The future of finance is self-driving money

What self-driving money is, and why it's coming to everyone.

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning”

-Henry Ford

We worry about how our children score on science, math and reading, but spend no time in school—or anywhere else—teaching them what money is, how it works, and what the rules of the game are.

Maybe that’s because we ourselves don’t understand money very well.

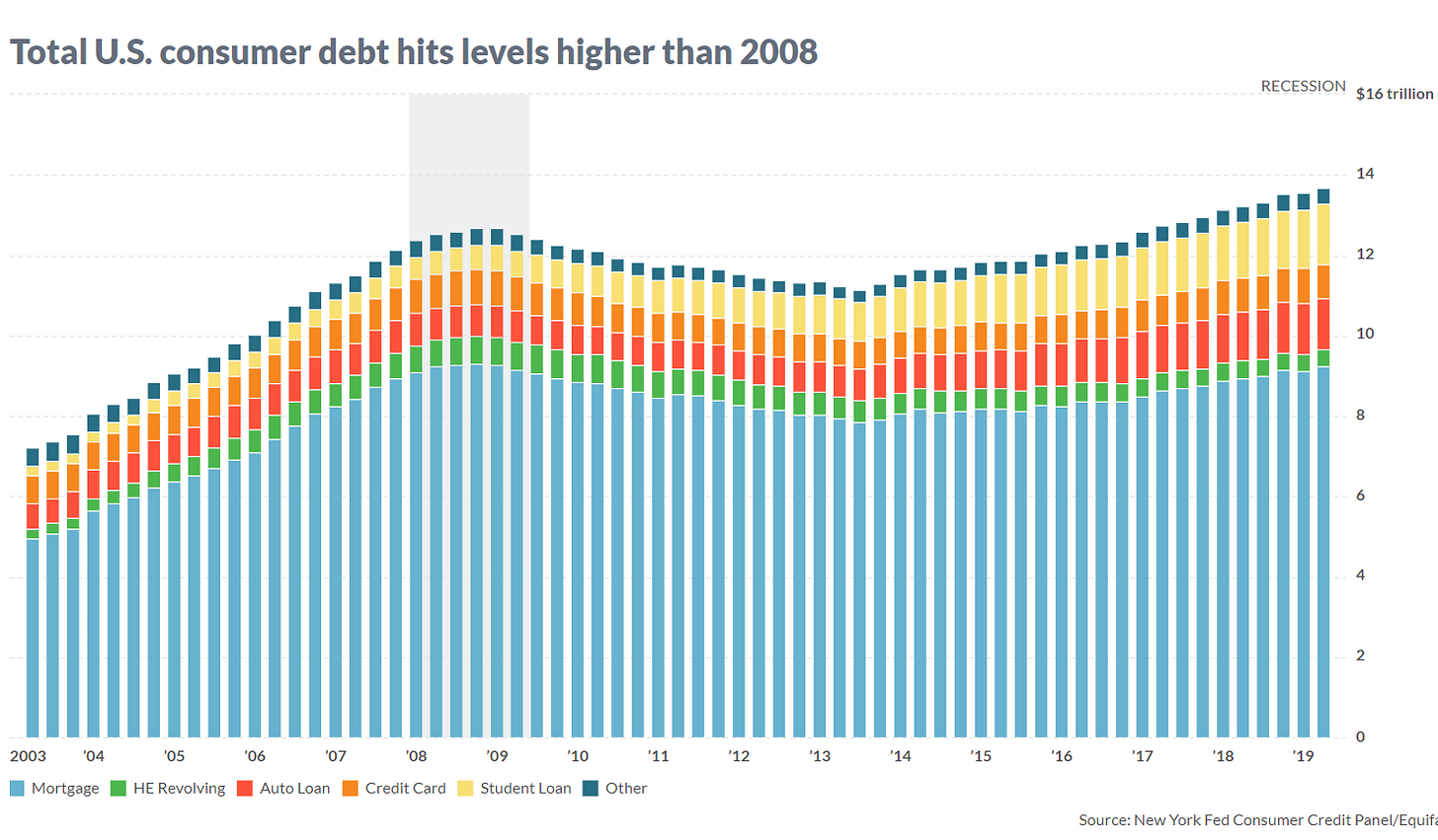

In 2019, US consumer debt hit record levels. Student loan debt alone is now $1.486 trillion, more than doubling since 2008.

