How to understand an economic engine

A framework for economic engines, a comparison of the Bitcoin and Ethereum economic engines, and why Ethereum is undervalued.

Economies are engines. The design of the engine impacts the economy. As does the fuel we use for it.

Michael Saylor, the CEO of Microstrategy, has produced a corporate playbook on Bitcoin. One of the things he talks about is how Bitcoin is like a battery charged with monetary energy.

Last week, Justin Drake, a researcher at the Ethereum Foundation, did a podcast where he explained how Michael Saylor's battery analogy inspired him to think about Ethereum and Bitcoin as economic engines.

Today, we're going to extend Justin's discussion into a framework we can use to think in detail about how economic systems work, compare the Bitcoin and Ethereum economic engines, and think about the impact changes in the engine have on the system as a whole.

The U.S. economic system

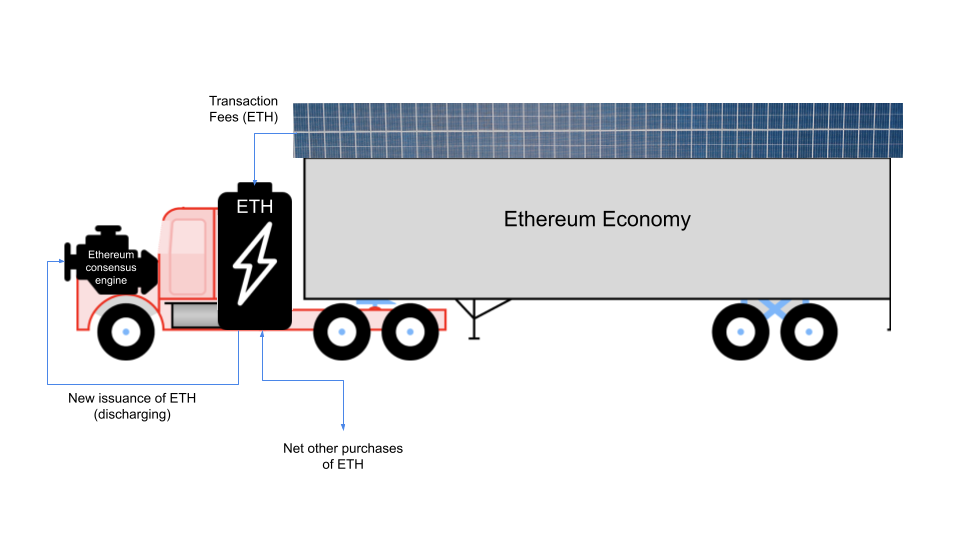

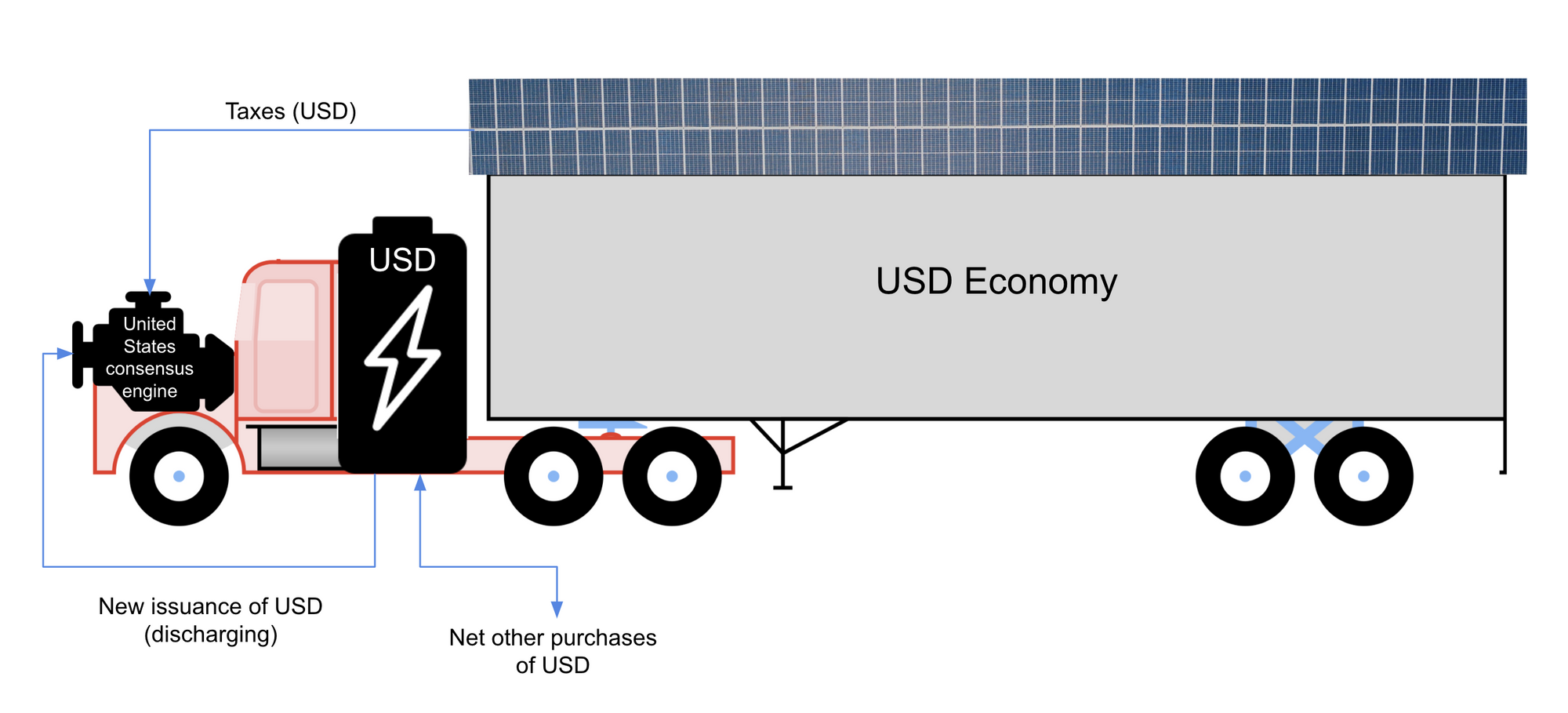

The metaphor we'll use for an economic system is a semi-trailer truck. Conventional 18 wheeler semi-trailer trucks have a tractor unit with a heavy duty towing engine that provides motive power for hauling a load.

The tractor unit contains a heavy duty engine and fuel for operating it. The engine must be sized appropriately. If the load is too big in relation to the engine, the engine will choke and stall.

The engine must consume fuel to haul the load. When the fuel tank nears empty, you must stop to refuel. So fuel efficiency is important. If you run out of fuel, the engine stops and the load is stranded and vulnerable. It's great if you can re-fuel while you're driving, because then you don't have to stop. Not all fuel is created equal, and some types of fuel are more reliable and efficient than others.

