11 metrics for DeFi marketplaces

Most decentralized finance applications are marketplaces, and marketplaces are hard. A guide to evaluating their health.

Decentralized finance (DeFi) is one of the fastest growing areas of crypto. DeFi is a more open and efficient full stack global financial system that operates in parallel to today's global financial system. We talked about the evolution of finance that's taking place at a high level when we talked about how software eats money. Now we'll start to look at it in more detail.

A great resource to understand the basics of DeFi is this guide from Finematics. It walks through each piece step-by-step and has excellent short explainer videos for everyone from DeFi beginners to DeFi experts. Here is the first in the series:

Another surprisingly good overview of DeFi was published by the St Louis Fed.

One common characteristic of most DeFi applications today is that they are marketplaces. Sellers lock assets into smart contracts to provide the supply, and buyers (the demand) transact with the smart contracts to accomplish their goals.

These innovative new marketplaces are interesting, but which are actually good businesses? If you wanted to figure out whether a DeFi application was on track for a commanding position in a defensible market segment, how would you do it?

Over the last ten years, a wealth of knowledge has developed around how to think about network and marketplace businesses. Specifically, marketplaces have well known metrics to evaluate their health and performance.

Andrei Brasoveanu from Accel Partners published a comprehensive list of marketplace metrics, and there are many others, like this one from Andreessen Horowitz.

Today we're going to take the existing literature and adapt and extend it so it can be used to evaluate the typical DeFi marketplace.

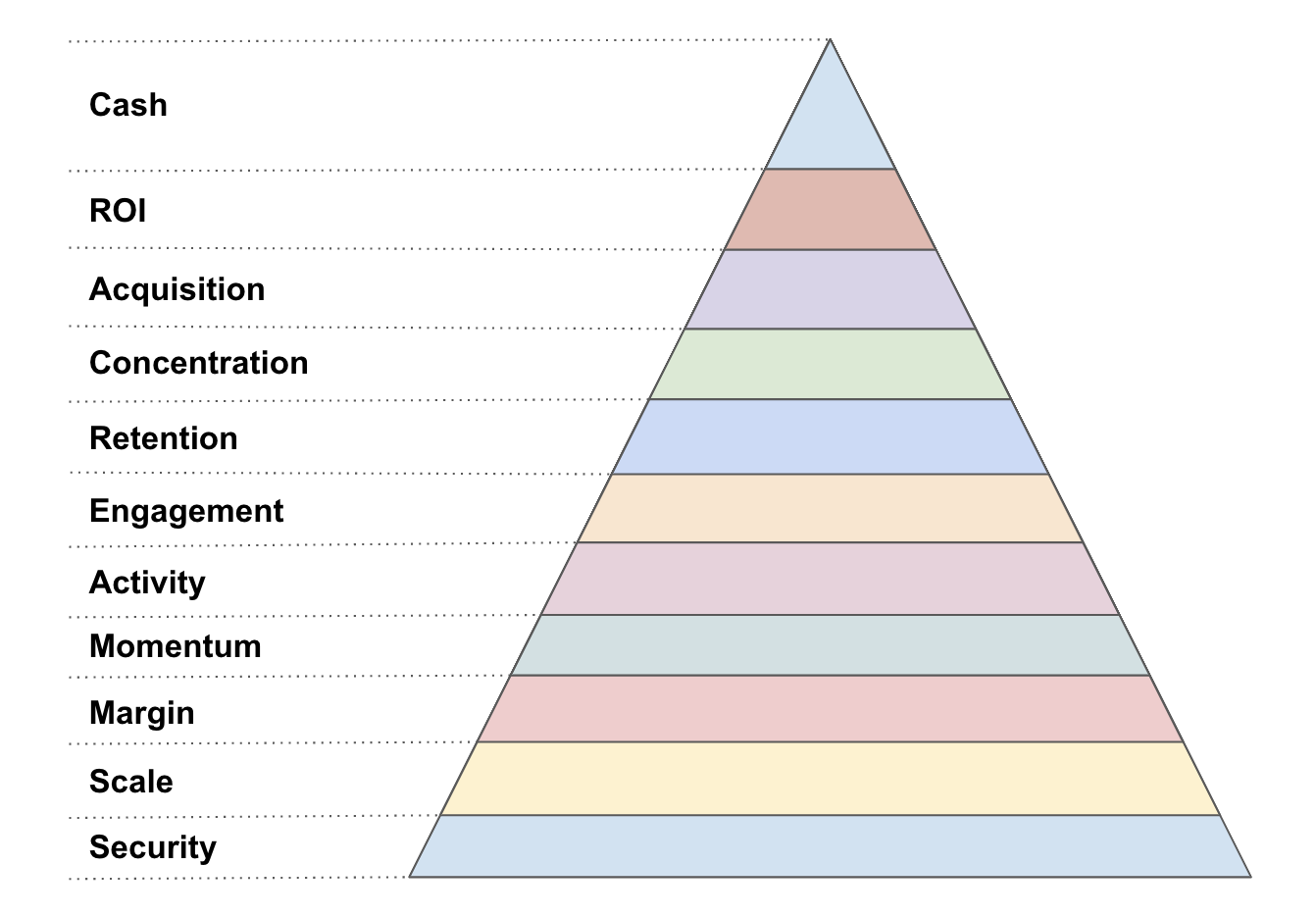

The result is 11 metrics for DeFi marketplaces:

We'll start at the bottom of the pyramid and work our way to the top.

