The shocking truth about crypto

How crypto networks collapse the cost of large scale network coordination and Big Tech's business model along with it.

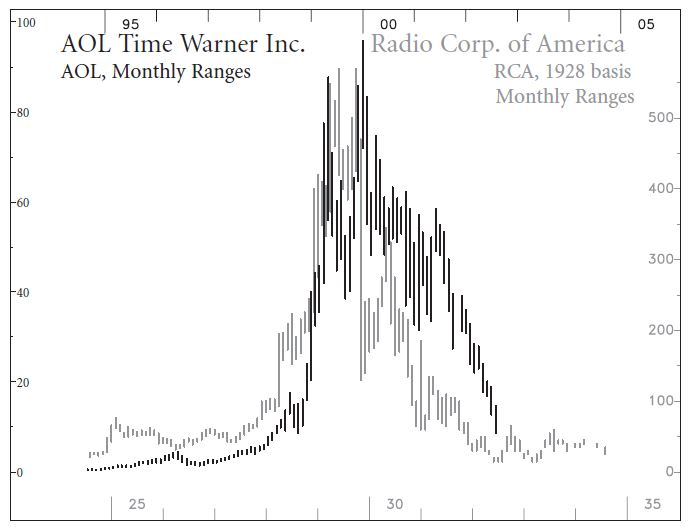

Investors in RCA at its 1929 peak were correct about the fundamentals of radio. Households with radio sets grew from 2.75 million in 1925 to 10.25 million in 1929. Then, during the Great Depression, continued to grow to 27.5 million by 1939. What they were not correct about was the stock price.

AOL followed a similar pattern. Investors at its peak in 1999 were correct about the fundamentals of the internet. They were wrong about the stock price:

RCA and AOL were bubbles. Extreme examples. But are there examples today where we're correct about the fundamentals, but wrong about the price?

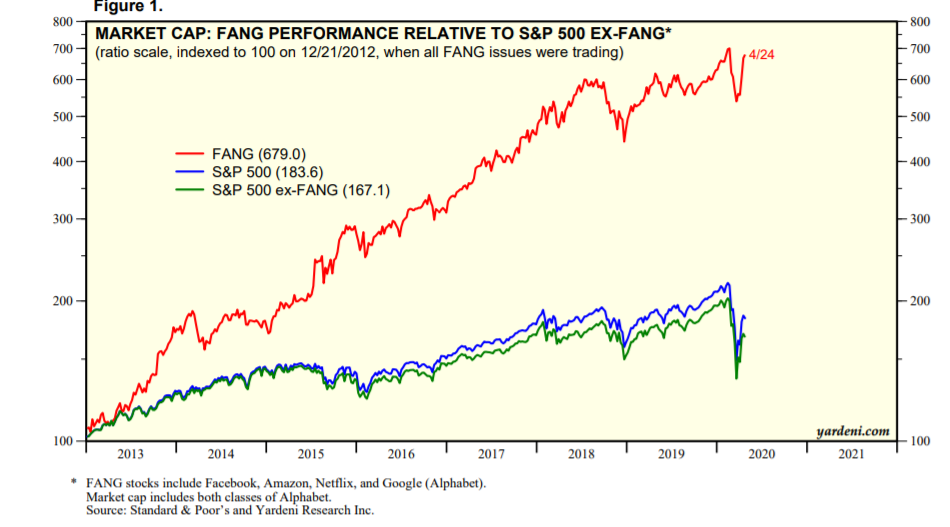

The performance of FANG vs the S&P 500 is staggering:

When you include Apple and Microsoft, the market cap of these companies is almost 20% of the S&P 500. And this pales in comparison to the almost 40% of the MSCI China Index that Alibaba, Tencent, and Meituan Dianping (ATM) make up.

Software is eating the world. And these companies seem unstoppable.

But don't let them keep you up at night.

For 10 years now, a new paradigm has quietly been building momentum that will shake the foundation of Big Tech's proprietary data business model to the core.