If we think about the U.S. economic system in this context, the engine takes economic fuel as input and provides economic security as output. It's the consensus system that protects the economy and sets and enforces its rules. This includes many pieces of the legislative, executive and judicial branches of the internetwork of local and state governments, as well as the federal government. Importantly, it includes the U.S. military, which enables global power projection and cost over $700 billion in 2019. The load the engine hauls on the semi-trailer is the aggregate dollar sum of all USD economic activities.

The engine has two sources of fuel, a solar panel and a battery.

Let's focus first on the solar panel. The solar panel captures a portion of the energy of the economy in the form of a tax on all participants. This includes all forms of tax: corporate taxes, income taxes, property taxes, sales taxes, etc.

The reason this is like a solar panel is because the amount of tax (fuel) received is heavily dependent on exogenous factors. Whether an economy is in boom or bust, changing demographics, war, and many other factors out of the control of the economic system determine the actual income (fuel) received.

If the economic system encounters an adverse situation (like a cloudy day or dark tunnel), the solar panel can generate less fuel than expected, though in good times (long sunny days in the middle of summer) the solar panel can generate more than expected. Because the solar panel is wired directly to the engine, the consensus system typically spends the excess energy rather than using it to charge the battery. And if the consensus system doesn't get enough fuel from the solar panel, it's forced to draw from the battery

Let's now turn to the battery. Similar to the way a battery stores electrical energy in battery cells, the US dollar (as an asset) stores monetary energy in units we call dollars.

One way to charge/discharge battery cells is through buying and selling on the open market. Buying dollars charges the battery. Selling dollars discharges it.

The second way to charge/discharge battery cells is through issuing or burning currency units. In this context, issuing new currency (printing money or increasing the money supply) means selling Treasuries. Burning currency (reducing the money supply) means buying Treasuries.