Security

Metrics for security are particularly important for DeFi marketplaces because they depend on public blockchain infrastructure. If the infrastructure is compromised, the entire marketplace is at risk. And DeFi applications have little control over the security of their underlying blockchain.

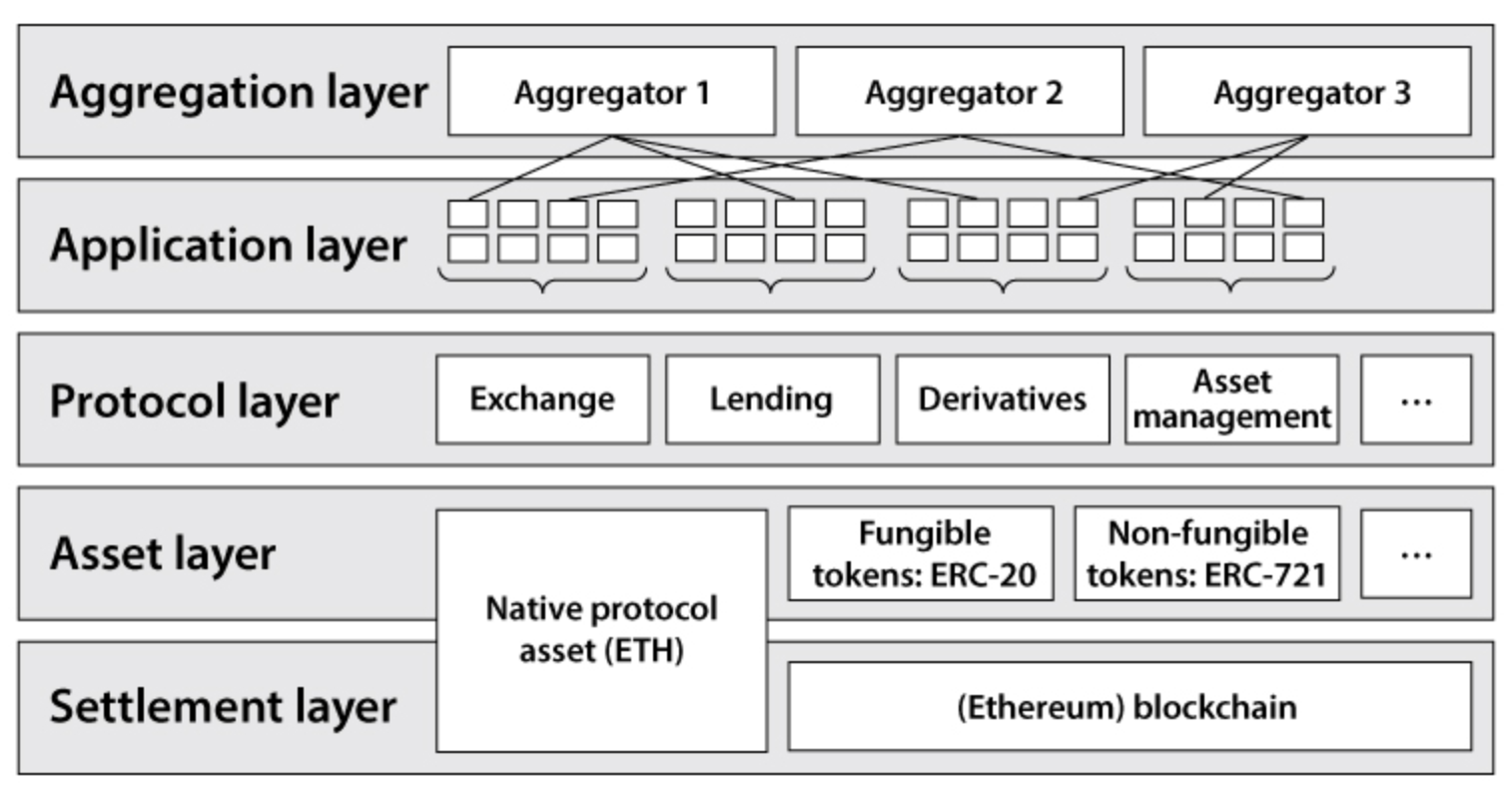

Most DeFi applications are built on Ethereum, meaning they rely on Ethereum for the security of their assets and settlements. Ethereum secures hundreds of billions of dollars in value and to date has not experienced a successful attack at the settlement or asset layer.

This said, successful attacks and hacks have happened at the protocol layer, where DeFi applications implement their smart contracts and user interactions.

We'll talk first about security metrics, followed by decentralization metrics and why decentralization is important.

Settlement and Asset Layer Security

Ethereum uses Proof of Work to provide security for its chain, which means miners validate transactions and build the blockchain in return for a reward. Any would-be attacker requires more than 50% of all miner's combined computing power (called hashpower) to be able to process invalid transactions.

Ethereum's hash rate has risen to over 400 TeraHash per second (TH/s), which is equivalent to 1 trillion hashes per second. If you were to try to buy hashpower from an online hash marketplace like Nicehash, it would appear to cost millions of dollars per hour to attack the network. However, no provider has 200 TH/s to sell, and as you purchased hashpower, its price would go through the roof, making the attack all the more difficult. Keeping tabs on the cost to attack Ethereum is important.

