The wallet is the new bank

The wallet's jobs to be done and why the biggest company in the internet of money will own the wallet.

The first use of the word internet was in 1974 when Vint Cerf, Yogen Dalal, and Carl Sunshine published their Specification of Internet Transmission Control Program.

Internet is short for internetwork, the combination of the prefix inter and the word network, which was used as early as 1894 to mean an interconnecting network in plant biology. In fact, the word internetted was used as early as 1849 to mean interconnected or interwoven.

The concept of an internet, or network of networks, is not new. In fact, it's at the core of some of the world's most important societal changes.

Today, I will talk about three internets. One from the past, which has long since matured. One from the present, still approaching its peak. And one from the future, just barely getting started.

From this, we'll see a pattern. We'll use it to inform how we think about the future and explain why the wallet will be the new bank.

The internet of goods

Today, you can live anywhere and still have access to the best goods the world has to offer. But before 1830, access to goods required being on a navigable waterway (ocean, river or canal), and so this is where people lived―in dense cities that minimized transportation costs. By 1830, investment had shifted from canals to railroads, which for the first time enabled cities to develop away from navigable water.² But it wasn't until the explosive growth of the automobile, combined with the US Numbered Highway System and the Interstate Highway System, that the internet of goods truly emerged.

The internet of goods is enabled by highways interconnecting local city networks, and is navigated by the automobile.

If waterways and railroads formed the backbone that solved for long haul, highways and automobiles solved the "last mile" problem, unlocking cities from the backbone and enabling unfettered expansion in every direction.