Issuing new units is like creating new battery cells, whereas burning units is like destroying battery cells. Issuing and burning does not actually charge or discharge the battery as a whole, it merely redistributes value. This is because all units are completely fungible, meaning they all store the same amount of energy. Adding new units causes value to flow out of existing units into the new units until all the cells contain the same amount of energy. This decreases energy per unit. Destroying units does the opposite. It redistributes the energy the destroyed units contained to the remaining units, increasing the energy per unit.

Provided that you have a strong battery and a way to keep it well charged, drawing fuel directly from the battery is more reliable than depending on fuel from the solar panel. Thus, you can think of fuel from the battery as Grade A fuel and fuel from the solar panel as Grade B.

Taking a step back, this framework allows us to answer many important questions about our engine:

- How powerful is it? Meaning, how much economic security does it give you?

- How fuel efficient is it? Meaning, how much power does it give per unit of fuel?

- What is the best type of fuel to feed the engine?

- What is the power to load ratio? Meaning, what is the ratio of the load the engine is under to the power it has? Is it adequate?

With this in mind, let's now explore the Bitcoin and Ethereum economic systems.

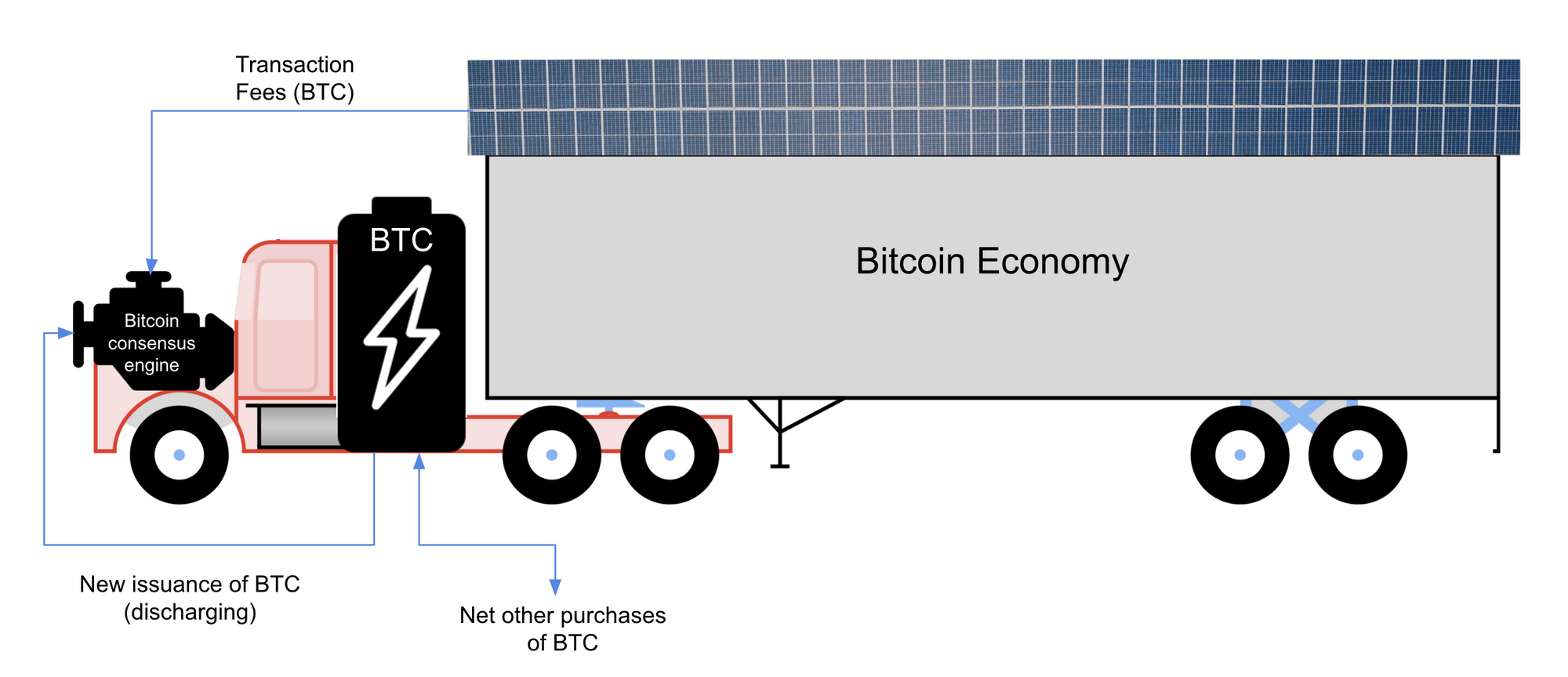

Bitcoin's economic system

The Bitcoin economic system has been engineered to be as close as possible to gold. Whether you believe the gold on earth is a result of supernovas or the merger of two neutron stars, an economic system based on gold means that the laws of physics effectively give you an engine for free, including the critical properties of no double spend, unforgeability, and censorship resistant. With blockchain-based systems, as with traditional economies, you have to pay for your engine every year.