Ethereum will be moving from a Proof of Work to a Proof of Stake consensus mechanism over the next year or two. The details of the difference are beyond the scope of this article, but it's important that the cost to attack the base layer chain remains sufficiently high to deter any potential attacks.

Protocol and Application Layer Security

Security risks at the protocol and application layer are mostly related to smart contract bugs or exploits. To protect against these risks, a DeFi application should have professional smart contract audits and should monitor the following network metrics: transfers of large fund values, high frequency of repeated actions, and fixed behavior patterns (i.e. bots). Consensys has a good article on this topic for further reading.

Decentralization

Decentralization is very important for a number of reasons. First, it increases transparency and trust in the overall system. No changes to any underlying system or economics can be made unilaterally. And no one can be de-platformed. Second, there is no single point of entry to the system, and therefore no single point of failure. Finally, as public blockchains grow, they become more and more difficult (e.g. expensive) to attack.

This said, there is still room to improve, and it's important to be aware of potential security risks stemming from the tech stack a decentralized application is dependent on. A project called Are we decentralized yet? tracks decentralization metrics for various layer 1 chains. Bitcoin is the most decentralized, and would require the 4 largest mining/validating entities to collude to control over 50% of the mining/voting power, followed by Ethereum which would require 3.

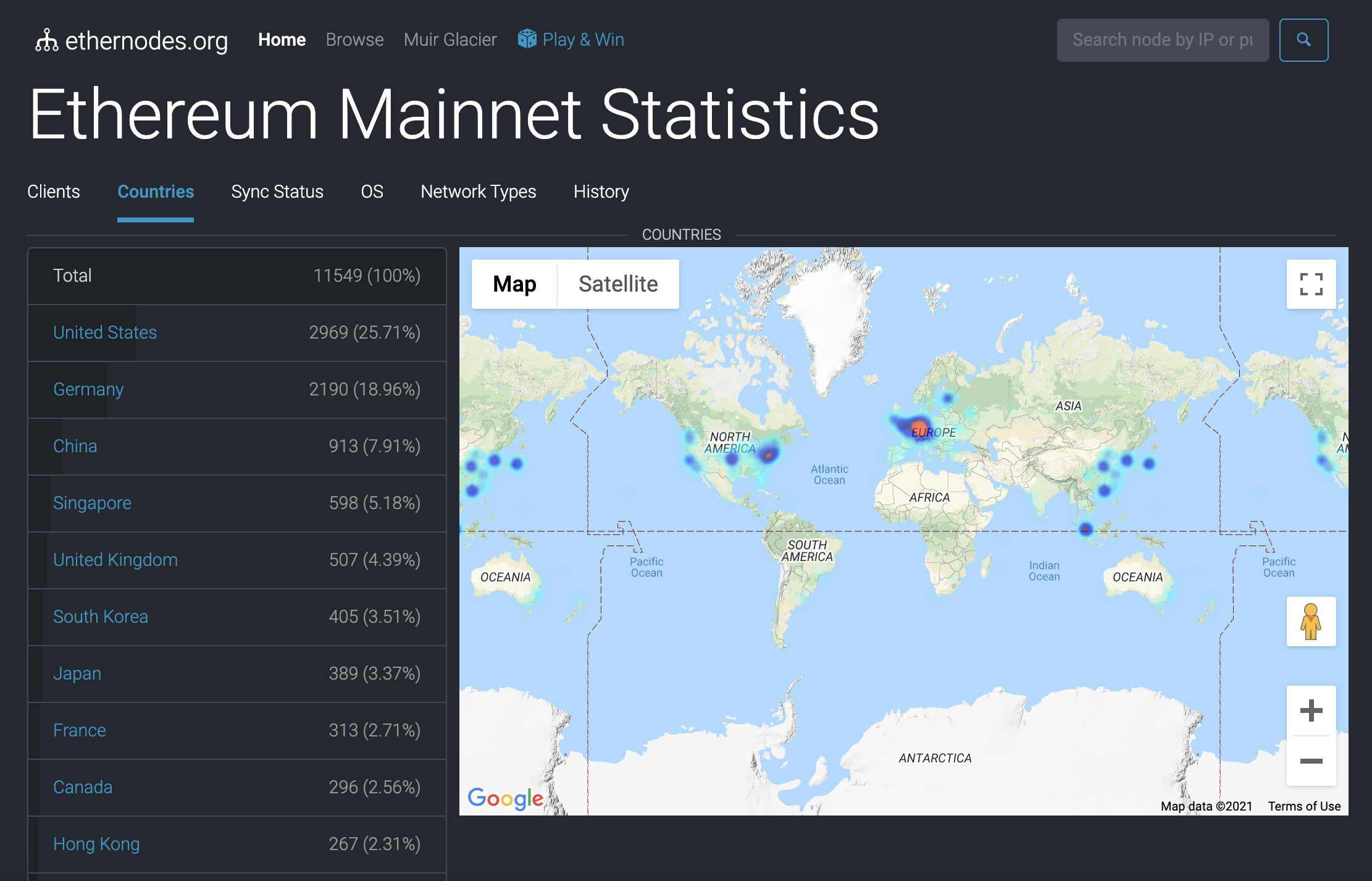

Apart from concentration in ownership, decentralization of nodes, miners and validators by jurisdiction is also important. Below is how 11,549 Ethereum nodes are currently distributed around the world.

