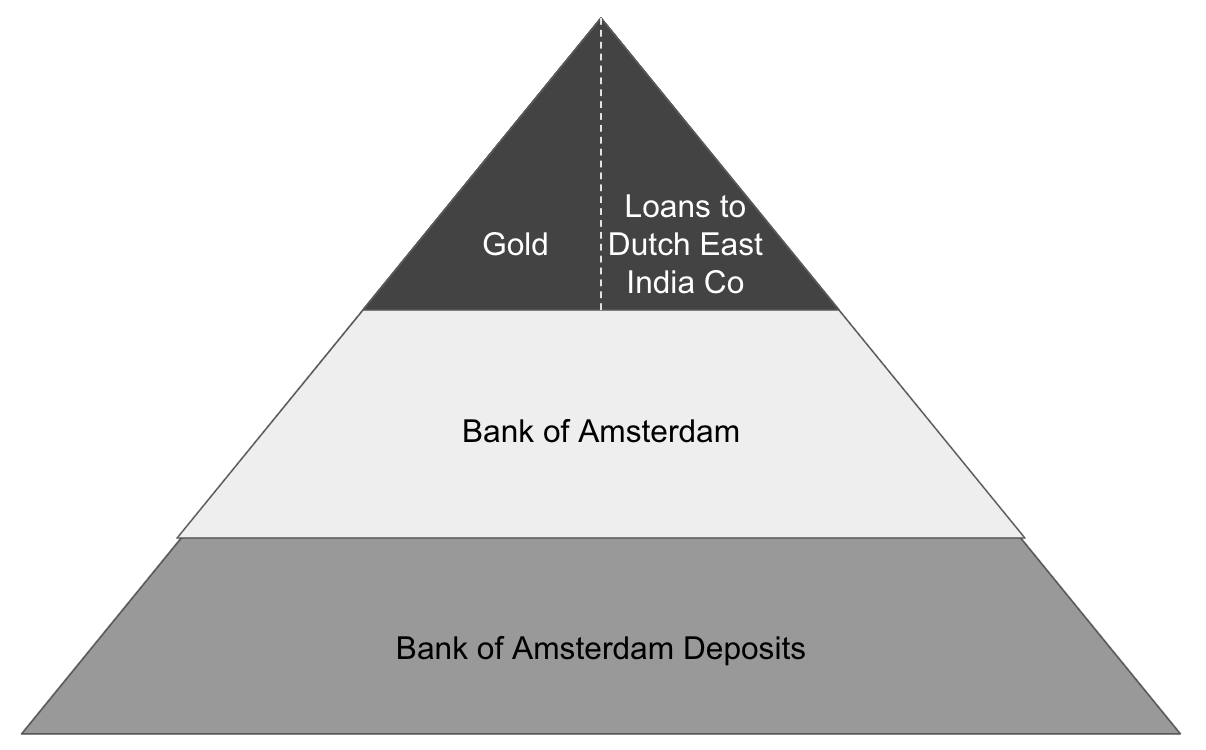

In response to the emergence of a liquid second layer of money, governments stepped in to take control of the critical position between the first and second layers.

Established in 1609, the Bank of Amsterdam is one of the earliest examples of what we might recognize as a central bank. The Bank of Amsterdam outlawed private cashiers and their notes and required all gold and silver coins to be deposited with the bank. An innovative benefit was that depositors could instantly transfer money between accounts and there was no fee for internal transfers. Bank of Amsterdam deposits became preferred money throughout Europe and the Dutch guilder was the world's reserve currency until the 18th century.

Additionally, the Bank of Amsterdam made loans to the Dutch East India Company, classifying them as assets on its balance sheet and crediting the Dutch East India Company with deposits. For the first time, an asset other than precious metal shared the top of the pyramid as a layer 1 money.