Bitcoin's tractor unit is responsible for hauling the Bitcoin economy, worth slightly more than $1 trillion as of this writing. The tractor unit is propelled by the Bitcoin consensus engine, which is a proof of work mining process for verifying transactions on the blockchain. BTC (the asset) is the battery, and also the primary source of fuel for the engine today in the form of new BTC issuance. The engine also receives fuel in the form of transactions fees via the solar panel wired directly to it that collects a tax on all transactions in the Bitcoin economy.

Since the Bitcoin engine uses proof-of-work for consensus, the way you calculate its economic power is to calculate the cost to do a 51% attack, the minimum required to allow an attacker to create fraudulent transactions. Bitcoin's current hash rate is roughly 150 million Terrahashes per second (TH/s). The cost per TH is roughly $30, so 150 million TH/s is $4.5 billion. If you assume that the existing mining stock is honest, then an attacker would have to match it to attack the system, meaning they would need to spend $4.5 billion buying the necessary ASICS mining equipment. The costs of electricity is perhaps $20 million per day, so negligible when compared to the hardware. The net result is that we can conclude our Bitcoin consensus engine has economic security or power of $4.5 billion.

This $4.5 billion of power secures the load, which is bitcoin's $1 trillion market cap. This gives the Bitcoin system a load:power ratio of 222. The higher this ratio is, the more attractive it is to attack the system. For example, today it costs $4.5 billion to go after a prize of $1 trillion.

One concern with the Bitcoin system is that new issuance of BTC is exponentially decreasing, so the engine will be forced to increasingly rely on fuel from the solar panel to operate. By 2030, 98% of all BTC will have been mined, and by 2040 all 21 million BTC will have been mined. This effectively severs the connection between the battery and the engine for Bitcoin. At this point, Bitcoin's economic engine is completely dependent on transaction fees collected by the solar panel to operate. This is like removing the battery from an electric car and being solely dependent on a solar panel wired to the engine for energy.

As the system becomes more and more dependent on transaction fees for fuel, the load:power ratio will continue to get worse and worse.