Today we're going to talk about why your biggest competitor might be the one you never see coming.

Technology market cycles

Naval Ravikant, founder and chairman of AngelList and early stage investor in 10 unicorns, recently tweeted that blockchains are the third epoch of the Internet after web and mobile:

Few understood what he meant. His tweet got a strong response, ranging from confusion to people suggesting he replace blockchain with bitcoin.

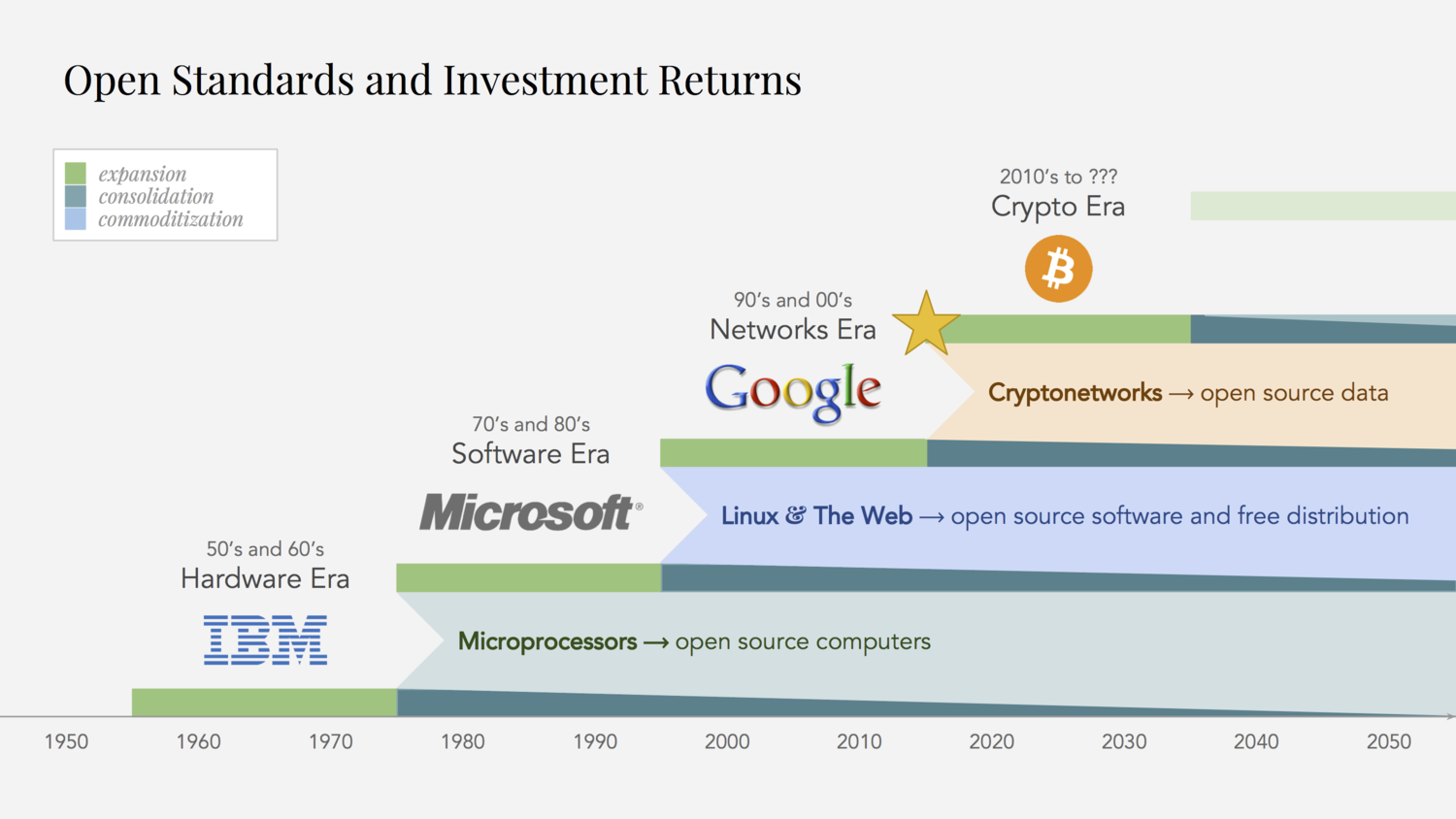

To cut through the noise and explain what he meant, we need to look at a short history of technology market cycles:

First launched commercially in 1947, transistors collapsed the cost of logic circuitry, enabling IBM to create the System/360, a modular computing platform with interchangeable parts that allowed them to dominate computing in the 1950s and 1960s.

In 1971, Intel released the first microprocessor, which would collapse the cost of building computers because they eliminate the need to build custom processing systems for each new use case. As microprocessors unbundled the computing business, IBM's dominance faded and demand grew for a standard operating system. In 1980, Microsoft signed the contract that put MS-DOS on the IBM PC. As PCs took off, so did Microsoft, who leveraged their 80% market share in operating systems to dominate any application segment they entered.

Meanwhile, the first PC modem was released in 1977, the US government made TCP/IP the standard for ARPANET in 1983, and Tim Berners-Lee initiated the development of HTTP in 1989. Then, in the early 1990s, the NSF opened the Internet for commercial use and Linus Torvalds released the first version of Linux. A free, open operating system and a free, open communications network collapsed the cost of building and distributing software. The new scarcity was how to find and derive meaning from an almost incomprehensible amount of data and connections. Microsoft's dominance faded, and Big Tech, epitomized by Google, emerged to build and monetize proprietary datasets.

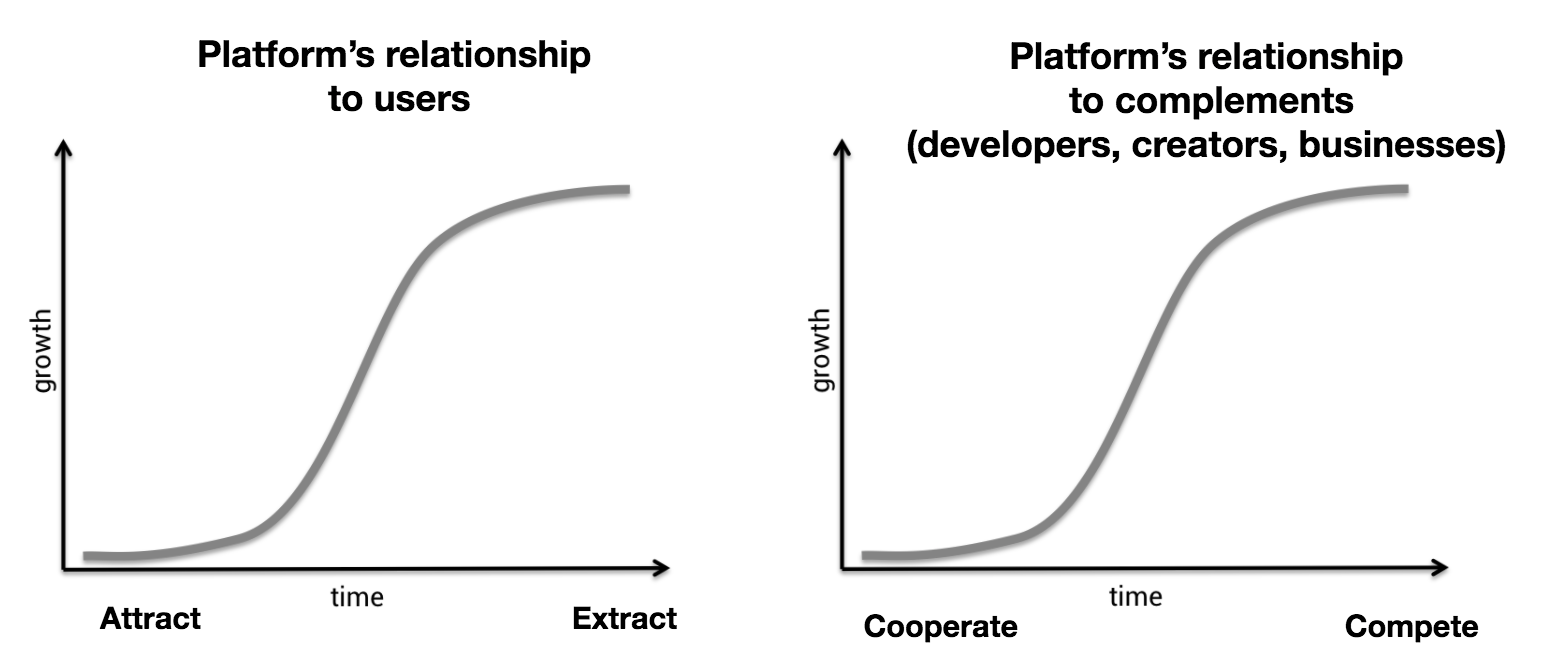

The most successful Big Tech companies operate as multi-sided networks, where the platform becomes more valuable to all users as each new user joins. While innocuous at first, over time these platforms are increasingly difficult to compete with. No competition plus pressure for growth and earnings mean that these platforms shift from attraction to extraction and from cooperating with their users to competing with them.

This brings us to today. Is Big Tech unstoppable? Sometimes it seems like it. But at their peak, IBM and Microsoft seemed no less unstoppable. Both faced government investigation and antitrust action, just as Big Tech is today. And both saw their dominance fade when new technology enabled others to give away what they had been charging for.

The enabling innovation for Big Tech was open source software and free distribution. The enabling innovation for the next technology market cycle is open source data, enabled by the public blockchain.

In popular culture, crypto and blockchain are synonymous with bitcoin. This is the wrong way to think about it. It misses the forest for the trees. Public blockchains collapse the cost of large-scale network coordination problems. Bitcoin is just one example of many that will challenge business as we know it. Said differently, we are about to see the erosion of proprietary data business models everywhere.