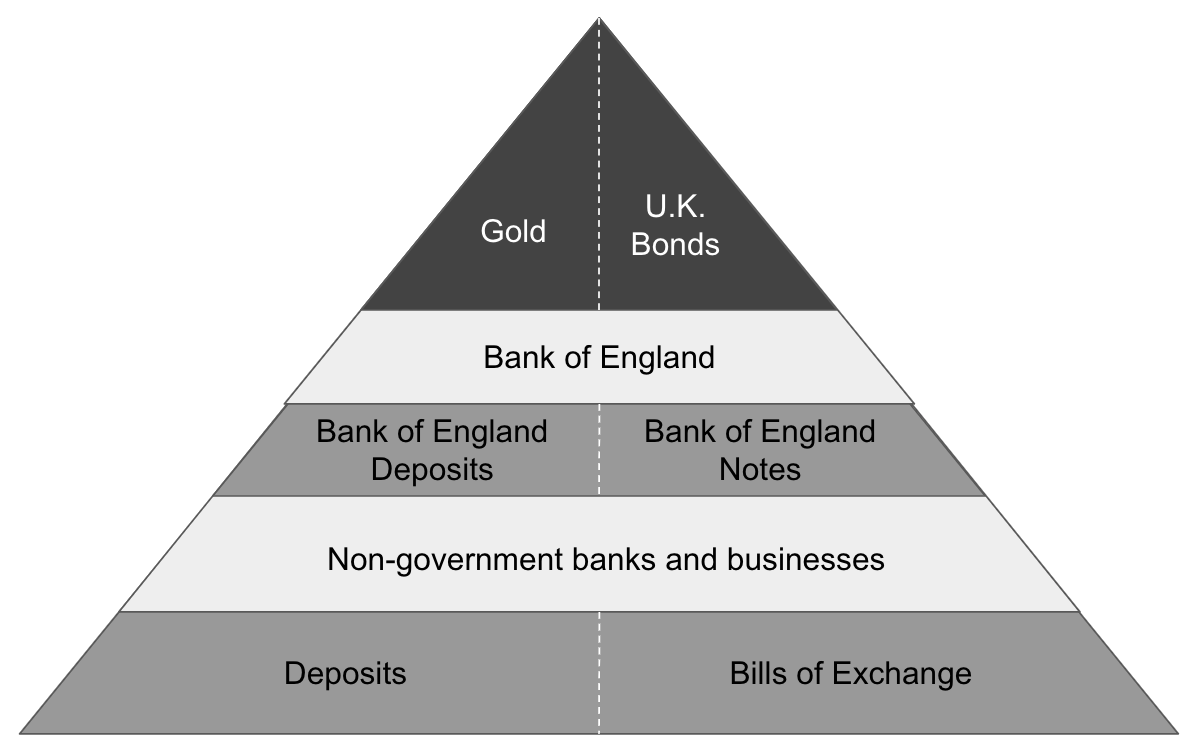

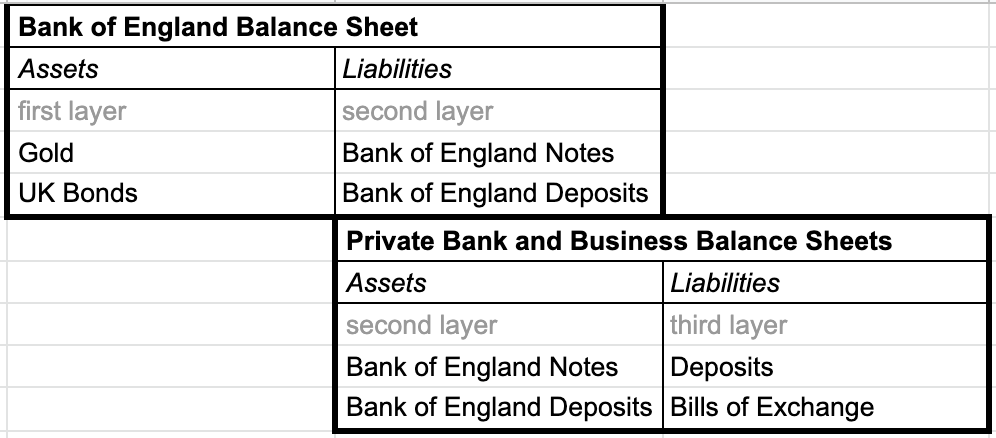

The Bank of England's first charter was granted in 1694, and it would soon establish the modern model for a central bank. Unlike bills of exchange in previous eras, bills of exchange in the English model were promises to pay pounds. Non-government banks and businesses issued promises to pay second layer money in the form of bills of exchange or deposits, and therefore these liabilities exist on the third layer of money.

