How software eats money

Unpacking the software eats the world hypothesis and explaining why and how software eats money.

People often say that software is eating the world. But have you ever wondered what that really means?

Ten years ago, software eating the world might have been hard to believe. In 2008, only one of the top ten companies in the S&P 500 was a tech company: Microsoft.

Today, all five of the top five companies in the S&P 500 are tech companies. Their combined market cap is 22% of the entire index. Or as much as the bottom 363 companies combined. They are so dominant, lawmakers want to break them up.

How did this happen? And what happens next?

What role did software play in this outcome? And what does it mean for the future of financial services?

To understand what's really happening, you need to unpack the software eats the world hypothesis and understand why digital is different and the implication this has on value chains everywhere.

In a 2019 interview, Marc Andreessen describes in three layers how the software eats the world hypothesis unfolds across industries. Layer one is:

Any product or service in any field that can become a software product, will become a software product.

If there's something you're used to doing on the phone, that will go to software. If there's something you're used to doing with paper, that will go to software. If there's something that you're used to doing in person and there is any way it can go to software, it will go to software.

Countless physical products are now just apps on the phone for most people: cameras, maps, keys, paper tickets, books, newspapers, magazines, calendars, radios, televisions, measuring tapes, remote controls, mirrors, and flash lights. Just to name a few. And more are being added all the time.

In other words, if it can become bits, it becomes bits.

What are bits? Zeroes and ones―a basic unit of information in computing. Data expressed as a series of zeroes and ones is what we call digital.

And digital is different. On a deep and fundamental level.

An obvious reason is that digital products are easier to change, so it's faster to innovate and add new capabilities or features. Digital products are also easier to replicate at scale and are much more cost effective.

A less obvious reason is that digital products enable a shift from a world based on scarcity into a world based on abundance, unlocking large opportunities for value creation and re-arranging existing value chains in the process.

Albert Wenger, a partner at Union Square Ventures, describes the two most important ways digital is different:

- Zero marginal costs Making one additional unit and delivering it across the network costs nothing. The price for a product with zero marginal cost trends towards free. Zero marginal cost is like an economic singularity similar to dividing by zero in math―as you approach it strange things begin to happen, ranging from digital near-monopolies to granting all of humanity access to the world's knowledge.

- Universality of computation Anything that can be computed in the universe, can be computed by the type of machines we already have today, given enough memory and time. Computation means taking information inputs, executing a series of processing steps, and producing information outputs. Which is essentially what a human brain does. In principle, a digital machine can do everything a human brain does.

So if products and services in your field are becoming software products and can take advantage of zero marginal costs and universality of computation, how do you figure out what might happen to your market?

Ask yourself some of the questions an early stage investor asks before investing in a startup:

- What used to be scarce but is now abundant?

- What used to be full of friction but is now no friction? And how will consumer behavior change?

- What is the new scarcity that the startup is going to claim?

- How is the value chain arranged today and how can it be re-arranged to eliminate existing players or reduce their margins so that the total friction to a customer is lower but that the new point of friction is the startup—and that is why the startup can collect money?

For example, before the Web, information was scarce. Getting answers to questions was full of friction. It required knowing who to ask, or which physical books, magazines or articles to pore over. And then, how did you actually know if you had really found the best answer? Or just a local maxima?

With the emergence of the Web, information was digitized and only a click away. Information was now abundant. But there was a new problem. How did you find it?

Finding the best answers to questions was the new scarcity, and Google built clever software that did a much better job of ranking answers to questions than anyone else. Because of zero marginal costs, they allowed people to use it for free. The experience was 10x better than any alternative, and made users feel awesome. Like they had a superpower.

This was the beginning of a virtuous cycle. As people clicked on answers, Google recorded clicks as votes and then recalibrated their rankings. The more people used Google, the better it got. And the better it got, the more people used Google.

Software and digitalization enabled Google to aggregate the world's demand for answers on a scale never before seen. Google was the new point of friction in the value chain, and anyone who wanted to show up as the top answer had to pay. Many selling information (the old scarcity) had to find a new business.

OK, so what does all this mean for financial services?

Most money today is just information in a database. Deposits (checking and savings) should already be zero marginal cost, but banks have added friction and bureaucracy to keep money safe because of fraud and the absence of trust. Customers have been okay with this because trust is fundamentally what they've been buying.

As an individual, how can I trust that my money will be there when I need it? How can I trust that when I send a payment it's received by who I intended? How can I trust that I can borrow money when I need to? And that my loans will not be called in early? How can I trust that I own what I believe I have invested in? And when I have an accident, how can I trust my policy will pay as expected?

In today's world, trust is scarce.

But what if the world changed, and this was no longer true? What would happen to today's leading financial companies and their business models if trust became abundant?