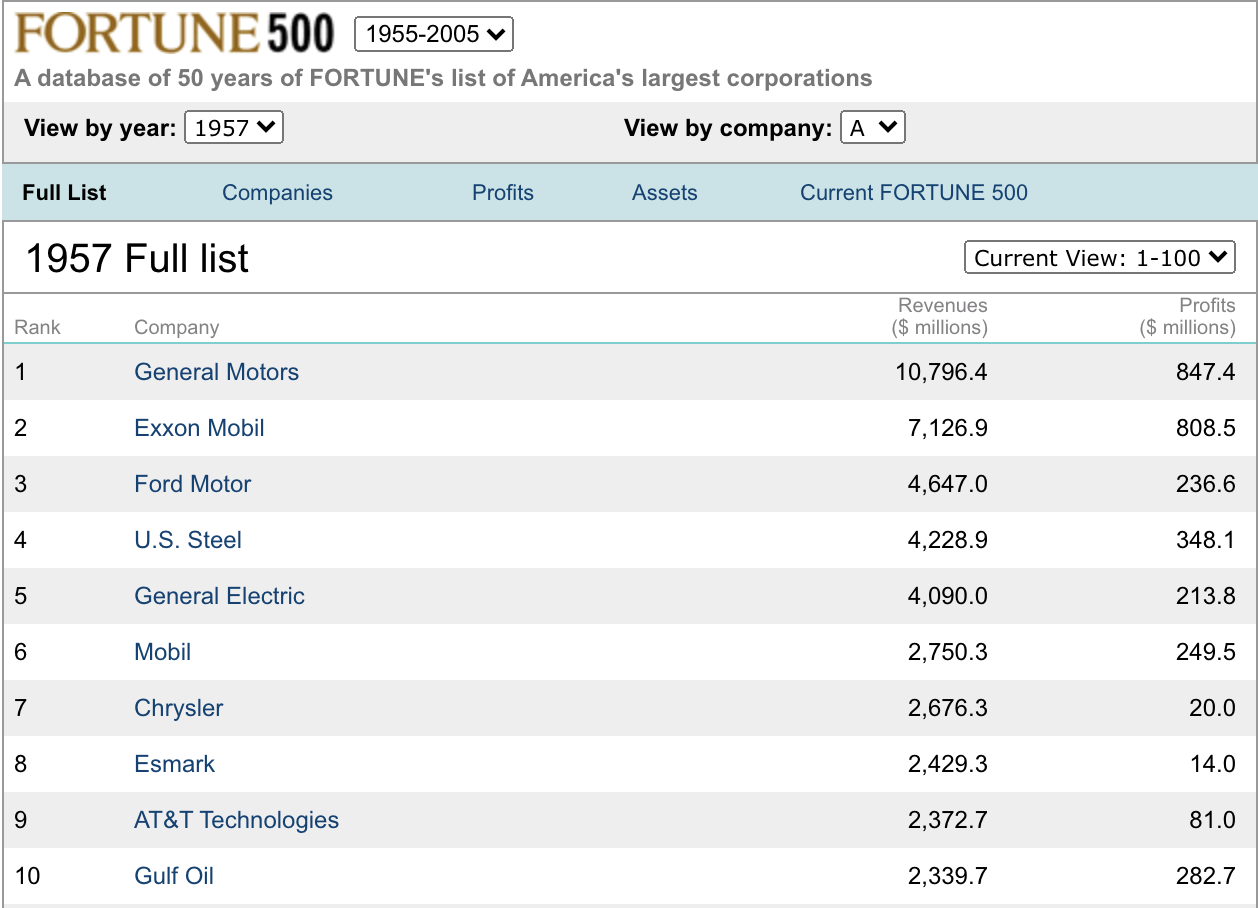

It should be no surprise that two of the top three companies in America in 1957 produced automobiles. General Motors was number one, both in sales and profitability. General Motors generated $10.8 billion in sales and $847 million in profit. Ford was number 3, generating $4.7 billion in sales and $237 million in profit.

While the top position went to an automobile provider, it's worth noting that the number two position went to Exxon Mobil, who happened to provide (among other things) the scarce ingredient required to get your automobile from A to B. In 1957, Exxon Mobil generated $7.1 billion in sales and $809 million in profit.

In number four is US Steel, who happened to provide key primitives for the world of goods. In 1957, US Steel generated $4.2 billion in sales and 348 million in profit.

Fast forward sixty years to the internet of information, and you'll see a familiar pattern.

The internet of information

The internet of information is enabled by interconnected computer networks that allow nearly instantaneous exchange of information between any number of parties in the world, and is navigated by the browser.

When I say browser, I mean the term very loosely. I do not mean Chrome, Safari or Internet Explorer. I mean the computing device that packages the web browser, the app ecosystem, and all the other hardware and software necessary for the best experience navigating the internet of information.

By this measure, Apple undoubtedly produces the best products, and it's reflected in their $2.2 trillion market cap and number one ranking in the S&P 500.

In the same way the top company in 1957 produced the best product for navigating the internet of goods, so does the top company in 2020 produce the best product for navigating the internet of information.

Going down the list of top companies in the S&P 500 by market cap, we see Amazon at number 3. Like US Steel for the information age, Amazon provides key primitives for the world of information. Much of Amazon's profit comes from Amazon Web Services, and Amazon's design approach to all its businesses is a platform of primitives for which they are their own best customer.

In position number four, Google is like Exxon Mobile for the information age. Google provides the scarce ingredient to get your browser from A to B. In the internet of goods, the scarcity was fuel. In the internet of information, the scarcity is knowing where everything is and being able to give you a great answer to any question you can think of. In the same way your car is no good without gas, your browser is no good unless it can find things you want.

Patterns of value creation from the internet of goods and the internet of information gives us clues where we might find value creation in future internets:

- The provider of the device to navigate the internet.

- The provider of a scarce resource needed to travel the internet.

- The provider of key primitives for the internet.

Let's use this as a framework to think about the internet of money.

The internet of money

Marc Andreessen, who built the first widely used web browser and who founded the venture capital firm Andreessen Horowitz, says that the 'original sin' of the Internet is that payments weren't built into the browser.

The internet of money is emerging to fix this.

But as I've written about here and here, the internet of money is not a bolt-on feature for the financial services industry or for the internet of information. It's a complete reimagining of money, value exchange and financial services as we know them.

The internet of goods was enabled by interconnected city networks and navigated with your automobile.

The internet of information was enabled by interconnected computer networks and navigated with your browser.

The internet of money will be enabled by interconnected public blockchain networks and navigated with your wallet.

If the top company in the internet of goods produced automobiles, and the top company in the internet of information produced browsers, might the top company in the internet of money produce wallets?

Let's look at wallets from a product perspective. In the internet of money, what are a wallet's jobs to be done?

It might surprise you to learn that, aside from lending, the jobs to be done are the same jobs your bank currently has. This is why the wallet is the new bank.

Let me explain.

Today, banking is a service you buy from companies we call banks. You give your money to a bank, and in return they provide services we call banking. But once your money is in a bank, it is technically no longer yours. It is the bank's. If a bank fails, you cannot just come by and pick up your money. This is why we have deposit (e.g. FDIC) insurance.

