How to value and invest in money

How to think about a new money as a venture investment and navigate the path from hypothetical value to real value with Bitcoin.

Early stage investing is a bet and arbitrage on the state of the world today vs the state of the world tomorrow. Fred Wilson describes this as the journey from hypothetical value to real value.

Real value is value as calculated for a business with customers, cash flow and profits. By contrast, early stage investors make decisions using hypothetical value, when a company might not yet have customers–or even a product.

Buying cryptocurrencies is similar. Today, they exist in the world of hypothetical value. Owning them is making a bet on the state of the world tomorrow vs the state of the world today. Like any other venture investment.

But many cryptocurrencies have no cash flows or profits. And they never will. They are money. So how do you figure out if they are good investments? And since they're liquid from day one, how do you figure out when to sell?

Today we'll talk about how to think about a new money as a venture investment.

This essay will focus on Bitcoin, but the early stage investment framework is not specific to Bitcoin and we'll use it again in future editions for other crypto assets.

Market

Bitcoin is a store of value money similar to gold. Both are commodities, and commodities are priced purely based on supply and demand.

Our first step is to put together a back-of-the-envelope forecast for gold.

Gold as a comparable

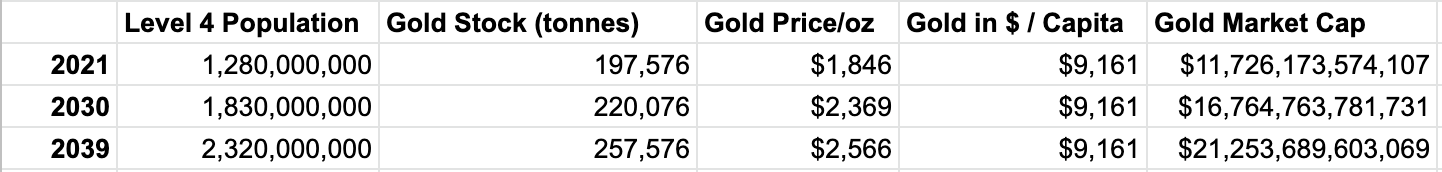

Total above ground gold stocks as of the end of 2019 were 197,576 tonnes and each year gold mining adds roughly 2,500-3,000 tons to this number. On January 18, 2021, the price of a troy ounce of gold was $1,846. A metric tonne is 32,150.7 troy ounces. This makes the total gold market cap $11.7 trillion.

For simplicity, let's assume that demand for gold is driven exclusively by population and income. You might argue that using wealth would be a much better proxy for gold ownership than income. I agree. Global wealth was $360.6 trillion in 2019 and increased 2.6% in nominal terms over 2018, but unfortunately we don't have good projected data for global wealth and we do for income.