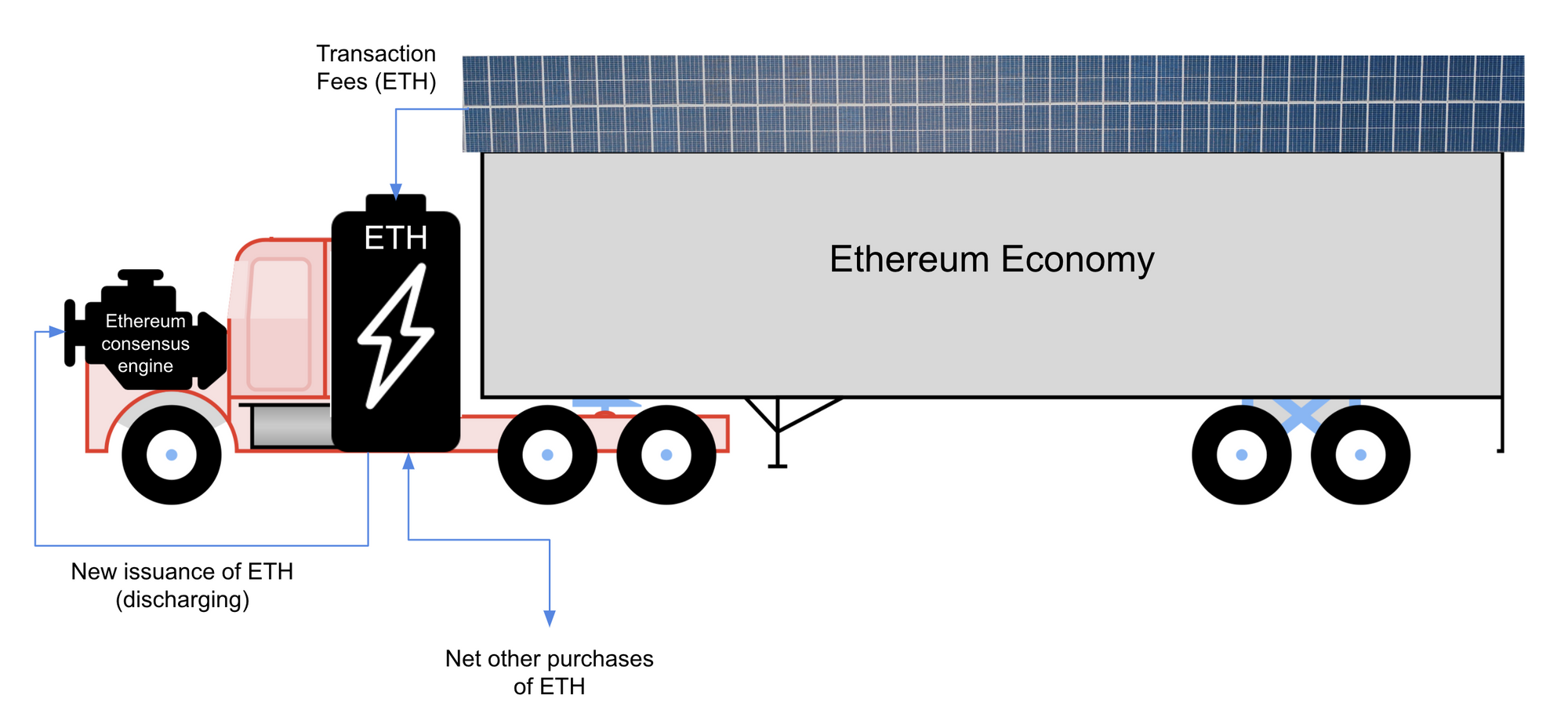

Ethereum's economic system

Today, Ethereum's economic engine works quite similarly to Bitcoin's. But unlike the Bitcoin community which has decided to ossify early, the Ethereum community has continued to work on improving their engine and has made several changes since launch.

Rather than optimize for short term predictability with long term unknowns, the Ethereum community is optimizing for long term predictability with the caveat that this has required making some changes in the short term.

Over the next year, two very significant upgrades are scheduled to take place: ETH2 (scheduled for 2022) and EIP-1559 (scheduled for July, 2021). Our analysis will explore the Ethereum economic engine as it will be after these upgrades.

The upgrade to ETH2 is a switch in the consensus engine from proof-of-work mining (like Bitcoin) to proof-of-stake validation to produce new blocks for the blockchain. It also reduces block rewards from 2 ETH to 0.2 ETH per block. This change in the engine has enormous benefits for the entire Ethereum economic system.

In proof-of-stake, validators who have posted ETH like a bond to guarantee their honesty (called staking), are required to create a new block when chosen randomly, and to validate blocks created by others (called attesting) when not chosen. Validators get rewards for proposing new blocks and attesting to ones they've seen. If a validator goes offline, they can lose a portion of their stake. If they collude and create or attest to malicious blocks, they can lose their entire stake.

Economic security

The amount of economic security (power) the engine provides in proof-of-stake is simply the value of the asset staked. Eth2 already has 3.5 million ETH staked in it, even though the chain will not be operational until next year. At today's market prices, this is roughly $6 billion. Thus, the new Ethereum economic system already has more economic security than Bitcoin, which has only $4.5 billion.

The load:power ratio for Ethereum today is 33, calculated by the percent of ETH staked. You can verify this by taking the ethereum market cap ($195 billion) and dividing it by ethereum economic security provided ($6 billion). This is dramatically better than Bitcoin's load:power ratio of 222, and means Ethereum is likely already more secure than Bitcoin. An engine that is overloaded can see settlement assurance times slow way down and become at risk for a sovereign state attempt to manipulate or control the system.