In the internet of money, for the first time since the days of gold coins, you are able to own your own money. But unlike with gold coins, it is practical and safe to do so. Your money is not under your mattress or in a personal safe. It's in a virtual safe deposit box called the public blockchain and is more secure than any bank.

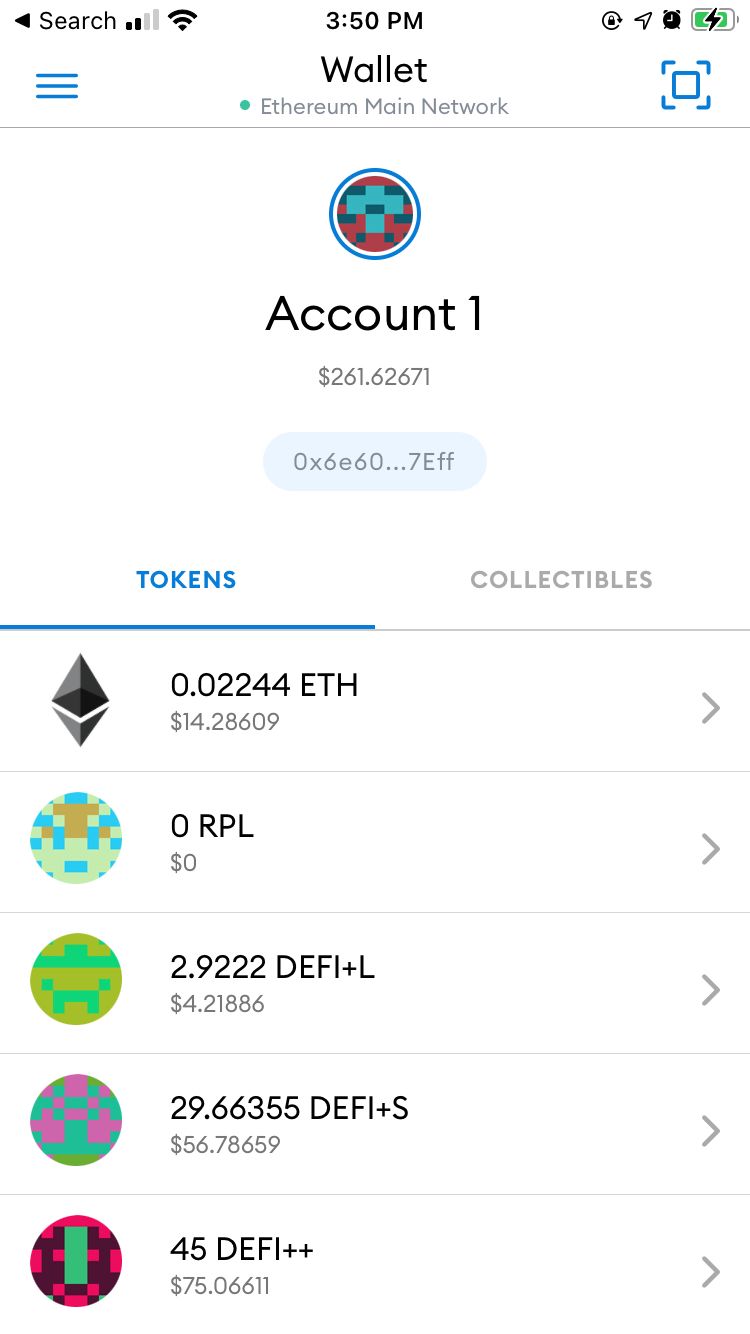

In this new model, instead of logging in to separate bank apps to use the money they're holding for you, you open your mobile wallet and it shows you all the money and financial assets you've allowed it to track. Unlike in the walled garden of your banking app, your money can flow freely to any financial product from any provider without limit or restriction. There are no forms to fax, approvals to get, or medallion stamps required.

Your wallet holds your keys. The public blockchain holds your money.

Because your wallet holds your keys, it's the natural place to go for all interactions involving your money. A second reason the wallet is the new bank.

Here are the jobs to be done for a consumer bank, and how they may change in the internet of money.

- Keep money safe Using a bank means that you don't need to worry about storing your money, losing it or having it stolen. But, as noted above, the money you keep in a bank is not technically yours and requires deposit insurance. Banks don't often advertise the fraud they face, but fraud losses are massive. A wallet using a public blockchain is more secure than a bank's IT infrastructure, and the money you keep there is actually yours.