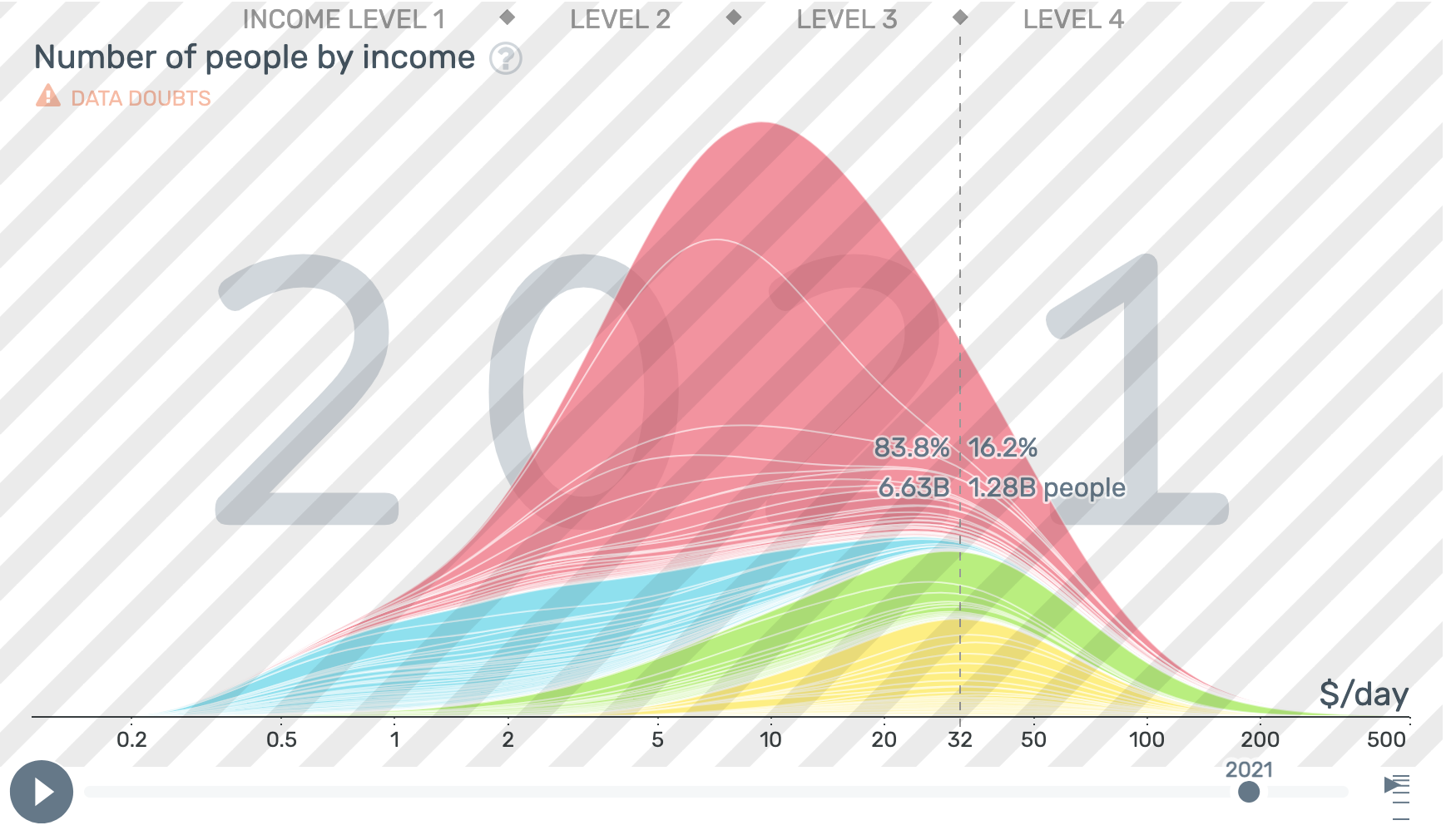

Hans Rosling divides the world into 4 basic income levels in his book Factfulness. Level 4 is the highest, and is made up of people who earn a minimum of $32 per day. Let's assume that in today's world, demand for gold is zero until a person has an income that puts them in level 4. In 2021, this is 16.2% of global population or 1.28 billion people according to data adjusted for inflation and price differences from the Gapminder project.