A good summary of this perspective comes from the investment thesis of Placeholder, a venture firm started by Joel Monegro, a former analyst at Union Square Ventures, and Chris Burniske, a former analyst at ARK Invest:

Information technology evolves in multi-decade cycles of expansion, consolidation and decentralization. Periods of expansion follow the introduction of a new open platform that reduces the production costs of technology as it becomes a shared standard. As production costs fall, new firms come to market leveraging the standard to compete with established incumbents, pushing down prices and margins, and decentralizing existing market powers.

The price drop attracts new users, increasing the overall size of the market and creating new opportunities for mass consumer applications. Entrepreneurial talent moves to serve the new markets where costs are low, competition is scarce, and the upside is high. Often these early entrepreneurs will introduce new kinds of business models, orthogonal to existing ones.

Those who succeed the most and establish successful platforms “on top” of the open standard later tend to consolidate the industry by leveraging their scale (in assets and distribution) to integrate vertically and expand horizontally at the expense of smaller companies. Competing in this new environment suddenly becomes expensive and startups struggle to create value in the shadow of incumbents, compressing venture returns.

Demand then builds for a low cost, open source alternative to the incumbent platforms, and the cycle repeats itself: the new open standard emerges and gets adopted, the market decentralizes as new firms leverage the cost savings to compete with the old on price, value creation shifts upwards (once more), and so on.

The takeaway from this is that your greatest competitor—no matter who you are—might be a crypto network you never see coming.

Crypto networks are like early Visa

Crypto networks are not companies. They're co-ops. Participatory enterprises owned and operated by their members.

We don't often think about cooperatives, but they're in far more places than you might realize. Many stock exchanges, including the New York Stock Exchange, were conceived as member-operated platforms. Land O'Lakes is a dairy cooperative with $14 billion in sales and a market cap of $22.5 billion. Vanguard is a financial cooperative that is owned by its funds and has $6.2 trillion in assets under management.