- Make payments Banks enable you to make fiat currency payments via billpay, check, debit, credit, wire, cashier check, or global remittance services using the bank as an intermediary. A wallet enables you to instantly pay anyone anywhere using digital money. To pay by fiat, you would have to use a service to bridge the payment.

- Receive payments Banks enable you to receive fiat payments by check, ACH, or wire. Check and ACH payments typically take a few days to clear. A wallet enables you to receive payments of digital money from anyone anywhere and have funds available immediately. To receive by fiat, you would have to use a service to bridge the payment.

- Provide records of what I've spent/received Banks provide access to an electronic general ledger of everything you have spent and received. Wallets also provide access to an electronic general ledger of everything you have spent and received.

- Separate money into logical buckets for convenient mental mapping Banks have not historically done a great job with personal financial managament (PFM). The reason for this is simple. A bank's primary business is lending, and PFM doesn't sell loans. New products are emerging that do this better, notably Google Pay. The open platform of the public blockchain will enable wallets to do likewise.

- Planning and financial education Honestly, banks do little more than lip service to this job. Misaligned incentives encourage banks to load people with as many loans as possible, so they don't really want customers to be financially astute. By contrast, a wallet provider wins when the user wins, and could integrate high quality content and gamification to encourage financial literacy.

- Lend money Banks provide a variety of loan products, including overdraft, payday, credit card, auto, mortgage, home equity, and student loans. A wallet could allow you to navigate potential loans, but the best wallets will remain neutral (but might support sponsored listings).

- Get cash or foreign currency Banks offer cash through ATMs and branches, and foreign currency by delivery or through branches. But demand for this is likely to continue to decrease. Some economies like China and Sweden are almost cashless already.

- Keep valuables safe Many banks provide safe deposit boxes for customers to store valuables. As banks get unbundled and do away with branches, it's likely this service will be discontinued. Specialist safe deposit companies will emerge to service this category.

The internet of money and its wallets are still in their infancy, but the writing is on the wall. Banks will be unbundled until lending is all that remains.

Banking will not be a service you buy, it will be something you do. This will be true whether your preferred money is crypto dollars, Bitcoin, a central bank digital currency, or any other cryptocurrency.

In the future, banks will be called lenders, and wallets will be called banks.

It will take time. Ten years. Maybe even twenty or more. It took twenty years from Vint Cerf's 1974 paper until the Internet started to break out.

I remember being a college student working in the accounting department of UC Berkeley in 1994 and being fascinated as we replaced Gopher with the Mosaic web browser. And then fighting to install a TCP/IP software stack on my Windows 3.1 computer at home so I could use a 9600 baud dial-up modem to access the Web.

Today's wallets are like 1994's Web browsers. Clunky and hard to use. With far too much technical detail exposed to the user. Here's what a popular internet of money wallet called Metamask looks like.

In 1996, I left my job as an analyst in management consulting to start an Internet software company. I'll never forget a sales call that year with the IT director of a large electronics company. He saw the email address on my business card and said "Email is never going to take off. Why would you ever email someone when it's so easy just to call?"

I was shocked. I couldn't believe he didn't see where the Internet was going.

Twenty five years later, his comment sounds just as preposterous as when Ken Olsen, the president of Digital Equipment Corporation said "There is no reason for the individual to have a computer in their home."³ Or when Paul Krugman, who has since won the Nobel Prize in Economics, said that "By 2005 or so, it will become clear that the Internet's impact on the economy has been no greater than the fax machine's"⁴.

It remains to be seen how the internet of money will ultimately look. But it will be bigger than the internet of information. It impacts much more than media and telecom companies. It impacts entire economies.

One of my favorite quotes from Bill Gates is "We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten."⁵