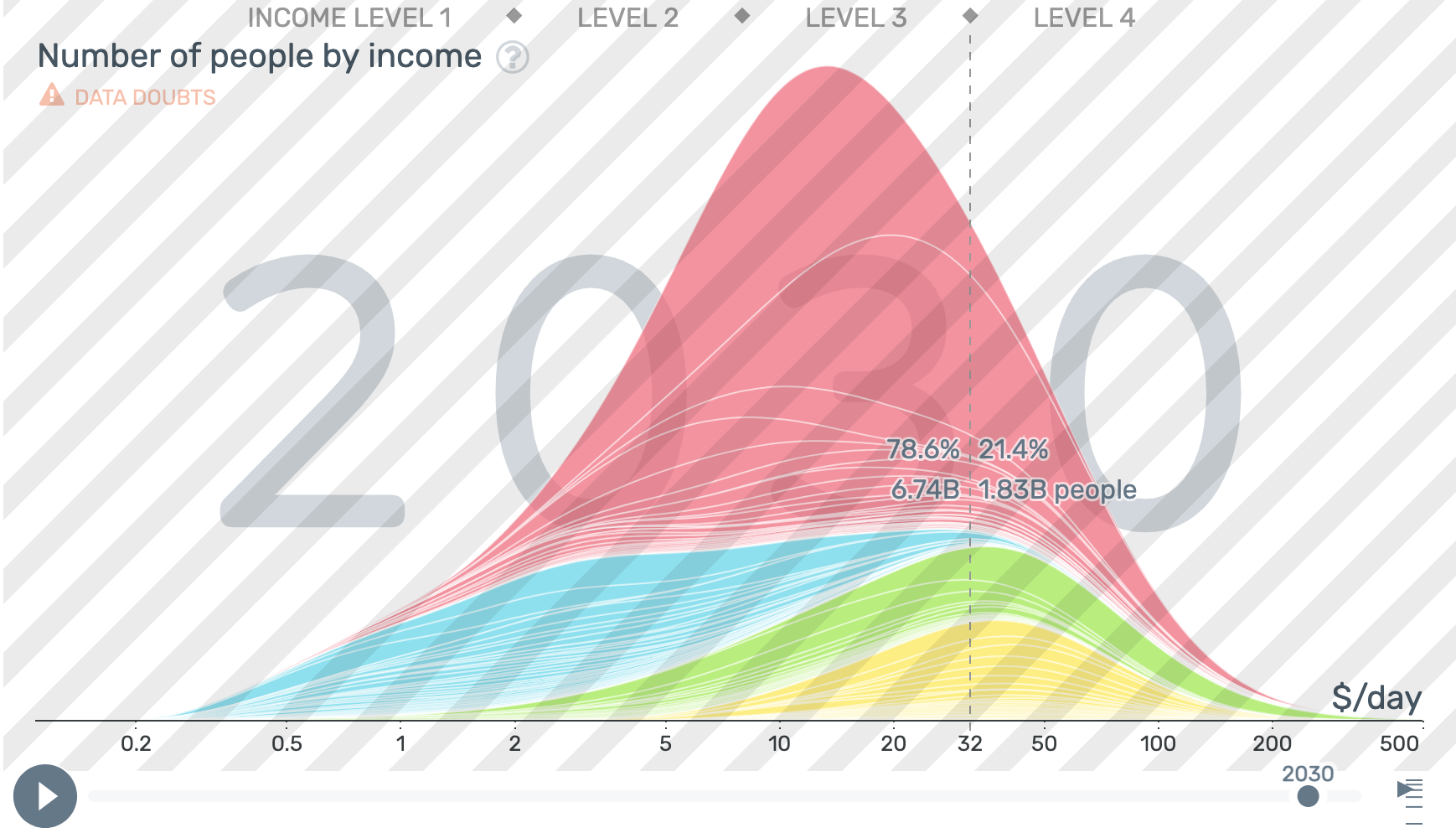

The level 4 population is expected to increase to 21.4% or 1.83 billion in 2030.