Security is the foundation for the entire DeFi marketplace. Since the foundation is shared public infrastructure, it cannot be an afterthought.

Scale

Gross Merchandise Volume (GMV)

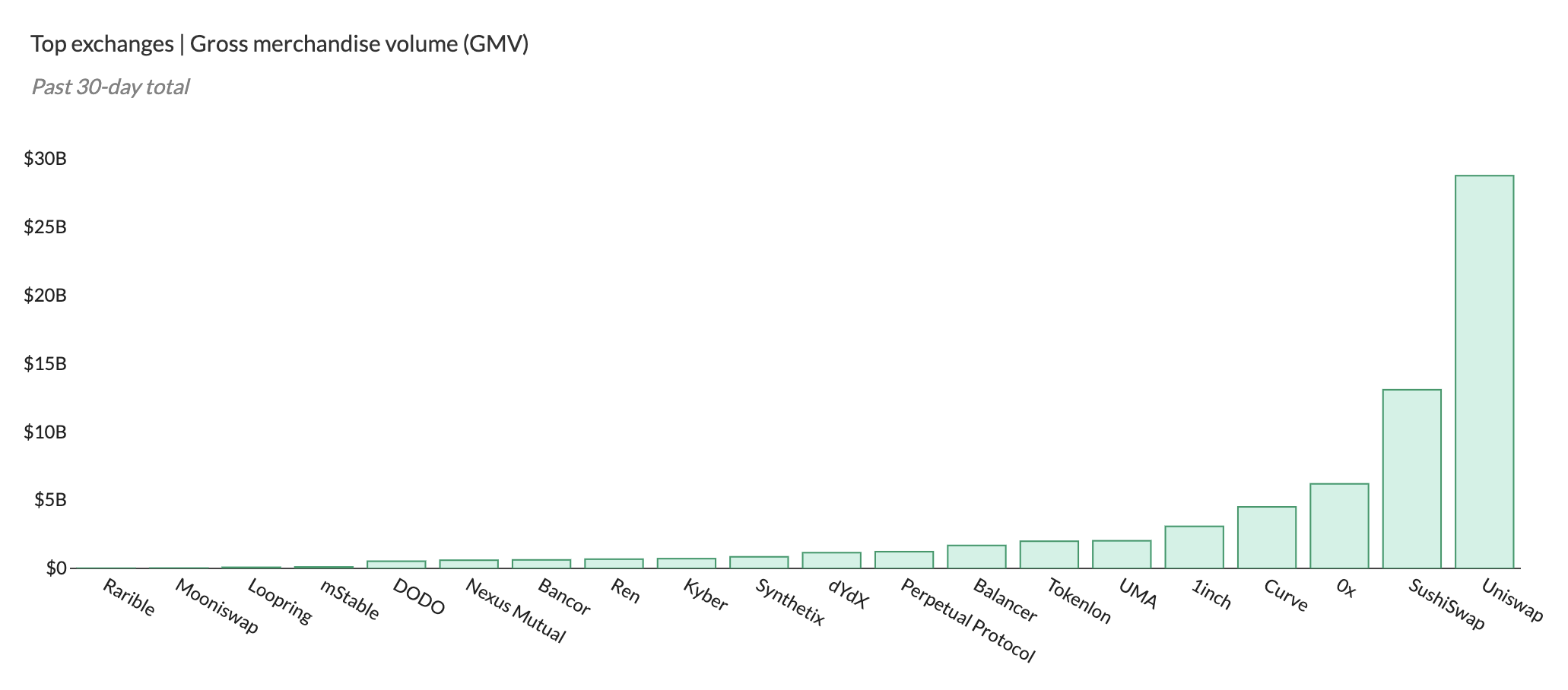

GMV is the total value of products or services transacted on the platform. Below is the trailing 30 days GMV from 2/23/2021 for various DeFi applications.