Meanwhile, it was not until 1913 that the Federal Reserve was established in the United States to fight financial crises. Specifically, it was:

An act to provide for the establishment of Federal reserve banks, to furnish an elastic currency, to afford means of rediscounting commercial paper, to establish a more effective supervision of banking in the United States, and for other purposes.

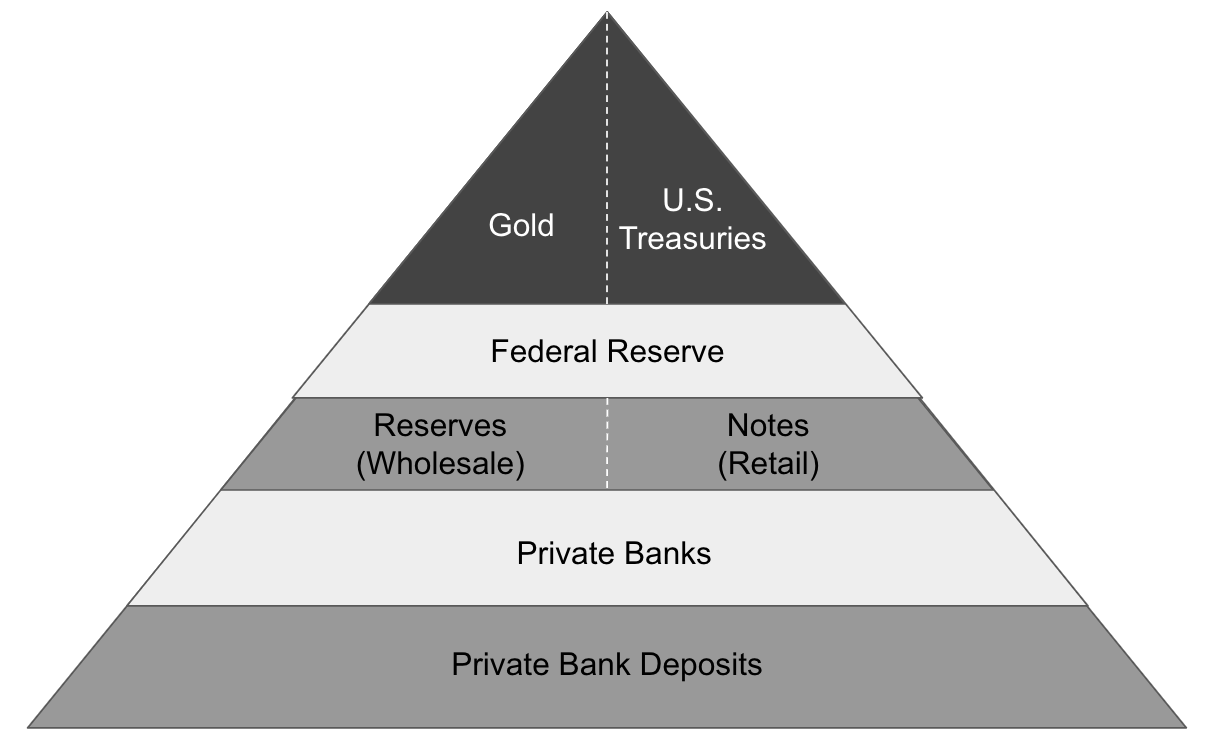

With the establishment of the Federal Reserve under the gold standard, the monetary system in the United States had gold and U.S. Treasuries as layer 1 money, wholesale reserves and retail bank notes as layer 2 money, and private bank deposits as layer 3 money.