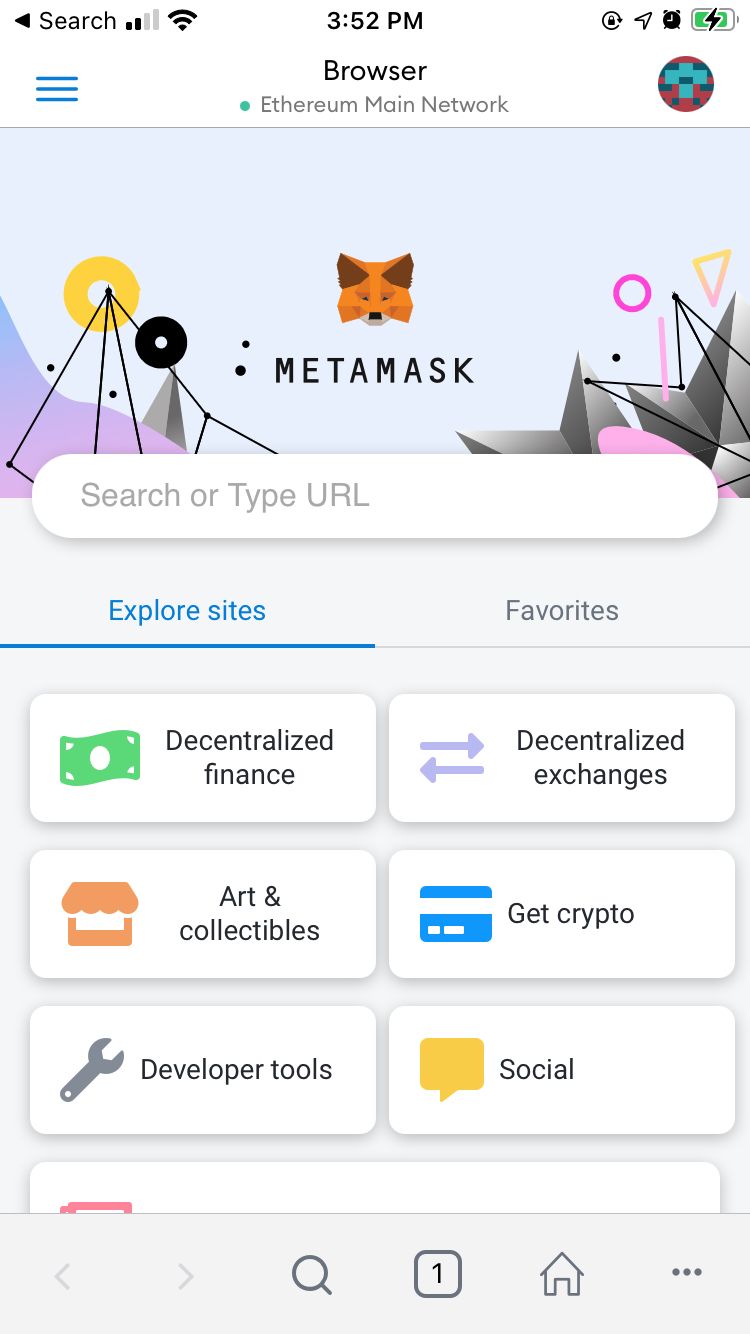

Here is a glimpse of how we might navigate financial services in the future, embedded in Metamask.

In the same way many physical products have been replaced with apps on your phone, many of today's financial services will be replaced with apps in your wallet.

But tomorrow's wallet will be about much more than just money. It will store digital versions of verified credentials, licenses, degrees and certificates as well. For example, the token Google issues your browser after you enter your username and password verifies your are able to use email, calendar and productivity resources as a specific user. Your passport is a credential that verifies who you are and what your citizenship is. Your driver's license is a credential that verifies that you may drive a car. And your student ID verifies that you may use school services.

The wallet will integrate many other services too. Just like the smartphone did.

Over time, not only is the wallet the new bank, it is who you are and your key to prove it.

The wallet will be the primary user interface for the internet of money, and the company that produces the best wallet may be among the most valuable in the internet of money. Like General Motors for the internet of goods. Or Apple for the internet of information.

Who will be the Exxon Mobil or Google of the internet of money? The platform that provides the scarce ingredient required to get wallets from A to B?

And who will be the US Steel or Amazon of the internet of money? The platform that provides the key primitives for the world of money?

That will have to wait for a future article.

Did you like this article? Subscribe now to get content like this delivered free to your inbox. Learn more about what I do: https://andyjagoe.com/services/

- Cover photo by Markus Winkler

- A. Nairn, Engines That Move Markets: Technology Investing from Railroads to the Internet and Beyond (2nd edition), Harriman House, 2018.

- C. Cerf and N. S. Navasky, The Experts Speak: The Definitive Compendium of Authoritative Misinformation, New York: Villard, 1998.

- In Red Herring Magazine, 1998. http://web.archive.org/web/19980610100009/www.redherring.com/mag/issue55/economics.html

- The Road Ahead by Bill Gates, (Completely Revised and Up-to-date), Section: Afterword, Penguin Books, New York, 1996.

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, Software Eats Money has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, Software Eats Money has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.