Given these debt levels, it’s not surprising that the US personal savings rate has been falling for 40 years and remains low.

78% of Americans live paycheck to paycheck, and most Americans would struggle to cover an unexpected $400 expense.

Low levels of debt and high levels of saving are key ingredients to financial freedom, resilience and security. But instead of being secure, America is on the verge of a retirement crisis, where 25 million retired Americans will face poverty or near-poverty in retirement by 2050.

How did we get here? Why aren’t we doing better?

Managing Money is Hard

Finance is a skill that needs to be learned, just like any other. If you don’t understand it, you will not make the best decisions—and a boat that is 1 degree off course, will soon be miles away from the target.

Companies of any significant size have what’s called a treasury department. The job of the treasury department is to make sure that the company pays all its bills, make sure the company doesn’t run out of cash, manage risks, manage investments, manage debt and capital raises, and maintain relationships with the financial community.

Individuals and households also have a treasury job to be done. They need to maintain budgets, save and invest for future needs, maintain insurance against the unexpected, finance/re-finance good investments, liquidate bad investments or assets no long needed, and not run out of money, among other things.

In the same way few people have the time, interest and ability to be their own IT manager, even the most financially sophisticated among us struggle to be a fully optimized personal treasury manager.

So why is it that we no longer need to be our own personal IT managers, but we still need to be our own personal treasury managers? How is it that we all have an always connected super-computer in our pockets (no IT manager required)—but still suffer the same financial management problems we did twenty years ago?

Lack of accountability

If you buy a technology product and it’s hard to use or doesn’t work as expected, you know almost immediately. In fact, Amazon reviews and sites like Wirecutter allow you to determine in advance, with high accuracy, how happy you’re likely to be with a product.

If you buy a financial product that’s hard to use or doesn’t work as expected, you might not know for decades—or until it’s an emergency and you actually need it—at which point you’re stuck. There is no option to switch it for another one. You might never know you bought an inferior product.

Technology products are frequently replaced. For example, most people buy a new phone every 2 years or so. This creates a tight feedback loop, where market dynamics and word-of-mouth lavishly reward great products and effectively eliminate inferior products.

Many financial products are only bought once or twice in a lifetime. For example, how many times do you buy a mortgage? Or life insurance? This creates a loose (or non-existent) feedback loop, where market dynamics favor large incumbents with a network of salespeople who tell good stories, with unclear quality or appropriateness of the products they’re selling.

The result is that financial products are not held accountable the same way products in other industries are. And lack of accountability stifles innovation and results in optimizing for the wrong things.

Misaligned Incentives

Unfortunately, what is best for today’s financial services companies is not always what’s best for you, the customer.

For years, the stock brokerage industry was driven largely by commissions on trading. This meant that when you traded more, they made more money. When you traded less, they made less money. But we know empirically that the more you trade, the worse your investment results tend to be. This is partly because of all the fees you pay, and partly because people naturally tend to buy high and sell low—exactly the opposite of what they should be doing.

The good news is that the days of fees for trading appear to be over. But this does not mean that the incentives problem is gone. As it happens, only 6% of Charles Schwab’s Q3 2019 revenue came from commissions. 70% of net revenue came from interest revenue, which includes cash balances in customer’s accounts. Last quarter, 11.4% of client’s assets were in cash, and Charles Schwab earned more than 2% on its interest bearing assets.

Large cash positions in customer accounts are no accident. Schwab’s “intelligent portfolios” default to large cash positions that some have argued are not good for customers. Either way, the fact that the majority of Schwab’s revenue comes from these cash positions creates bad incentives when compared to taking a simple annual fee the way others do.