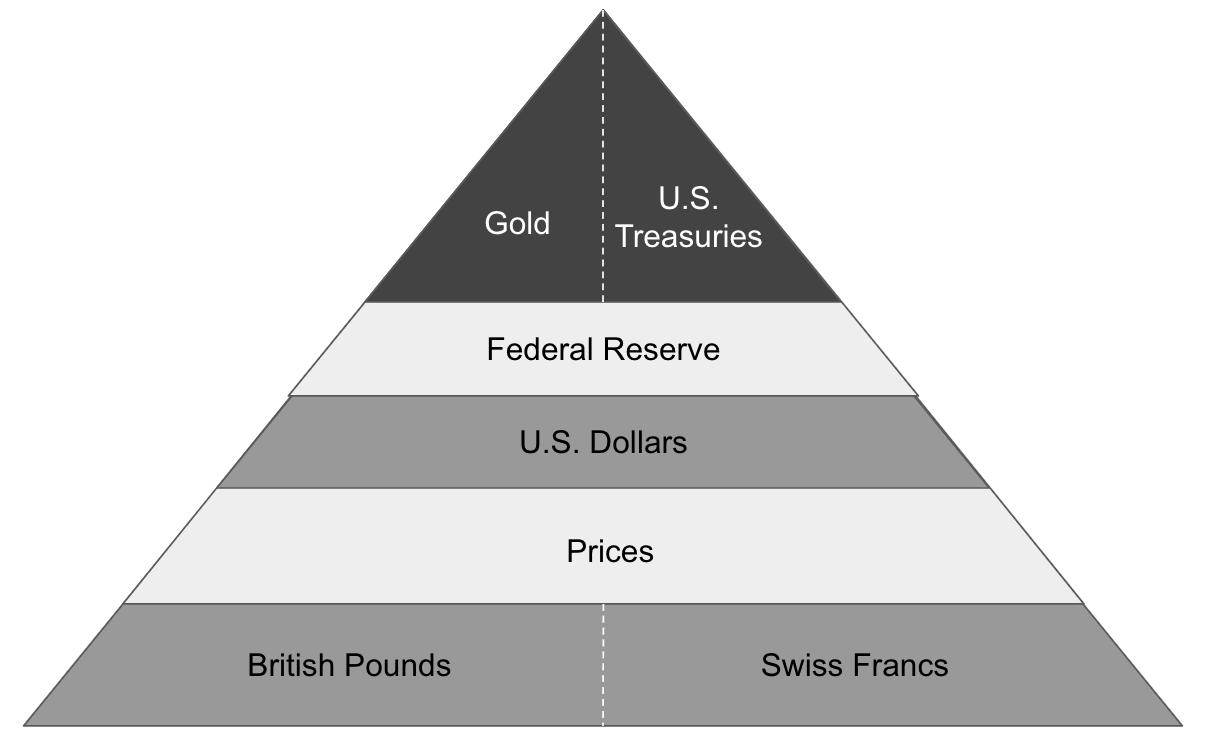

The pound sterling left the gold standard in 1931, ending its position as world reserve currency. It would be formally replaced by the US dollar at Bretton Woods in 1944, when world leaders agreed that all currencies beside the dollar were forms of third layer money in the dollar pyramid.

This system, however, would not last. Foreign nations started to deplete the United States' gold stock, making it impossible to maintain a fixed price. And foreign demand for dollars strengthened the dollar and caused trade imbalances that wouldn't otherwise have happened. In 1971, the United States ended gold convertibility for the dollar.

This brings us to the current U.S. dollar global reserve based monetary pyramid.

For over 500 years, the global monetary system has grown continuously in complexity, and the goods serving as money on each layer of the pyramid have also changed continuously as comparative saleability changes their moneyness.