GMV Growth

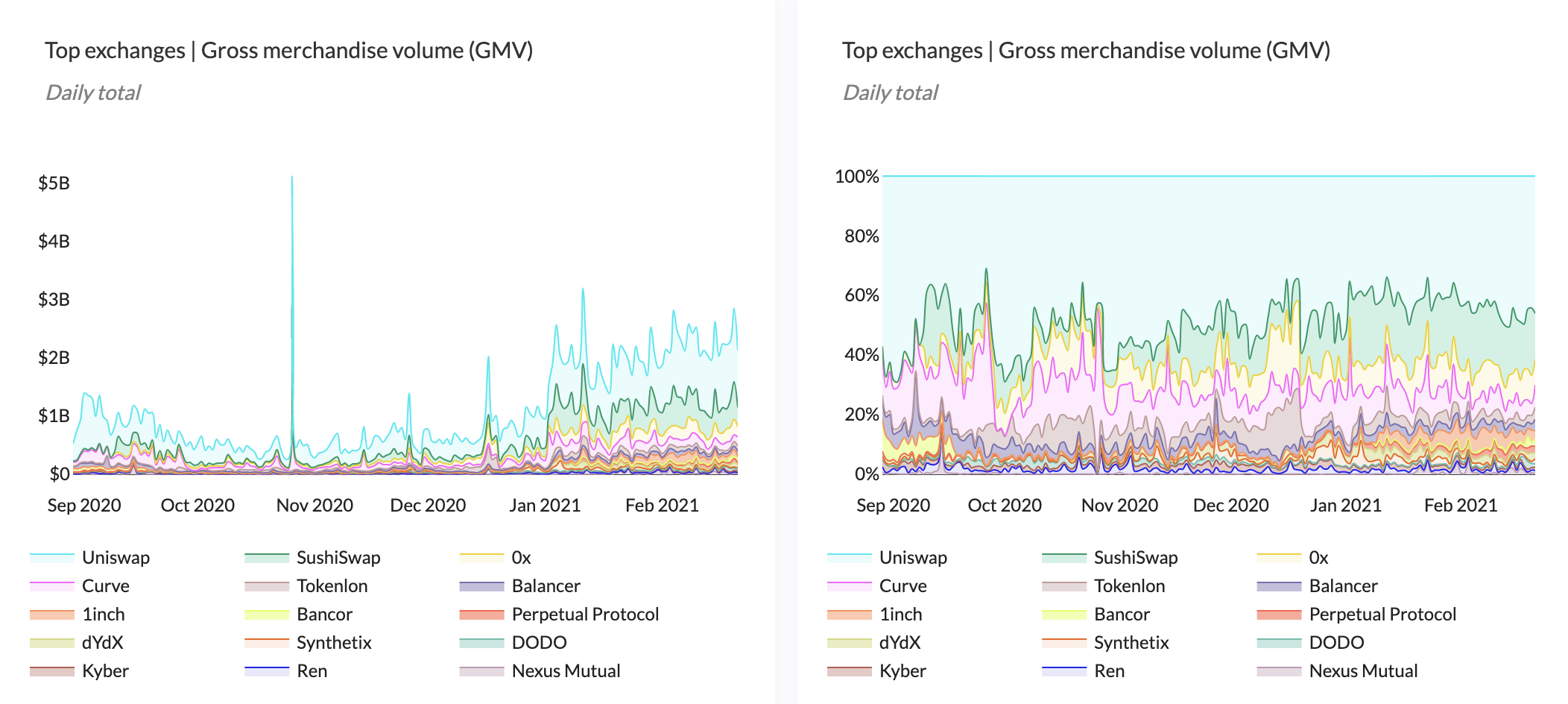

The rate at which GMV is growing. Below you can see the significant growth in GMV for DeFi applications for the six months prior to 2/23/2021.

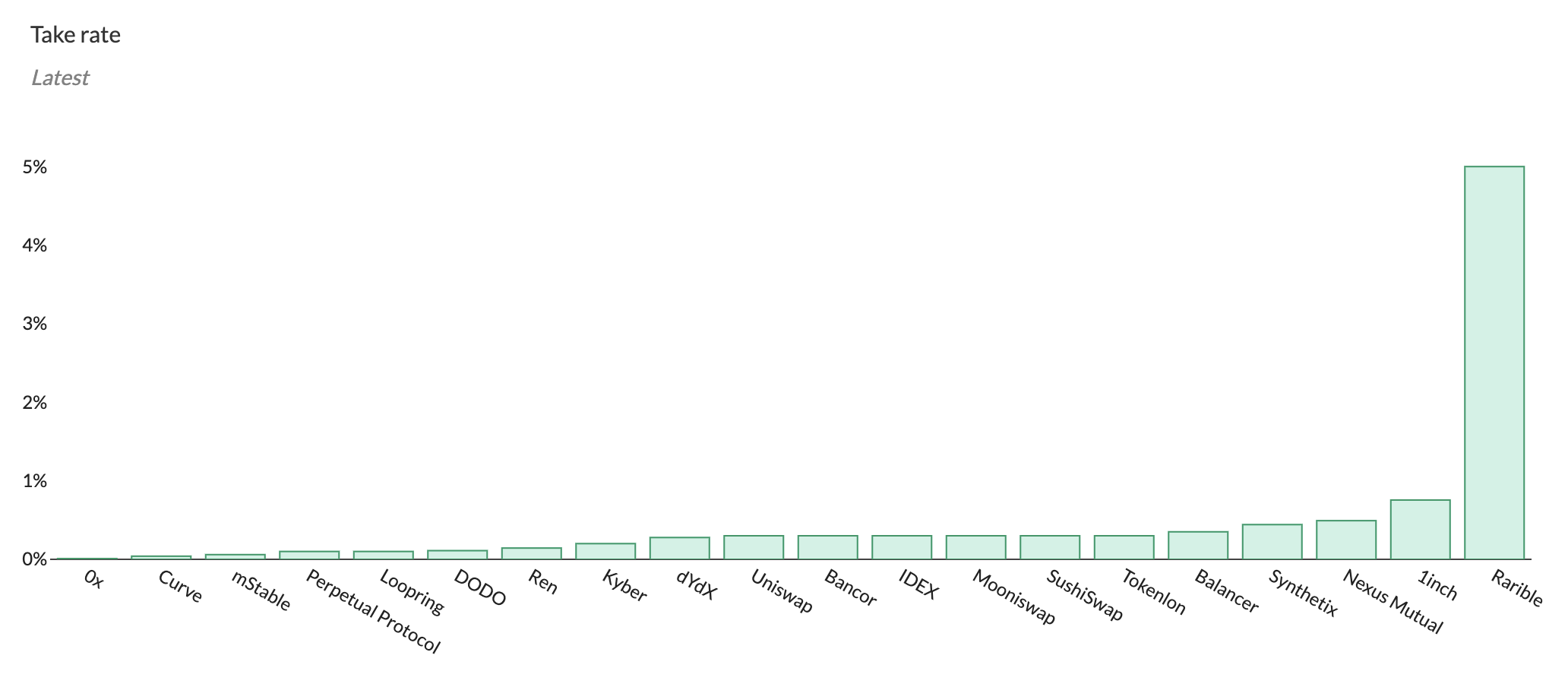

Take Rate

The take rate, also known as the rake, is the percentage taken by the marketplace for a successful transaction. Below are a sampling of rakes in DeFi as of 2/23/2021:

Use caution when comparing these rakes to those of a traditional marketplace. In DeFi, the rake is today often split between the platform and the liquidity provider (the "seller") because, in the case of an exchange, the seller is a market maker and must be compensated for providing liquidity. Each individual app is slightly different. Uniswap, for example, currently gives the entire 0.3% to the maker in handling the trade. This, of course, is being done to maximize growth.

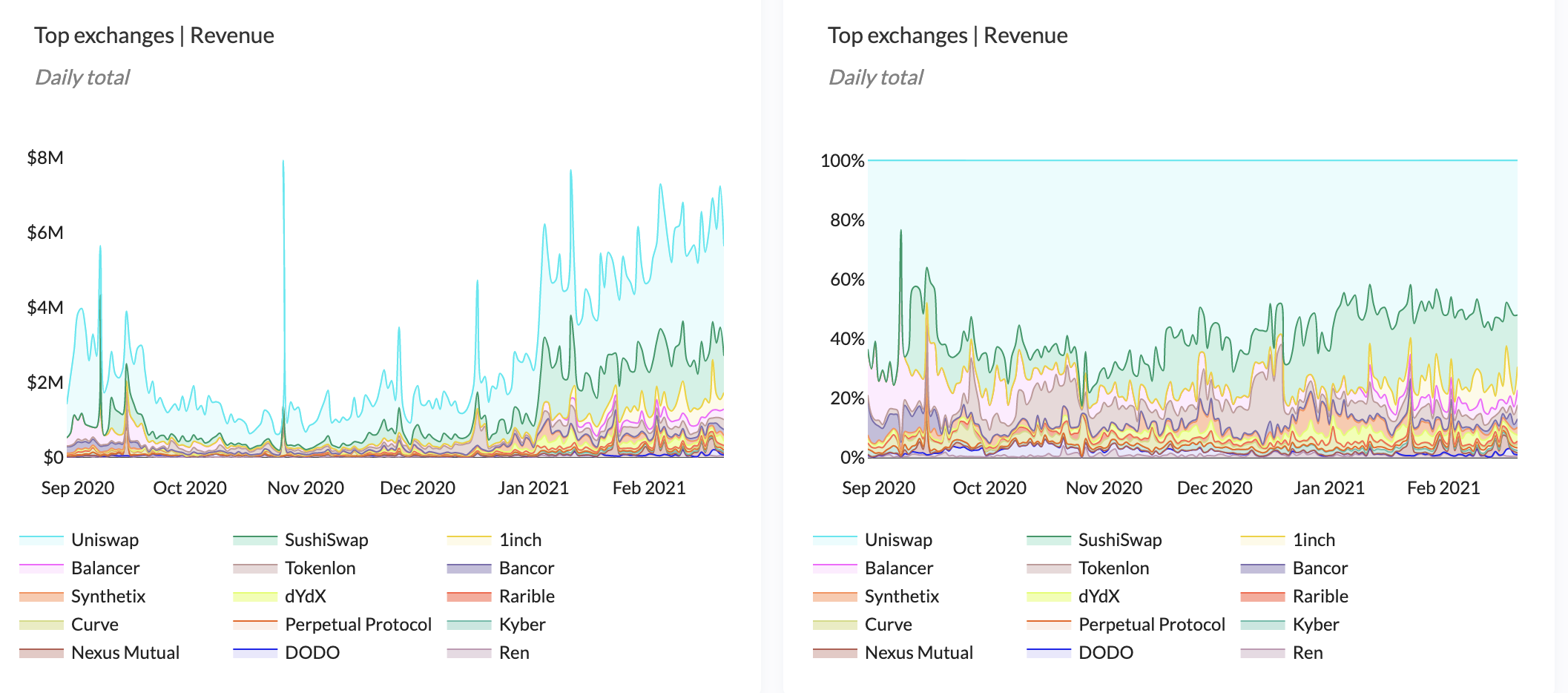

Net Revenue

Net revenue is the revenue that accrues to the marketplace, driven by the take rate. The graphs below from TokenTerminal have the same issue as the take rate. Comparing "net revenues" across applications in these charts is not an apples-to-apples comparison.

Margin

Gross margin

Gross margin is net revenue minus cost of goods sold (COGS). In today's decentralized finance applications, gross margins are 100% because the buyer bears the full cost of interacting with the blockchain to execute their transaction.

Contribution Margin 1

Contribution margin 1 is calculated by subtracting any other variable costs from gross margin. These costs might include payment, onboarding, customer service, data, compute or bandwidth costs specific to the transaction.