Also, proof-of-stake solves some of the problems a proof-of-work system has in handling an attack. If someone were to acquire the $4.5 billion of hardware to attack the Bitcoin proof-of-work network, they can repeatedly attack the network for as long as they like. If Bitcoin were to try to switch from the current SHA-256 hash algorithm to another algorithm, they would have to pick one that could be mined by GPUs since there would not be time to produce ASICs. If the attacker acquired the GPUs to continue the attack, it would be game-over. Hash power is anonymous, so you don't know who is attacking you. And even if you did, there's nothing you can do about it.

By contrast, Ethereum's proof-of-stake system is anti-fragile. It actually gets stronger the more it is attacked. Someone who cheats has their ETH slashed, which increases the value of all honest validator's ETH in a process of reverse dilution. This would be the equivalent of a proof-of-work attacker destroying the mining rigs they had bought for the attack. To attack the system again, you need to buy more ETH, but now there is less ETH than before and so the price has gone up. Each subsequent attack would be more expensive than the previous. In addition, each staker is pseudonymously identified by a pub key associated with a specific address so you could identify the attacker on the system even if you did not know who they were.

The result is a system that is actually more secure than the power value or load:power ratio might suggest.

Fuel efficiency

In addition to load:power ratio, we also need to think about fuel efficiency. Here we see that the fuel efficiency of the proof-of-stake engine is roughly 20x more efficient than proof-of-work.

Let my explain why.

In proof-of-work, miners are exogenous to the system and are effectively renting the use of their ASICS mining equipment to the security of the economic system. Thus, today's $4.5 billion annualized cost to produce the hashpower that powers Bitcoin's network has to be paid every single year. $1 of economic security costs $1 per year. It's like a lease with 100% APY.

In proof-of-stake, to participate as a validator requires putting capital at risk. If a participant wishes to exit, they withdraw their capital. Thus, the cost of security is not the entire principal every year, but merely the opportunity cost of capital. If we say the opportunity cost of capital is 5% annually, then the cost of $1 of annual economic security is $0.05, a 20x improvement over proof-of-work. If the engine is fully powered by the battery, the proof-of-work engine draws 20x as much energy than a proof-of-stake system for the same amount of power.

Not only is the engine much more fuel efficient, but ETH stakers are already likely to be bullish on ETH the asset. So they are happy to stake their ETH and receive dividends in ETH for acting as a validator because they're also anticipating price appreciation of ETH.

This is in contrast to Bitcoin's proof-of-work system, where miners are required to sell the BTC they earn in order to pay their electricity and mining costs. There is no requirement that bitcoin miners hold bitcoin, and this selling pressure discharges the BTC battery, whereas the proof-of-stake system turns ETH into a dividend yielding capital asset for people already long ETH.

One way to think about the difference between the two systems is that proof-of-work is like hiring mercenaries to provide economic security, whereas proof-of-stake is like hiring citizens deeply vested in the long term and with something to lose if things go wrong.

Rewiring the solar panel

You may remember that in the U.S. economic system and the Bitcoin economic system, the solar panel is wired directly to the engine. Unfortunately, this is very inefficient. Extra energy generated is used as fuel. In other words, it's wasted, providing extra security we don't need.

The objective of EIP-1559 is to rewire the solar panel to the battery so the energy it generates is instead always used to charge the battery. The goal is to fuel the engine only from Grade A fuel provided directly by the battery, where we can use issuance to ensure that the amount of fuel provided is always just right. We never underpay (jeopardizing security) or overpay (jeopardizing efficiency).

The way EIP-1559 charges the battery is by burning the majority of ETH collected in transaction fees (the amount beyond that paid to validators for their work). This has the effect of increasing the value of every unit of ETH by the amount being burned, or increasing the monetary energy of each remaining battery cell.

If you burn ETH at a higher rate than you issue ETH, the asset become deflationary. The moving average of transaction fees on Ethereum is currently 6,000 ETH per day. If you assume that 70% will be burned in the future, this is more than twice what is expected in issuance. It is almost certain that the amount of ETH will decrease over time. Once these changes are in place, it will immediately create a buying pressure equivalent to the entire DeFi ecosystem every single year.

The result is that the economic engine is efficiently powered with Grade A fuel only, and yet the battery does not leak. In fact, it continues to charge over time, since the burn exceeds the issuance.

Redundancy

Both Bitcoin and Ethereum have had bugs. This is something expected with all software. One way to protect against this is to have multiple implementations. An analogy is, would you prefer to fly in a single engine plane or a multi-engine plane?