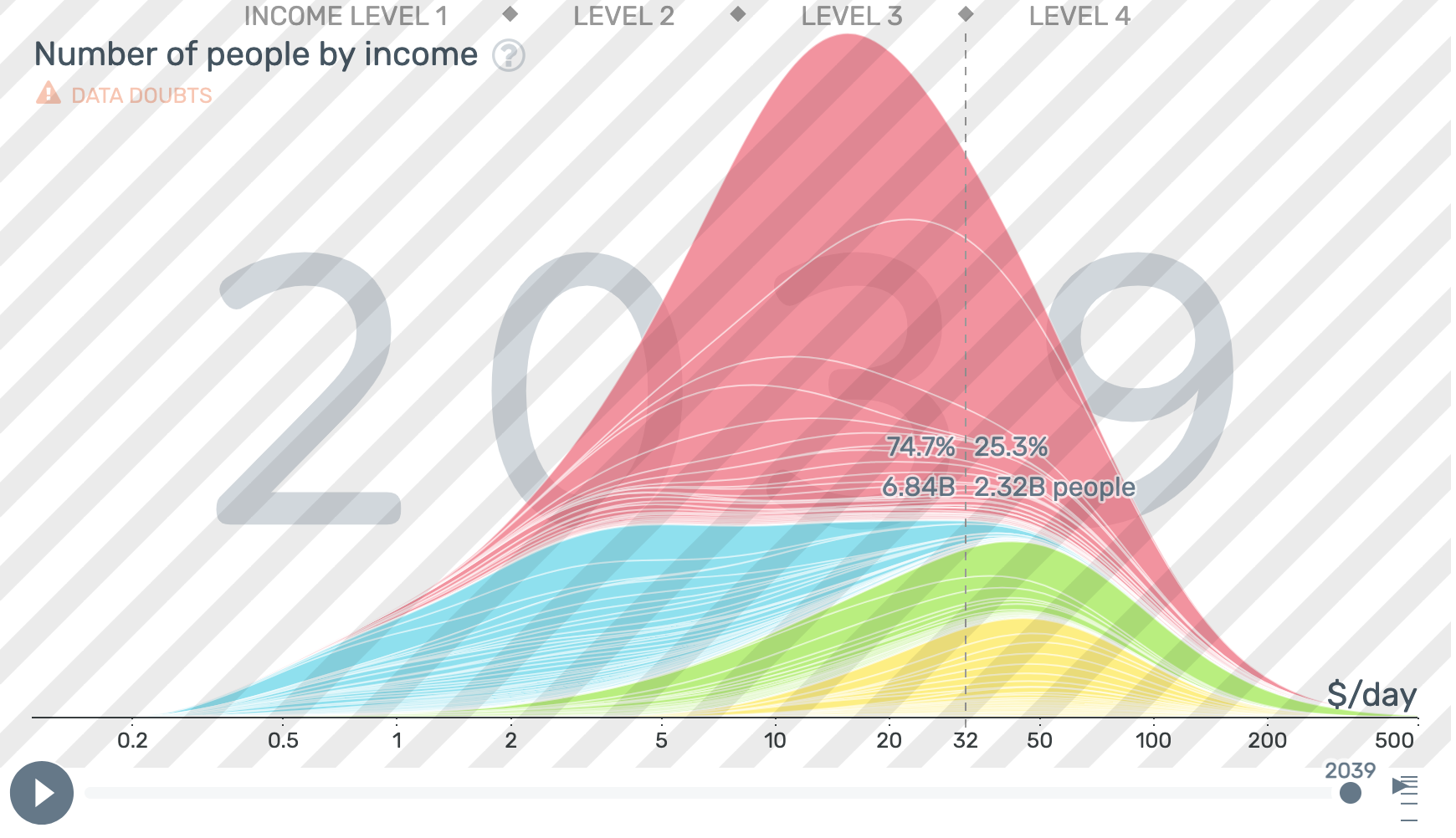

And to 25.3% or 2.32 billion people by 2039 (the last year we have data for).

Using what we know about today's market cap for gold, we can calculate that there is $9,161 of gold per person in the global level 4 population. If we assume that demand for gold per person is constant at the 2021 level, we can extrapolate that gold's market cap will increase to $16.8 trillion by 2030 and $21.3 trillion by 2045 even though the supply of gold is also steadily increasing.

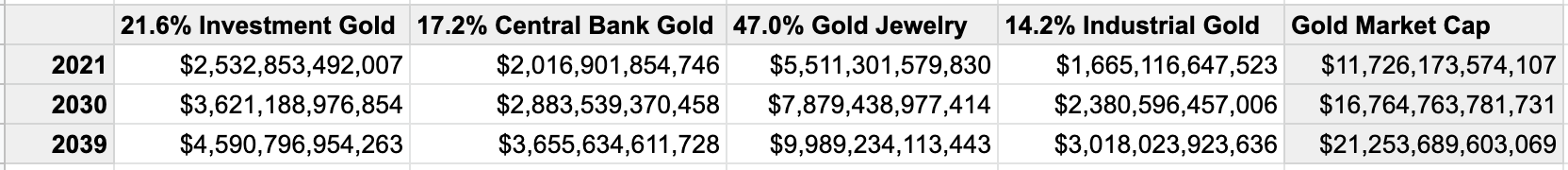

According to the World Gold Council, as of 2019, 47.0% of gold is held as jewelry, 21.6% of gold as held as private investment, 17.2% is held by central banks, and 14.2% is in industrial use:

Coming back to Fred Wilson's terminology, this simplistic forecast for gold comes from the world of real value. It takes a known state of the world in 2021 and makes forward projections based on increasing global income and population.

How big could Bitcoin be?

Our second step is a back-of-the-envelope forecast for Bitcoin using gold as a baseline. This is the world of hypothetical value.

As we construct the forecast, it might seem that Bitcoin is a textbook case for the software eats the world hypothesis:

Any product or service in any field that can become a software product, will become a software product. Every company in the world that is in any of these markets that this is happening, therefore has to become a software company. As a consequence, in the long run, in every market, the best software company will win.

But is it?

Before Bitcoin, store of value assets were always physical. Gold is the obvious example, but silver, diamonds, fine art, and real estate are other examples.

Bitcoin is 10x better at many of the store of value jobs that gold does. And there is no question that digital is different because of the incredible abundance that zero marginal costs and universality of compute can unlock.

But gold does other jobs, including being used in industrial applications and enabling exclusivity and belonging, connection and confidence. Bitcoin doesn't do these jobs. And might not ever. You cannot wear your Bitcoin, build works of art or monuments from it, or make wedding bands or cell phone components out of it.

Some people believe the market size for gold is the potential market size for Bitcoin, but this overlooks the fact that 47.0% of all gold is owned by individuals as jewelry and adornment and 14.2% of all gold is used in industrial applications. It also overlooks the fact that the store of value market is bigger than gold alone.