Contribution Margin 2

Contribution margin 2 is how much money is made after variable and acquisition costs, and is calculated by subtracting any sales and marketing costs from contribution margin 1.

Momentum

Growth

Growth is critical for any emerging marketplace. Traditional marketplaces measure Daily Active Users (DAU) and Monthly Active Users (MAU). DeFi apps do not typically require an onboarding or sign-up process. Users simply connect their wallet to the app and begin buying or selling. Therefore, the analog measurement in DeFi is Daily Active Wallets and Monthly Active Wallets. You need to be aware that users can have multiple wallets and service providers might trade for multiple customers from a single high value wallet.

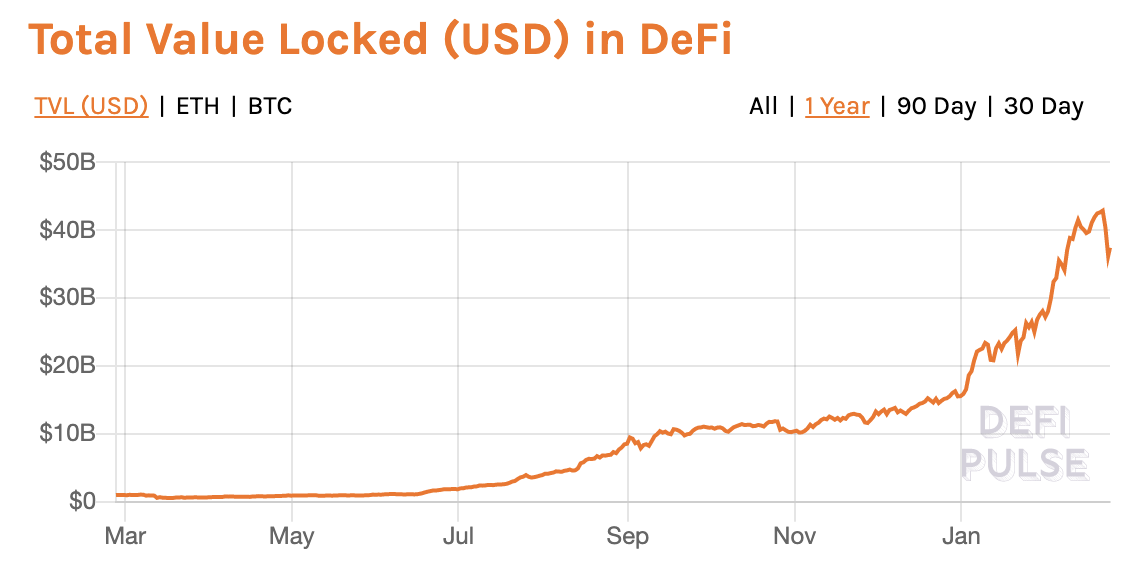

Confidence

Many DeFi applications require capital to be deposited to use them. For example, loan collateral or liquidity in a trading pool. This is referred to as Total Value Locked (TVL) and is sometimes used to show the growth of decentralized finance. That said, it's actually a better metric for confidence than it is a metric for usage. Assets locked have tangible value and bear an opportunity cost of other productive uses.

Market Share

Market share should be measured by dollar share of total revenue and unit share of total number of transactions.

You should track market share versus DeFi competitors as well as versus traditional finance competitors (as applicable). Also, market share should be broken out by segment/vertical to identify specific areas of market leadership.

Activity

Liquidity

Liquidity describes the degree to which an asset can be quickly bought or sold at a price that reflects its intrinsic value. In other words, how easily can an asset be converted into cash without affecting its market price? As transaction volumes increase and bid/ask spreads decrease, the market becomes more liquid.

Market Depth

Market depth measures whether there is enough supply and it fits users' needs. It's the market's ability to sustain relatively large orders without significant price movements. The more buy and sell orders at each price, the greater the market depth.

Average Order Value

Average Order Value (AOV) helps to measure who your customers are and how much and how often they transact. It measures how much a marketplace makes from customers with each order and can determine what is an appropriate channel mix based on the acquisition cost of different types of customers.

Engagement

DAU/MAU

Dividing the number of daily active users by the number of monthly active users is a common and rough measure of engagement. It can be useful to break out DAU/MAU for core transaction usage vs any usage.

Power User Curves

A more nuanced measure of engagement than DAU/MAU is the power user curve, which is a histogram of users' engagement showing the total number of days users did a particular action in a specific timeframe.

These curves can help analyze network effects in the business. Looking at how often users take a specific action on a cohort basis allows you to see whether a product's utility increases across cohorts.

If the product does get more valuable as the number of users increase, power curves should lean increasingly to the right over time and higher frequency engagement buckets will have a growing number of users over time.

Retention

Cohorts

Cohorts are used to track activity of a set of customers acquired in a specific period of time. Common metrics to track across cohorts are revenue, gross margin, contribution margin, and number of transactions. Tracking cohorts monthly is typically sufficient and using percentage basis rather than actuals makes it easier to see long term patterns.

Assuming a marketplace has network effects, you would expect newer cohorts to have better retention than older cohorts for any given time period since the absolute number of users is increasing. Reality can be slightly different, however, because a product's earliest adopters are often those for who the product is most ideal. The presence of a competitor can also distort retention expectations.