Given the history of change, you might be wondering what's next for the global monetary system? Particularly given the recent proliferation of digital currencies?

Previously, we unpacked the software eats the world hypothesis in detail and explained why and how software eats money. From our discussion of the global monetary system in the internet of money:

this is another case of the product (money) in an industry (central banking) becoming software. When this happens, every company (central bank) has to become a software company. And as a consequence, in the long run, the best software company will win.

And:

The electronic money the world has known to date has been account-based. An entry in someone's proprietary database. This electronic money is not software.

New electronic monies like central bank digital currencies, Bitcoin, or crypto dollars are not account-based. They are cryptographically secured asset nodes in a massively multi-client open-state database network. This electronic money is network software.

When money becomes software, it suddenly is able to provide substantial new benefits that money that is not software cannot. This means it has higher potential moneyness. Therefore, using Menger's theory of comparative saleability, it is reasonable to predict that over time money that is software will replace money that is not software as the layer 1 of tomorrow's monetary pyramid.

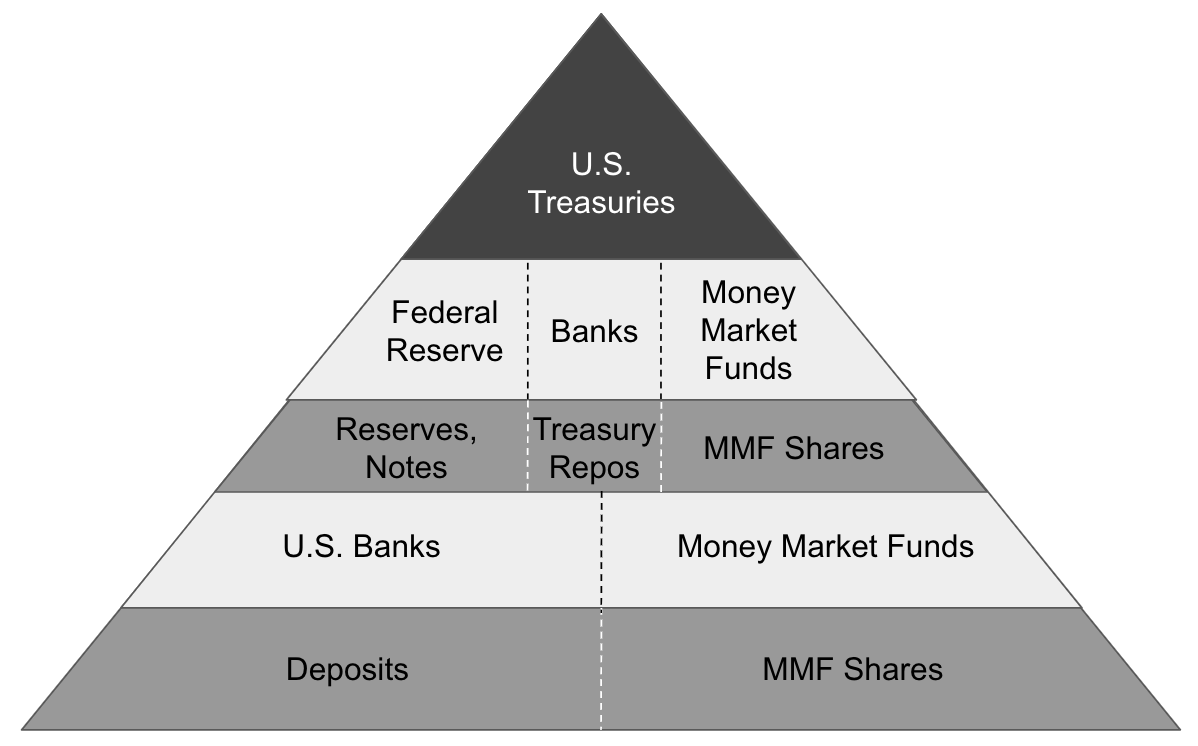

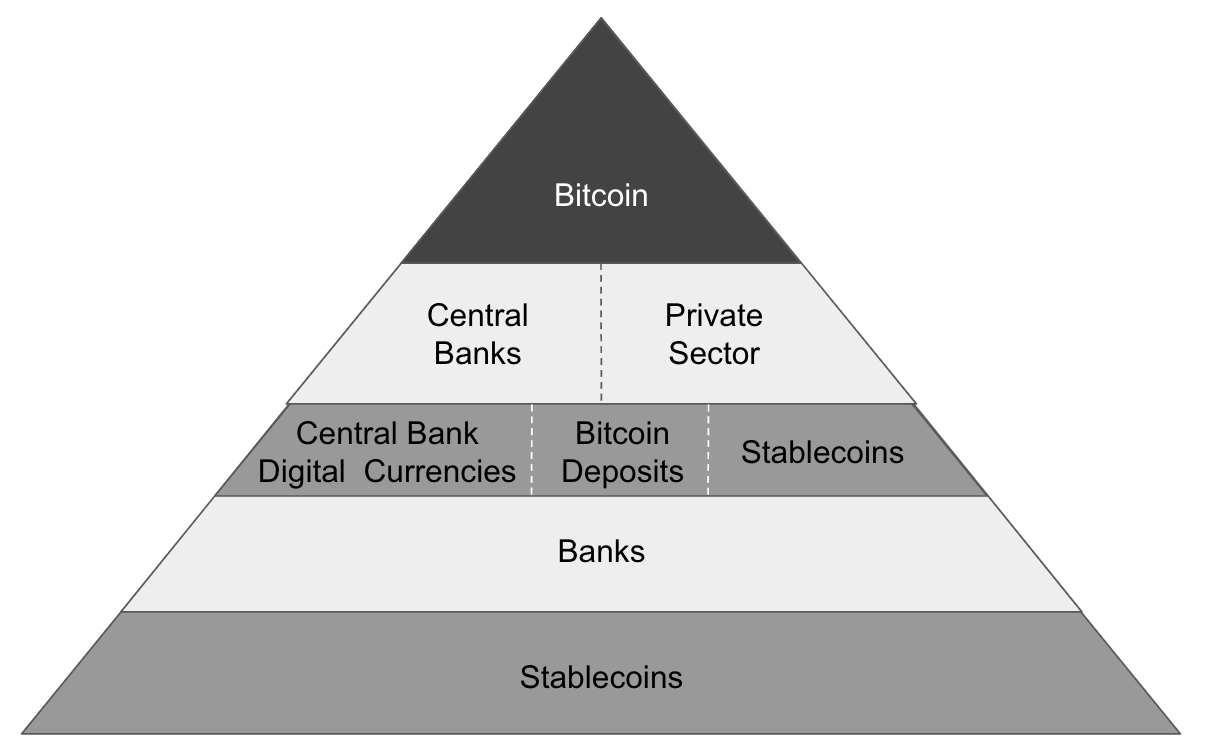

Layered Money comes to a similar conclusion, though its underlying thesis is that Bitcoin will stand alone on the first layer of money in the future. Layered Money imagines a new monetary pyramid where central banks issue central bank digital currencies as second layer money and clear and settle using first layer Bitcoin.

But will this be true?

Facebook was not the first significant social network. And Google was not the first significant search engine.

I wrote why Bitcoin will be bigger than you think. And I am bullish on Bitcoin. But the gap between digital gold and sole layer 1 reserve currency is very large.

We'll explore this in detail in an upcoming article on market dynamics in digital money. Is the market for digital money winner take all? Is it a natural monopoly?

Did you like this article? Subscribe now to get content like this delivered free to your inbox. Learn more about what I do: https://andyjagoe.com/services/

- Cover photo by Jason Leung

- N. Bhatia, Layered Money, 2021

- P. Mehrling, The Inherent Hierarchy of Money, 2012

- C. Menger, On the origins of money, Economic Journal 2: 239-55, 1892

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, Software Eats Money has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.