From this perspective, the store of value space is not a winner take all market. Bitcoin is not going to replace gold, though it may significantly soften the market for it. Silver provides a potential analog². For 3,000 years, the price ratio of silver to gold ranged from 9:1 to 16:1. This changed dramatically in 1873, the year that the U.S. and France both demonetized silver. From 1873 to 1929, the ratio ranged between 15:1 and 40:1, but was mostly in the high 30s. For the 20th century as a whole, the average ratio was 47:1, and between 2000 and 2020 the ratio has ranged mainly between 50:1 and 70:1. This amounts to about an 80% decrease in silver's purchasing power compared with gold.

That said, Bitcoin is likely to have great impact on the 21.6% of gold held by investors in the form of bars and coins and the 17.2% of gold that is held by central banks. Within these segments, typical software eats the world hypothesis dynamics will likely emerge.

Let's look first at the private investment market.

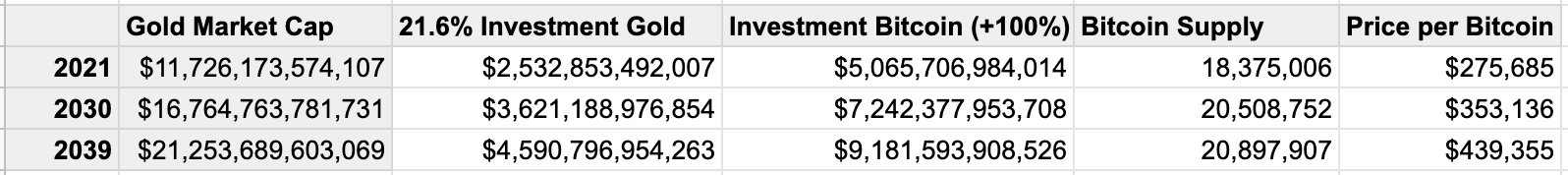

If Bitcoin were to replace 100% of gold in the private investment market, we can use the Bitcoin supply schedule and our back-of-the-envelope gold forecast to come up with an expected price for Bitcoin:

Historically, when a product becomes software, it significantly expands the original market. This is why thinking about Bitcoin in the context of gold is like thinking about Uber in the context of taxis. And this is why Bitcoin will be bigger than you think.

But how much bigger?

No one knows the answer to this question. However, we know from recent surveys that 12% of all Americans own gold as an investment. We also know that 18% of American millenials own cryptocurrency.

Ownership rates vary significantly by country. Germany and India have much higher ownership rates of gold than the U.S. Other countries have less. For simplicity, let's look at the case where Bitcoin expands the market by 50%:

We can also look at the 100% market expansion case:

Of course, Bitcoin having a 100% share of this market and gold having 0% is an unlikely outcome. As dominant as Google is in search today, their global search market share is 88% and not 100%. And to make the 2030 and 2039 valuations of gold and Bitcoin useful you would need to discount them to present value to take into account opportunity cost.

But our goal isn't to try to arrive at a specific price target. Stacking assumptions on assumptions is false precision. What we want to know is, assuming everything goes right, how big is the opportunity? Is it big enough to make it worth the risk?

With a Bitcoin price of $32,500 on Jan 26, 2021, there is perhaps a 5x to 10x upside if we look only at the private investment market and Bitcoin dominates it.

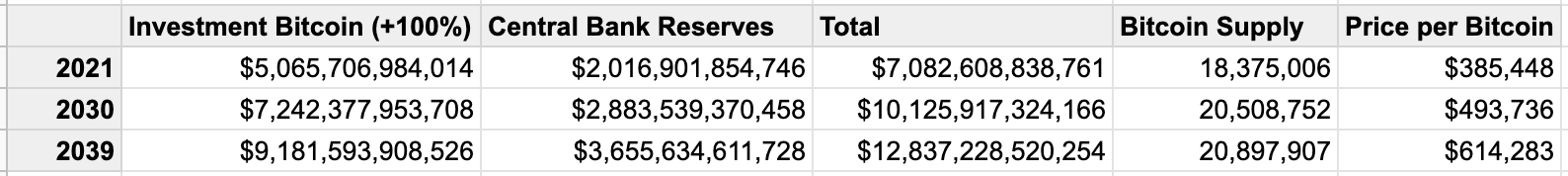

What if we stretch and ask what happens if central banks replace their gold reserves with Bitcoin reserves? There is no evidence this is happening today, but Bitcoin is a neutral money and it's possible to imagine countries that don't want to use the dollar and who don't trust each other might want to settle using it.