Core Action Retention

Does retention, defined as users who take a core action of the product, improve from cohort to cohort? The core action is the one that relates to users deriving value from the product. This measure can be split out between buyers and sellers. Repeat transactions can be calculated by taking weighted averages on historical cohorts.

Dollar Retention

Do newer cohorts retain better on a dollar basis for every period than older cohorts? Paying for a product is a measure for how much a user values that product. If a product has network effects, it becomes more valuable over time and should therefor see increasing dollar retention for newer cohorts.

Cohort Consistency

How consistent are metrics across cohorts? Are repeat transactions always completed by the same power users? Or is transaction activity spread broadly across buyers and sellers? Are recent cohort metrics as strong as early ones? Or stronger? This suggests the marketplace has a broad appeal and doesn't just serve the needs of a small number of early adopters.

Prevalence of Multi-Tenanting

How many users of a marketplace also use similar services? How many users are active on those similar services? If one marketplace can replicate another's network, it can layer additional functionality that reduces demand for the first. Even if the first marketplace is not wiped out, multi-tenanting can reduce usage and compress the margins for all competitors.

Switching or Multi-Homing Costs

How much friction is there to sign up and become an active user of another network? Products with a significant upfront investment in time and effort will have a lower activation rate, but will also have a substantial moat. Products that require little or no upfront investment, can more easily wedge their way into a market and get users to multi-home or switch.

A separate consideration is how much value can a user get from a cold start (i.e. at the very beginning)? For example, Facebook is not very useful until you have Facebook friends, which takes time. This is in contrast to many DeFi applications, like asset exchanges, which enable close to full value from a cold start and have very little switching or multi-homing costs.

Concentration

Fragmentation of Supply and Demand

Marketplaces with greater fragmentation of supply and demand tend to be more valuable and defensible. No participant on either the supply or demand side should account for a disproportionately high percentage of transactions. If this is not the case, that participant can take a large share of the transactions with them if they ever leave the network.

Aggregating a fragmented product or service enables access and discovery in the long tail which might not otherwise happen.

A marketplace can calculate concentration by measuring the percentage of GMV the top buyers or sellers account for. A whale curve plots the number of customers versus the business they generate over a period of time.

Sector Concentration

It's important to look at the level of concentration a marketplace has in specific verticals or sectors. Focus is important, but it's also good to know whether or not transactions are taking place in a profitable and growing segment.

Acquisition

User acquisition in DeFi is still in its infancy. Most acquisition today happens through word-of-mouth via social channels like Twitter, Discord, Telegram or Reddit.

One interesting and unique innovation around user acquisition is called liquidity mining, which allocates an application's tokens in return for providing liquidity to the protocol and/or using the application. This approach has been very successful in bootstrapping new applications, and most major DeFi apps now use it. Time will tell how effective this acquisition strategy will be and how well these incentivized users will be retained.

Customer Acquisition Cost (CAC)

CAC is the cost to acquire a customer. It should be calculated for both supply and demand side, and should include sales and marketing staff and expenses, including above-the-line media costs. More detail on customer funnels, like the AARRR framework, can be found here.

Channel scalability

How much could you increase your spend in a given channel without increasing CAC or reducing the quality of the acquired users? This is channel scalability.

You can measure channel scalability by tracking CAC by channel over time and breaking out cohorts by acquisition channel to see how changes in channel spend impact key metrics.

Channel mix

A diverse mix of acquisition channels is important. You should compare CAC and retention across channels to evaluate the return on investment between channels.

Over dependence on a single channel introduces significant risk. For example, if you're dependent on SEO, Google could change their algorithm. Or if you're using paid acquisition, your channel might not scale (your partners might run out of leads for you).

The best form of acquisition is word-of-mouth, especially when it can be facilitated via a viral messaging interaction.

ROI

Life-time Value

Life-time value (LTV) is the economic value that a buyer or seller is expected to generate on the platform over a typical "lifetime" on a contribution margin basis. The appropriate "lifetime" to choose varies by application. 1-3 years is common, but might be much longer for a very sticky consumer financial application. You can generate an LTV curve by taking a weighted average of customer cohorts (by size) and plotting the cumulative sum.

LTV/CAC

LTV/CAC measures the return on investment generated by acquiring an incremental customer. A good ratio on a contribution margin basis is 3:1. A ratio of 4:1 means a very good business model. A ratio of 5:1 or higher may mean you could grow the business faster by investing more in marketing.

Unit Economics

Unit economics tells you whether an average transaction on the marketplace is bringing an economic benefit to the network. It's calculated by subtracting the cost per transaction and any associated variable costs from the average order value.

Network effects often cause unit economics to improve over time. This is because network effects reduce the incentives required for each side of the market, reduce the percentage of paid users, and increase pricing power.

Cash

To win an industry, a marketplace must be building a long term sustainable business (i.e. a going concern). Sufficient cash to invest in improving the marketplace to defend against competition and acquiring/servicing customers is critical.

In the same way an early stage startup must diligently monitor burn and fundraising needs, so must a DeFi crypto network. DeFi applications raise money from investors through public or private offerings, maintain a treasury to invest in continued development and customer acquisition, and have token mechanics like inflation and rewards to replenish the treasury and compensate for work done for the network.

Did you like this article? Subscribe now to get content like this delivered free to your inbox. Learn more about what I do: https://andyjagoe.com/services/

- Cover photo by Austin Neill

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, Software Eats Money has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.