Ethereum has four separate implementations, each optimized for a unique niche, developed by four separate teams, all in different parts of the world. This is in contrast to Bitcoin's one: Bitcoin Core. Moreover, ETH2 has a specification meant to be the root of trust for design, and maximally simple, readable and understandable. Bitcoin Core has no specification, and any new implementation would have to reverse engineer how Bitcoin works and then be bug-for-bug compatible or risk having a consensus failure.

Having redundant engines and sub-systems increases the reliability and robustness of any system.

Stealth

In the same way that stealth fighters are valuable in the military, to be resistant to state attack we want our economic system to be stealthy too.

In Bitcoin's proof-of-work system, miner's have to be located in very specific geographies (often close to sources of cheap power, like a dam). They require huge warehouses to store all the mining equipment, and need to be in cool places like Iceland because the equipment gives off so much heat. The result is the system is not stealthy at all. Bitmain, the largest bitcoin miner, has facilities that can be seen from space, in the same way that marijuana fields can be seen from space.

Proof-of-stake, by contrast, has no physical footprint. At minimum, it requires only ETH, a raspberry pi, and an internet connection. Computational requirements are minimum. It requires very little compute, bandwidth or electricity. It can be behind Tor so it doesn't leak its IP address, and even if you found the raspberry pi, that's not where the ETH actually is. It's endogenous to the system.

Engine maintenance

How do we make sure our economic engine doesn't break down or degrade? What kind of maintenance does it need?

Proof-of-work engines like Bitcoin's degrade very quickly. Every year, roughly one third of mining hardware becomes obsolete and needs to be replaced. Moore's law suggests this process will continue. The more you run the engine, the more it is degrading.

Ethereum's proof-of-stake system is actually the opposite. The more the engine is used, the stronger it becomes. This is for a number of reasons. First, ETH issuance goes to ETH stakers, who have the disposition to stake more. Thus, the ratio of ETH staked has a tendency to grow over time. A second reason is the transaction fees, which are burnt and come from non-staking ETH, increasing the ratio of staked ETH to non-staked ETH. Finally, staking rewards are paid directly from non-staking ETH to ETH stakers, who have no need to sell the ETH to pay to upgrade obsolete mining hardware or pay for electricity.

Conclusion

We looked at an electric semi-trailer truck as a model for understanding the design and tradeoffs of economic engines. Both the Bitcoin and Ethereum engines provide order of magnitude improvements in efficiency over a non-digital system like the US economic ecosystem. This does not suggest that Bitcoin or Ethereum operate counter to today's state legal systems, but rather that they could provide a better system of global commerce and at the same time allow redirecting today's massive expenditures on economic security to more productive use.

When you compare Bitcoin's proof-of-work engine with Ethereum's planned proof-of-stake engine, it becomes clear that a proof-of-stake engine results in a better economic system on almost every metric.

How will the world decide how to prioritize tomorrow's economic engines? How will we get together to figure out our preferred store of value money?

These are great questions that today we can only speculate about.

That said, Bitcoin is currently at risk of having an excellent battery, but having a serious problem with the engine. You can't look at systems like this in isolation. Bitcoin is optimized for short term predictability but is not maximized for long term predictability. In the next 10-20 years, something has to change in Bitcoin for it to continue to function. Maybe Bitcoin will move to proof-of-stake, maybe Bitcoin will adopt the Ethereum network, or maybe it will remove it's 21 million BTC cap.

No one knows.

Bitcoin has chosen the path of stone-age economics. Literally. Bitcoin follows a skeumorphic design pattern modeled on the shiny rocks we call gold. Ethereum, by contrast, has asked if the last 12 years of exponential compounding innovation in blockchains might allow us to transcend stone-age economics to take a fresh approach. To use sci-fi economics to make the engine work better than ever before.

Will Ethereum succeed?

Only time will tell.

Bitcoin is so simple. And has captured the imagination of many.

But I worry that Bitcoin is optimizing for the wrong things. That having the world's best battery has caused people to get lost in short term number go up culture instead of being focused on building a long-term economic flywheel.

And this is why ETH is probably substantially undervalued relative to BTC.

Did you like this article? Subscribe now to get content like this delivered free to your inbox. Learn more about what I do: https://andyjagoe.com/services/

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, Software Eats Money has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.