Here's our 50% market expansion case with Bitcoin capturing 100% of central bank reserves:

Here's our 100% market expansion case with Bitcoin capturing 100% of central bank reserves:

This increases our potential upside to perhaps 10x to 15x. Not exactly what you want for your "everything goes right" success case for an early stage investment.

That said, Bitcoin is now much less risky than a seed stage startup investment. It's more like a Series C or later investment.

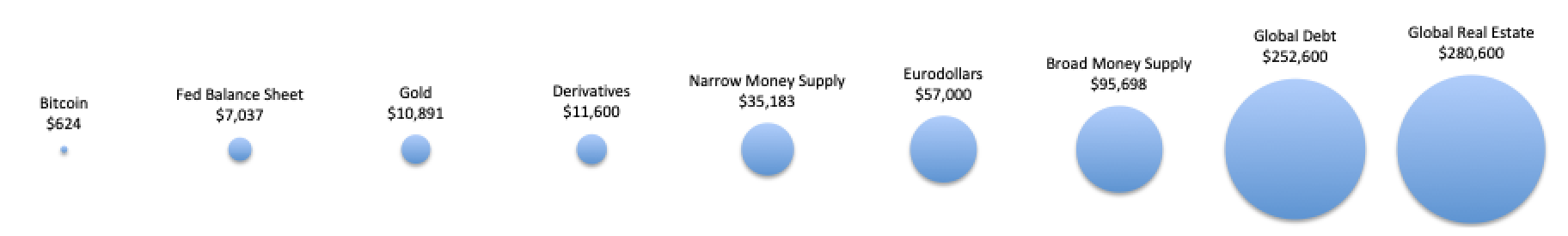

Some people believe that Bitcoin could replace fiat currencies like the dollar as a global medium of exchange and unit of account. This leads to the conclusion that the realistic potential for Bitcoin is actually much larger.

For example, the broad dollar money supply is $95 trillion.

I do not believe this market is accessible to Bitcoin, and I will explain why in detail in next week's article. Bitcoin may significantly expand the store of value market, but will not move beyond it given how Bitcoin is currently conceived.

Until this is generally well understood, speculation may cause the price of Bitcoin to rise well above its realistic long term value.

Product

Bitcoin is at least 10x better than gold at many of gold's jobs, including wealth preservation, protection against capital controls, protection against financial instability, and protection agains crime and theft. 10x is the threshold an early stage investor looks for to overcome the friction and resistance in getting people to adopt something new.

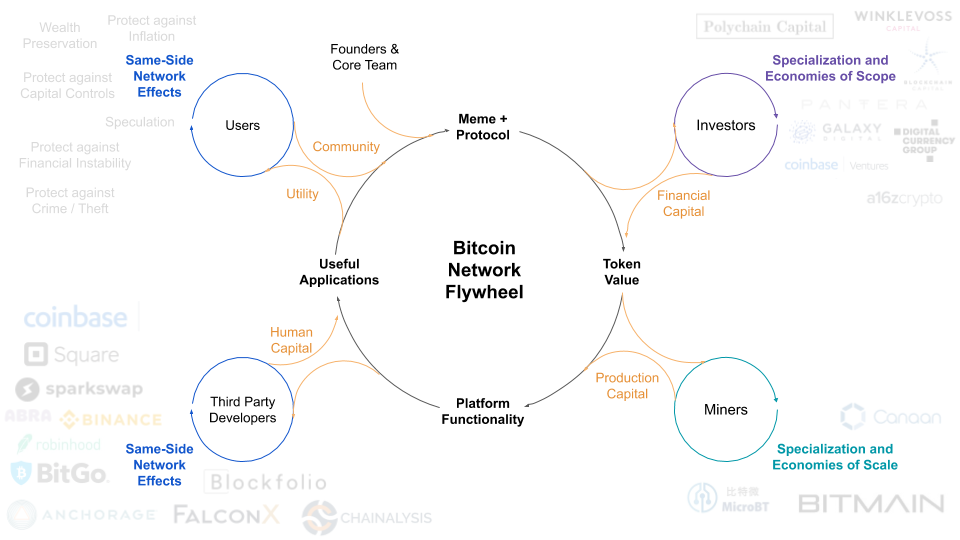

Bitcoin (the network) is a software protocol that generates a multi-sided network that produces and consumes BTC, a software-based store of value asset.