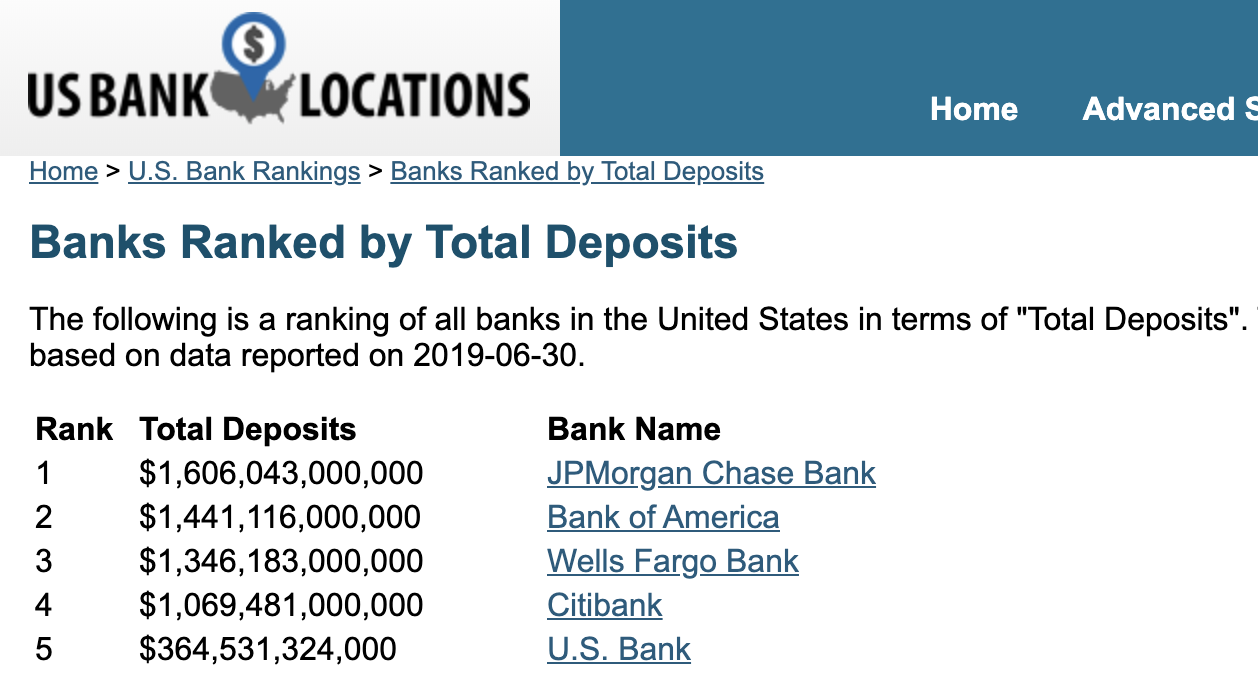

But this is nothing compared to what banks are doing. The top 4 banks hold more than $5 trillion in deposits.

As of December, 2019, JPMorgan Chase and Wells Fargo offered an average of 0.01% interest on savings and interest checking accounts. Bank of America and Citibank offered 0.03% and 0.04% respectively on savings accounts, and 0.01% on interest checking accounts. With a federal funds rate of 1.75%, these banks are earning billions of dollars per year on your money, without passing anything on to you.

When faced with the prospect of squeezed margins due to lower rates, Jamie Dimon, the CEO of JPMorgan Chase, says the bank can cut costs and charge clients more account fees.

No mention of new or better products. No mention of value or customer benefits. No mention of tools, service or education to help customers win.

More fees.

Fees for making a mistake. Fees for using the wrong ATM. And fees for not having enough money in your account.

Today, bank fees are at record highs. But product benefits are unchanged.

In what other industry is this possible?

Despite the growth of bank fees, issuing loans and collecting interest is still the primary way banks generate income. This includes interest from mortgages, credit cards, and auto, student and small business loans, among others.