Many industries have successfully used cooperative ownership structures, including mutual insurance, credit unions and housing. The International Co-op Alliance reports that co-ops “provide jobs or work opportunities to 10% of the employed population” and the 300 top co-ops generate $2.1 trillion in turnover.

Perhaps the most successful cooperative ever is Visa. Spun out of Bank of America in 1970, Visa was a member-owned consortium that incentivized competitive banks to join. This created strong network effects, and protected against a centralized third party from extracting fees from members. Visa is now worth more than the sum of its members, who all benefited significantly when Visa went public.

Crypto networks have some remarkable similarities to Visa.

At Visa's core was a set of rules and regulations that governed everything from fees to transaction disputes to card design. All member banks had a say in decision making and all accumulated profits were reinvested in the operation. This enabled one unified offering and resulted in powerful network effects.

Crypto networks also have a guiding principle of credible neutrality, instantiated in the blockchain protocol and not changeable without the agreement of its members. Since these principles are publicly documented in the open source code the network is operating, they are even stronger trust guarantees than Visa's.

Both early Visa and today's crypto networks also share an ideology of transformation, airdrops for distribution and the use of memes.

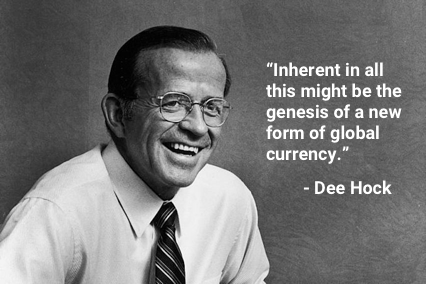

Visa's founder, Dee Hock, wrote in his autobiography:

Money would become nothing but alphanumeric data in the form of arranged energy impulses. It would move around the world at the speed of light at minuscule cost by infinitely diverse paths throughout the entire electromagnetic spectrum. Any institution that could move, manipulate, and guarantee alphanumeric data in the form of arranged energy in a manner that individuals customarily used and relied upon as a measure of equivalent value and medium of exchange was a bank. It went even beyond that. Inherent in all this might be the genesis of a new form of global currency.

If electronic technology continued to advance, and that seemed certain, two-hundred year old banking oligopolies controlling the custody, loan, and exchange of money would be irrecoverably shattered. Nation-state monopolies on the issuance and control of currency would erode.

In creating Visa, Dee did what few believed was possible, but regrets that he was not able to get merchants and cardholders direct access to the system: “By the standards of what Visa ought to be, it would be a lie to deny a sense of failure. In spite of my pride in all that Visa demonstrated about the power of the chaordic concept of organization and all the things it has accomplished, I do not believe that Visa is a model to emulate. It is no more than an archetype to study, learn from, and improve upon.”

Despite the benefits of cooperatives, they have a number of important drawbacks. They're harder to grow and fund because they don't have access to the same capital markets. This causes many cooperatives to "demutualize" or convert to for profit, investor owned organizations (Visa did this when it went public in 2007). They also have higher coordination costs because of their more complex governance processes. Cooperatives have to balance operational efficiency while ensuring the diverse views of their memberships are represented.

Digitalization, universality of compute, public blockchains, and cryptocurrency are innovations that traditional cooperative organizations have not had access to.

Could they change the game?

Digitalization's zero marginal cost enables services to be provided more cheaply than ever before. Universality of compute enables systems to make good decisions in unknown situations. Public blockchains provide trust because rules are public and predictable. Cryptocurrencies, when combined with public blockchains, allow anyone to safely send and receive value as easily as email.

When you overlay these capabilities on a network inspired by a cooperative, a better way to think about it might be as an emerging economy.

Crypto networks as emerging economies

Andreessen Horowitz (a16z) hosted a great conversation between Jesse Walden and Denis Nazarov (former a16z partners) and Joel Monegro and Chris Burniske (introduced above) to talk about crypto networks as emerging economies.