The Bitcoin network exhibits increasing returns, which means that the more people who participate in the network, the more valuable the network is to every participant. This generates a natural monopoly and starts an exponential growth curve.

We go into detail on Bitcoin's network effects here and do an analysis of Bitcoin as a product here.

Complementary asset

No one owns the complementary asset (the open Internet) that Bitcoin is built on. Here is why this is important to value capture and success in innovation. This is in stark contrast to everything in traditional fintech, which is all built on top of the existing financial system.

Why now?

Public blockchains are a new technology that make trust abundant for the first time in history. Difficult economic times, massive U.S. fiscal and monetary stimulus and negative interest rates create strong tailwinds for a product like Bitcoin.

Community

In a typical early stage investment, you want to understand the founders' motivation, grit, track record, ability to learn, optimism and unfair advantages. This doesn't make sense for Bitcoin, since its momentum is driven by a global community and not be any one person or company.

That said, when you look at the Bitcoin community, you quickly realize it is extremely mission-driven, so much so that some have called Bitcoin the first 21st century religion, complete with prophets, apostles, sacred texts, holidays, internal schisms, and frequently repeated sayings and incantations. This level of devotion can create blind spots, but as legendary venture capitalist John Doerr once said, truly great ventures are led by missionaries, not mercenaries.

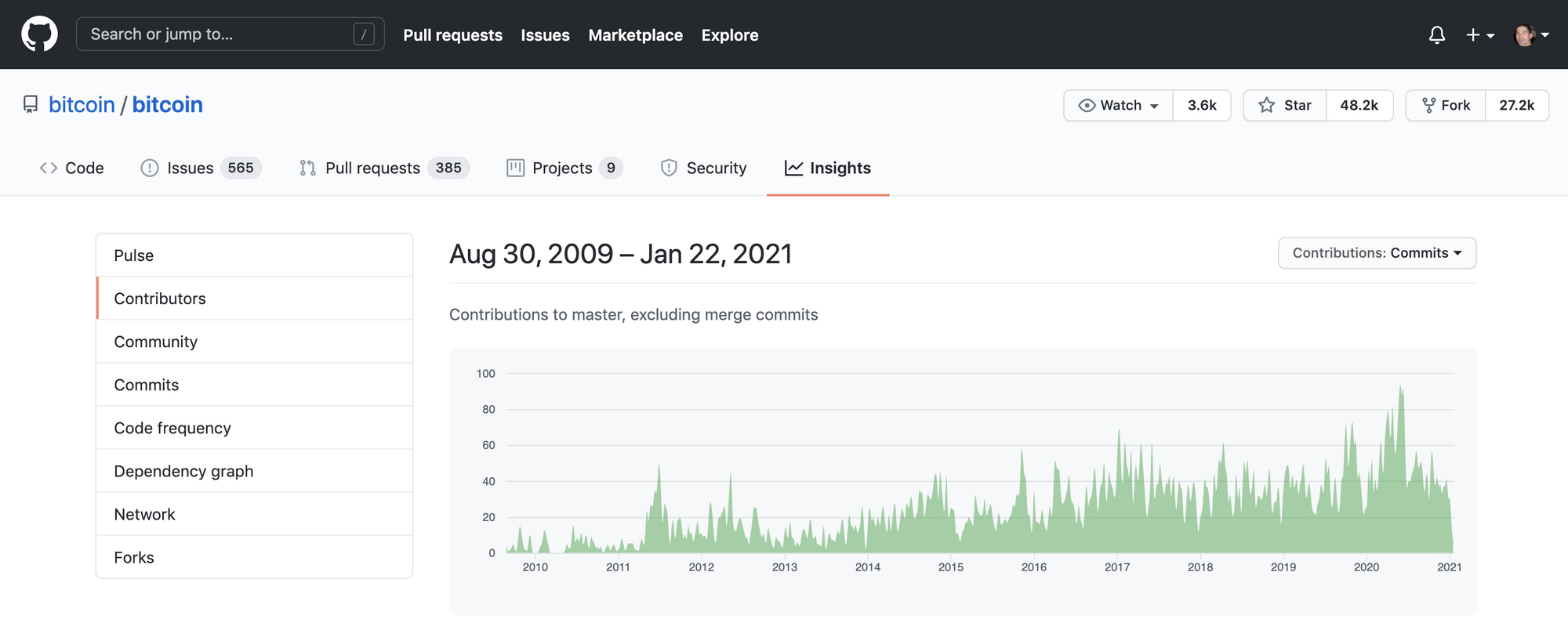

The Bitcoin developer community is large and growing. Contributions to the Bitcoin core software have been steadily increasing for 10 years. This shows a lot of grit and is particularly impressive in that the project is open source and most developers receive little or no pay for their contributions.