Here again we have misaligned incentives. Banks optimize revenue when customers have as much debt as possible. Not so much that they might default, but enough that the bank earns lots of interest income.

The optimal amount of debt a profit maximizing lender’s wants you to have is much, much, much higher than the optimal amount of debt you want to have when planning for your family’s needs and a comfortable retirement.

So if this is the case, who’s looking out for you?

Crisis of trust

As it turns out, if you want someone who’s truly on your side—if you want your own personal treasury manager—this doesn’t exist today. You either have to do it yourself or hire a team of professionals to do it. This might include a Registered Investment Adviser (an RIA—required by law to act as a fiduciary), an accountant, a tax specialist and a lawyer.

The problem is that these people are extremely expensive. A RIA will charge 1% of your assets annually for their standard service, with additional services available at an hourly rate. And a good RIA will also require an asset minimum—maybe $500,000 or more—which is out of reach for most people. Accountants, tax professionals and lawyers all charge high hourly rates which run up quickly.

What do we do when we can’t trust the people selling financial services, and we can’t afford to pay a team of people to make decisions for us?

The answer today is to do as much as you can by yourself. Or just copy what friends and family are doing. But no matter who you are, this is suboptimal.

What you really need is someone who’s actually on your side. Who wins when you do. Someone who really knows you and where you’re going. Someone who can see around corners that you didn’t even know where there. Someone you can understand, who’s making or suggesting course corrections while you sleep.

You need your own personal virtual treasury manager. Who’s cheap.

The good news is—as software eats money—for the first time this might be possible.

The future of finance is self-driving money.

Self-Driving Money

What is self-driving money?

Self-driving money knows who you are and uses the best possible route to take you where you want to go. If traffic is bad or a road is closed, it automatically figures out the next best route. If it can’t get you to where you want to go, it tells you and gives you choices of the next best places it can take you that you might like.

Self-driving money gives you warnings if there’s something on the journey you need to know about. Self-driving money tells you what it’s doing and why, but doesn’t require you to understand how your vehicle actually works. At any moment you can change your destination, and it will recalculate everything. Just as if it were Google Maps.

Self-driving money means peace of mind.

Self-driving money means freedom.

Self-driving money means you can be confident you can provide for those you love.

Managing cash

Self driving money makes sure you know about your bills and don’t miss payments.

Self driving money makes payments in the cheapest way possible.

Self driving money doesn’t let cash sit idle in checking accounts or savings accounts that don’t pay interest.

Self driving money makes sure cash generates as much interest as possible.

Self-driving money makes sure you have multiple banking relationships, and moves money automatically between accounts in response to changes in interest rates or fees.

Self-driving money keeps you up-to-date on your account balances.

Self-driving money tells you about any transaction on any of your accounts.

Self-driving money helps you create budgets and savings goals, and helps you stick to them.

Self-driving money notices if your income has dropped or stopped, and makes suggestions of what you can do.

Self-driving money knows when you have worked and gives you a low cost way to advance your paycheck without going to a payday lender.

Self driving money notices if you get a bonus, and shows you the long term benefits of paying off debt or investing it—even if you ultimately decide to spend it.

Self driving money notices how much you spend on groceries, and can suggest meal services that might save you money and give you more time with your family.

Self-driving money can tell you the financial costs/benefits of moving closer to (or further from) work, or getting a second job.

Managing risk

Self-driving money can tell you what the recommended levels of health, auto and home insurance are for you and what a competitive price is.

Self driving money can tell you why people buy life insurance, and if you’re interested, make sure you get the right amount of coverage for your specific situation at a good price.

Self-driving money can monitor your insurance policies and instantly provide you alternative options if your carrier raises rates.

Self-driving money can notice if you’re self-employed and can tell you why some people buy disability or errors & omissions insurance and present you with competitive offers if you’re interested.

Managing investments

Self driving money can pick the best portfolio allocation for your risk profile and goals.

Self-driving money can automatically invest for you every month.