If you look carefully at a crypto network, it looks a lot like a small economy. A country that produces only one good or service.

Crypto networks have a currency that's exchanged between buyers and sellers. The core development or executive team is like a country's executive branch. The public blockchain is like the legislative branch, making the rules that govern exchange. On the supply side you have miners and producers, and on the demand side you have users consuming the service.

Physical economies are good when you have strong rule of law, low corruption, sound monetary and fiscal policies, rich supply, and active demand. Good crypto networks are no different, and you can use this framework as a tool for evaluating them.

OK, so what does all of this mean?

What happens if a crypto network enters your market?

Competing with a crypto network

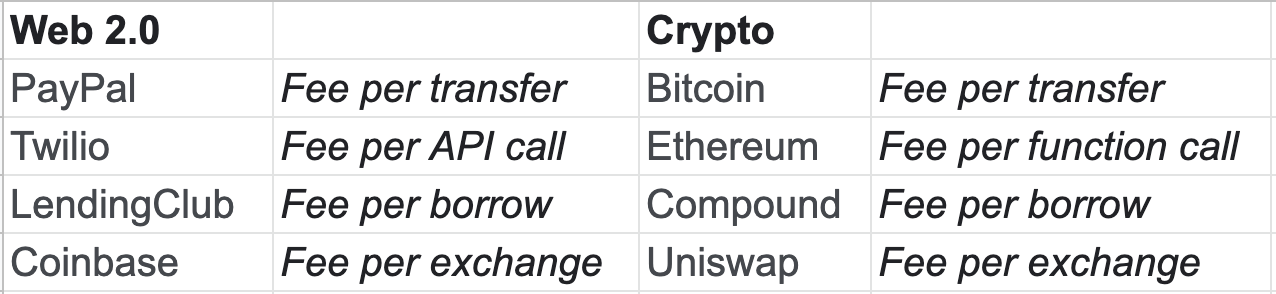

In many ways, crypto networks are similar to today's Web 2.0 marketplaces. Just like marketplace companies, crypto networks create defensibility through networks effects that allow them to charge fees and make users reluctant to switch:

Compound is an automated money-market protocol for lending and borrowing. As lending liquidity increases, the interest rates it offers on loans become more competitive. Uniswap is an automated token exchange. More liquidity in the marketplace means a better prices on trades. In other words, each additional user makes the network more useful to all.

What's different about a crypto network is that the rents that might have been extracted under a Web 2.0 proprietary data business model are now reinvested in operating the network or distributed to network participants in the form of lower fees.

This is why, at scale, crypto networks will be the low cost provider and natural monopoly in their market.

This phenomenon will rearrange today's value chains in many markets, creating abundance in places where today there is scarcity. This will create new scarcities to be claimed. Those who can claim them will be the new friction in the value chain—and this friction will be why they can collect money.

Will crypto eat the world?

The software eats the world hypothesis is almost ten years old now, and has been accurate and prescient. We unpacked it in detail previously when we talked about how software eats money.

Crypto is software. And the Big Tech proprietary data model cannot compete with the crypto network open source data model.

As such, layer one of the software eats the world hypothesis can be narrowed to:

Any product or service in any field that can be provided by a

software companycrypto network, will be provided by asoftware companycrypto network.

This said, crypto networks are very immature and still have a long way to go, especially around privacy, governance, monetary policy and token value accrual mechanics. This might take ten years or more.

One day, will we be able to narrow layer two and layer three of the software eats the world hypothesis in the same way we can narrow layer one?

Every company in the world that is in any of these markets that this is happening, therefore has to become a

software companycrypto network.

As a consequence, in the long run, in every market, the bestsoftware companycrypto network will win.

Only time will tell.

Did you like this article? Subscribe now to get content like this delivered free to your inbox. Learn more about what I do: https://andyjagoe.com/services/

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, Software Eats Money has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.