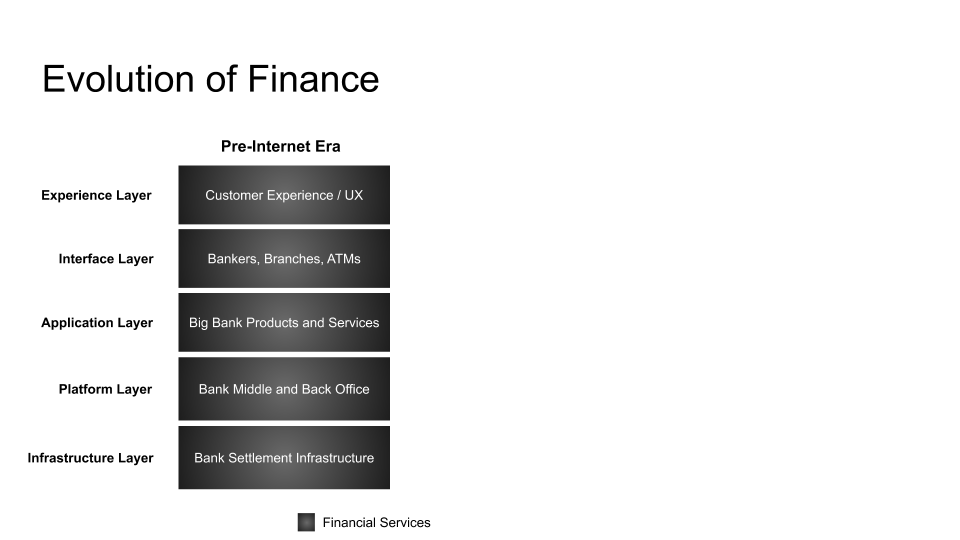

Let's take a look at the evolution of the financial services platform stack¹ and see how things are changing.

Pre-Internet Era

For hundreds of years prior to the Internet, financial services were a vertically integrated oligopoly controlled by large banks. Names varied by country, but the story was always the same. Big banks managed every aspect of the stack, from the end user experience (bankers and ATMs) all the way down to the lowest level of infrastructure (settlements).

Regulation, infrastructure and customer acquisition cost made entry difficult, and so existing firms were very profitable. New products were rare, and old products hardly changed (aside from rates, fees or terms of service). Software was important at the platform and infrastructure layers, but would not be considered good software by today's standards. Software was used mainly to do old things better. There was no incentive to innovate, so things stayed the same.

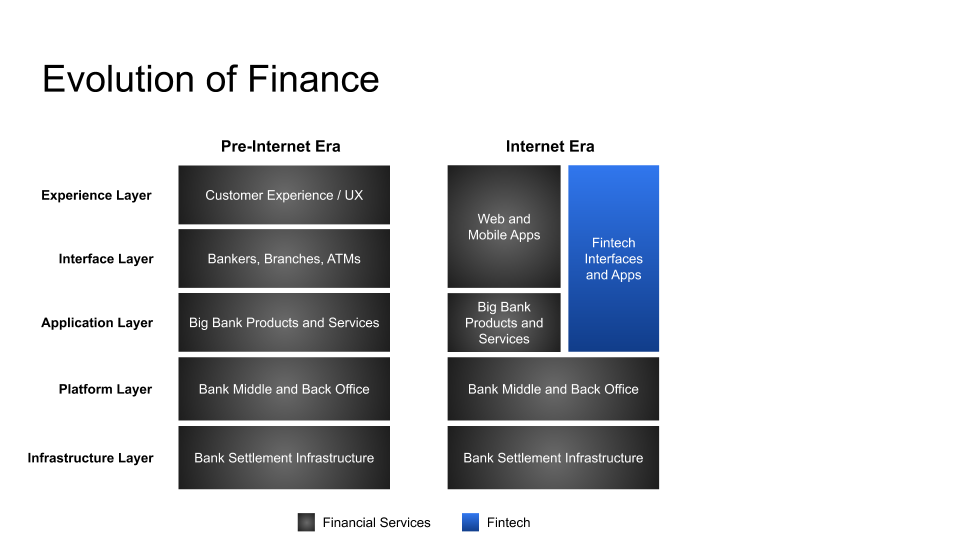

Internet Era

Mobile phones and broadband access to the Web meant that customers wanted always-on self-service access to financial services. Banks launched web sites and mobile apps, but there was no change to the underlying products and services being offered. Just a new way to interact with them that saved banks money. Once again, new technology was used to do old things better.

Meanwhile, a new class of innovators called fintechs emerged that were good at software, user experience and interfaces. They started targeting underserved customer segments and making improvements in the experience and interface layer, while partnering with existing financial services players for the middle office, back office and settlements.

These fintechs and neobanks are software companies in a way that banks are not. And some have become very big, like PayPal, Stripe, Square and Robinhood. Despite this, they are mainly innovating around the edge. Money and value still settles through fintechs essentially the same way paper bills settled hundreds of years ago.