Self driving money can rebalance your portfolio automatically and change your allocation when your situation or goals change.

Self-driving money can warn you against selling near the bottom or buying near the top.

Self-driving money can automatically diversify or switch your assets between institutions in response to pricing and policy changes.

Self-driving money can transparently stack assets across multiple institutions, so if you are a high net worth individual, you are not limited by any one institution’s FDIC or SIPC insurance limits and there is no inconvenience or negative impact on your portfolio allocation strategy.

Self-driving money can give you access to alternative investments and allow you to maintain a portfolio similar to professional investors if it is appropriate for you.

Managing debt

Self-driving money constantly monitors your loans and mortgages for interest rate changes, and can present you with a refinance opportunity as soon as it might make sense.

Self-driving money monitors your credit card spend and gives you warnings if your spending is increasing or might be compromising your goals.

Self-driving money monitors credit card interest rates and consolidates any revolving balances to make sure you’re paying as little in interest as possible.

Self-driving money tells you why you should never choose variable rate loans when a good fixed rate loan is available.

Self-driving money can present you with ideas and options you might never have considered. Like selling Patch Homes equity in your home in the form of a partnership instead of taking out a home equity line of credit.

Self-driving money can help you through a debt settlement process and avoid bankruptcy if things get out of control.

Managing liquidation

Self-driving money notices when you have bought a new phone, computer or other asset and can suggest ways to sell the old one while it still has value.

Self-driving money knows when your kids have probably outgrown the strollers, bikes, or toys you bought for them, and can suggest ways to sell them.

Self driving money notices if you buy a lot of new clothes, and can suggest you consider reselling (e.g. on Curtsy).

Managing taxes

Self-driving money knows the tax consequences of your decisions, and can make suggestions on how to save.

Self-driving money saves you money.

Self-driving money saves you time.

Self-driving money can even reduce accidents—of the financial kind. 66.5% of personal bankruptcy filings are related to unexpected medical issues, either because of high cost of care or time out of work. With the right savings or insurance, many of these situations could be averted.

Life isn’t fair, but self-driving money gives every person a chance at their best life.

Is this for real?

All these promises might sound like a dream. Something that’s impossible to deliver. Or will cost a fortune to build.

But this is not true.

You can see the first glimpse of this vision becoming reality at Wealthfront. And actually see what they’re doing to make it work under the hood.

Wealthfront’s pricing is simple. They charge an annual advisory fee of 0.25% of all assets under management. For a $10,000 account, this is $25 per year.

Other startups touching pieces of this vision include Digit and Tally.

Everything these companies do is built into software. While expensive to develop, the beauty of software is it can be infinitely replicated. And at scale, the marginal cost of one additional user approaches zero.

This is why companies like Amazon, Google, and Facebook are as large and profitable as they are. Google Search isn’t just for wealthy people. It’s for everyone.

And this is why today’s financial services landscape will dramatically change.

As Bill Gates once said “Most people overestimate what they can do in one year and underestimate what they can do in ten years.”

The future

I love the idea of self-driving cars. They have a science fiction mystique that captures your imagination and feels like magic. There is no question that self-driving cars will change the world and make it a better place. Self driving cars are fun and sexy.

By comparison, self-driving money is boring. You can’t wear it or park it in your driveway. And it might take 10 years to show that it works.

Self-driving cars make it cheaper and more pleasant to go to work. But self-driving money gives you freedom, so you don’t have to.

It is not acceptable that so many Americans have no savings and would struggle to cover an unexpected $400 expense. We are all weaker because of this. Money is not a zero sum game, and there is no reason why every American family should not be financially secure.

I’m excited for a future where everyone has the financial superpowers they deserve. Most money is just entries in a database. It’s information. A language we use to communicate value to each other.

Software eats money. And the best software company will win.

Did you like this article? Subscribe now to get content like this delivered free to your inbox. Learn more about what I do: https://andyjagoe.com/services/

—

Photo by Thought Catalog

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, Software Eats Money has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.