The spectacular success of linux shows just how powerful open source can be. The now famous essay the Cathedral and the Bazaar explains why. Every Android phone and virtually the entire Internet runs on linux.

The Bitcoin community has a number of unfair advantages when compared to any potential competitor, including strong growth and network effects at critical mass and ten years of brand building around strong memes. The bar for a separate standalone layer 1 store of value public blockchain is now quite high. The innovation around strong privacy from projects like Zcash and Monero are more likely to become features of the Bitcoin ecosystem rather than separate products.

Reality Checks

Scarcity

The best investment returns are when you are non-consensus right. Often these are ideas that seem bad or boring, but are actually good ideas. Many have heard of Bitcoin, but few understand it. Many struggle to simply understand what it is and why it's valuable. This makes Bitcoin an opportunity hiding in plain site.

Risks

There is a risk that governments try to shut Bitcoin down or add onerous regulations that curtail its use. This has happened before many times. In 1609, the Bank of Amsterdam outlawed private cashiers and their bank notes, mandating that all gold and silver be deposited at the bank. This was how the Bank of Amsterdam became a central bank and gained control over the currency.

It has also happened in the United States. On April 5, 1933, President Franklin Roosevelt signed Executive Order 6102 that required all “gold coin, gold bullion, and certificates to be delivered to the government” where they were exchanged for reserve notes. Private ownership of gold remained illegal until 1974.

While Bitcoin is currently legal in most developed nations, there are a number of countries where Bitcoin is illegal and others where it is restricted (including China and India). This said, there are reasons to believe shutting down Bitcoin is unlikely and perhaps even impossible.

There is a risk that Bitcoin is hacked or a bug enables the draining of funds. Bitcoin has operated for 10 years and has not been hacked, despite it being publicly accessible and containing hundreds of billions of dollars in value. That said, there are well known examples of Bitcoin businesses being hacked and the customers of those businesses losing their Bitcoin.

Long term monetary policy and network security risk. Bitcoin's capped supply might make securing the network difficult long term since the block rewards (inflation) paid to miners for securing the network will disappear over time and must be replaced by transaction fees. Here's a good writeup to better understand this issue.

There are other common critiques, but these are the three to be concerned about.

Summary

Bitcoin is an asymmetric bet that is a good fit for a late stage venture portfolio.

Bitcoin's opportunity is to capture and expand today's financial store of value market. This market will be bigger than many people think. But it's not the entire store of value market, nor is it the market for all money.

Warren Buffet has said that in the short term the stock market is a voting machine, but in the long term it is a weighing machine. The same applies to Bitcoin.

Bitcoin will continue to have extreme short term volatility, exacerbated by confusion in the market around what jobs Bitcoin will do, a fixed supply, and the ease with which Bitcoin can be bought and sold. It's reflexivity at work―with the pendulum overshooting in both directions.

Bitcoin's price will not go up forever. Trees do not grow to the sky, as the old proverb goes.

Like a startup, Bitcoin's price today is based mostly on hypothetical value and not real value. It's easier to "drink the Kool-aid" in the world of hypothetical values than in the world of real values. In the world of real values, the numbers are right in front of you. What can be done, though, is to think about base rates and how large the gap between hypothetical value and real value might be.

At a price of $32,500 per Bitcoin, the gap has started to narrow.

The good news is that crypto is much bigger than just Bitcoin.

Did you like this article? Subscribe now to get content like this delivered free to your inbox. Learn more about what I do: https://andyjagoe.com/services/

- Cover photo by Jason Dent

- Friedman, Milton, Money Mischief, Mariner Books, 1994.

- Source - Bitcoin: Messari, Jan 22, 2021; Fed's Balance Sheet: U.S. Federal Reserve, July 2020; Gold: World Gold Council, May 2020; Derivatives (Market Value): BIS (Dec 2019); Narrow Money Supply: CIA Factbook; Eurodollars: BIS, World Bank, Rabo Bank; Broad Money Supply: CIA Factbook; Global Debt: IIF Debt Monitor; Global Real Estate: Savills Global Research, 2018

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, Software Eats Money has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.