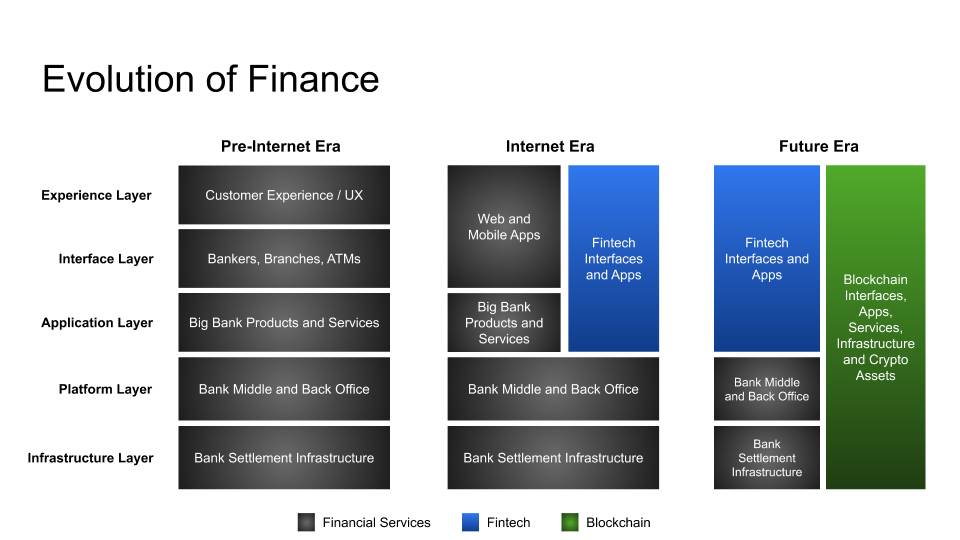

Future Era

Large financial institutions from the Pre-Internet era are still in control of the financial system today. The top four US banks each hold over a trillion dollars in deposits and maintain their positions through bundling, regulation and scarcity of access to the financial system's platform and infrastructure layers―coupled with a good measure of inertia, fear, uncertainty, and doubt.

Their value proposition is trust.

But public blockchains make trust abundant. And when trust is no longer scarce, big changes will happen in financial services.

It's hard to overstate how important this is. Today's entire financial system is based on trust being scarce. And unlike fintechs innovating around the edge, trust becoming abundant will enable fundamental and deep re-ordering of the financial services value chain.

Like many new technologies, today public blockchains and crypto-assets seem like toys. Strange, unserious, and expensive. Maybe even dangerous. But over time, new technologies like these get better and are adopted gradually, and then suddenly. And often massively expand a market, making it orders of magnitude bigger.

This is how software eats money. Multi-sided networks like Bitcoin will emerge and provide parallel platform and infrastructure layers that make trust abundant and can be freely innovated on. Like other multi-sided networks, they will have increasing returns to scale and be natural monopolies. Central bank digital currencies will also emerge. But if they are not open and permissionless in the same way the Internet is, they may suffer a fate similar to networks like Microsoft's Information Superhighway that tried to compete with TCP/IP.

A software player that recognizes trust becoming abundant will re-order the value chain by aggregating demand using zero marginal costs and universality of compute to give away much better versions of the products and services that today's financial services companies charge for. Customers will love this aggregator, and it will ship a continuous stream of customer-centric and innovative new financial services. It will make money from a new scarcity in the value chain, perhaps positional scarcity. It will do for financial services what Amazon did for retail. Or Google did for web pages.

In the past, financial services firms were protected. They were able to look at new technologies through a lens of doing old things better.

This time, it's not the case.

Why?

Because if you believe layer one of the software eats the world hypothesis (above), then layer two says:

Every company in the world that is in any of these markets that this is happening, therefore has to become a software company.

This means that financial services companies must become software companies to be able to compete. Real software companies. Like Google, Facebook or Amazon. Not sales organizations with an IT department. Or outsourced software development.

And if you believe layer two of the software eats the world hypothesis, it follows that layer three says:

As a consequence, in the long run, in every market, the best software company will win.

Are today's financial services companies good software companies?

Let alone the best?

If you're a fintech, you're already a software company. You may already recognize the emergent opportunities in the blockchain ecosystem. Square has long allowed customers of its Cash app to buy Bitcoin, and Jack Dorsey recently diversified 1% of Square's assets into Bitcoin. PayPal also has just announced it will enable its customers to buy, hold and sell cryptocurrencies.

If you're an incumbent financial services company, what do you do? First, operate like a technology company that is making investments it knows might disrupt itself. Apple didn't stop when iPod dominated the personal media player space. It built iPhone, and relegated iPod to a niche product that no longer makes the home page. Second, build a portfolio of early stage investments in your space with a right of first refusal in an acquisition. Fund aggressive Internet entrepreneurs who understand software. Do not staff these companies, share office space, or give them any preferences. They should sink or swim like any other startup.

The biggest mistake you can make when software eats money is to think about how to do old things better.

The only way to win is to do brand new things.

Did you like this article? Subscribe now to get content like this delivered free to your inbox. Learn more about what I do: https://andyjagoe.com/services/

- This is a riff on Ian Lee's evolution of finance at https://synthesis.substack.com/p/the-future-of-finance-is-decentralized.

- Cover photo by Jorge Salvador

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, Software Eats Money has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.