Analysis of bitcoin as a product

Who are Bitcoin's customers? What jobs does bitcoin do? Is bitcoin digital gold? Is digital gold better than physical gold? Is bitcoin money?

This article is the second in a three part series that explores gold and bitcoin in detail as products, including who the customers are for gold and bitcoin, what jobs gold and bitcoin do for them, and a perspective on the future markets for gold and bitcoin.

What everybody ought to know about gold and bitcoin

- Part 1: Gold as a product

- Part 2: Bitcoin as a product (this post)

- Part 3: The future for gold and Bitcoin

“I do think Bitcoin is the first [encrypted money] that has the potential to do something like change the world.”

– Peter Thiel, Co-Founder of Paypal

Who’s buying bitcoin? And why are they buying it?

The answers might surprise you.

In our first post in the series, we did an analysis of gold as a product. Bitcoin and gold are similar in many ways. To really understand Bitcoin, you have to understand gold.

Gold and bitcoin both have a finite supply which must be mined at great expense to obtain. No matter what you do to gold or bitcoin you cannot destroy it or make it disappear. Gold is imperishable, and every bitcoin ever mined is permanently recorded in the Bitcoin blockchain and cannot be altered or removed.

Gold and bitcoin are both a store of value, a medium of exchange and a unit of account. This means both gold and Bitcoin are money.

But not all money is created equal.

In this post, we look at who Bitcoin’s customers are, and what jobs bitcoin does for them. How does this compare with gold? And finally, is “digital gold” a good way to think about Bitcoin?

Bitcoin customers can be divided into two groups: individuals and professional investors. Let’s look first at individuals.

Individuals as Bitcoin customers

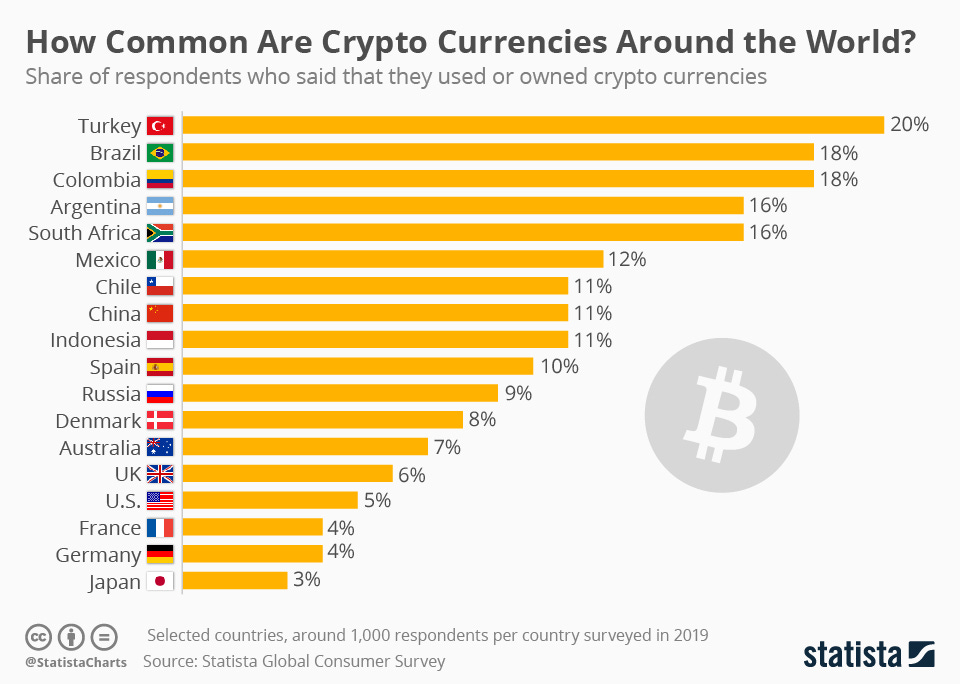

According to the 2019 Statista Global Consumer Survey, the top five countries in terms of cryptocurrency penetration are Turkey, Brazil, Colombia, Argentina, and South Africa.

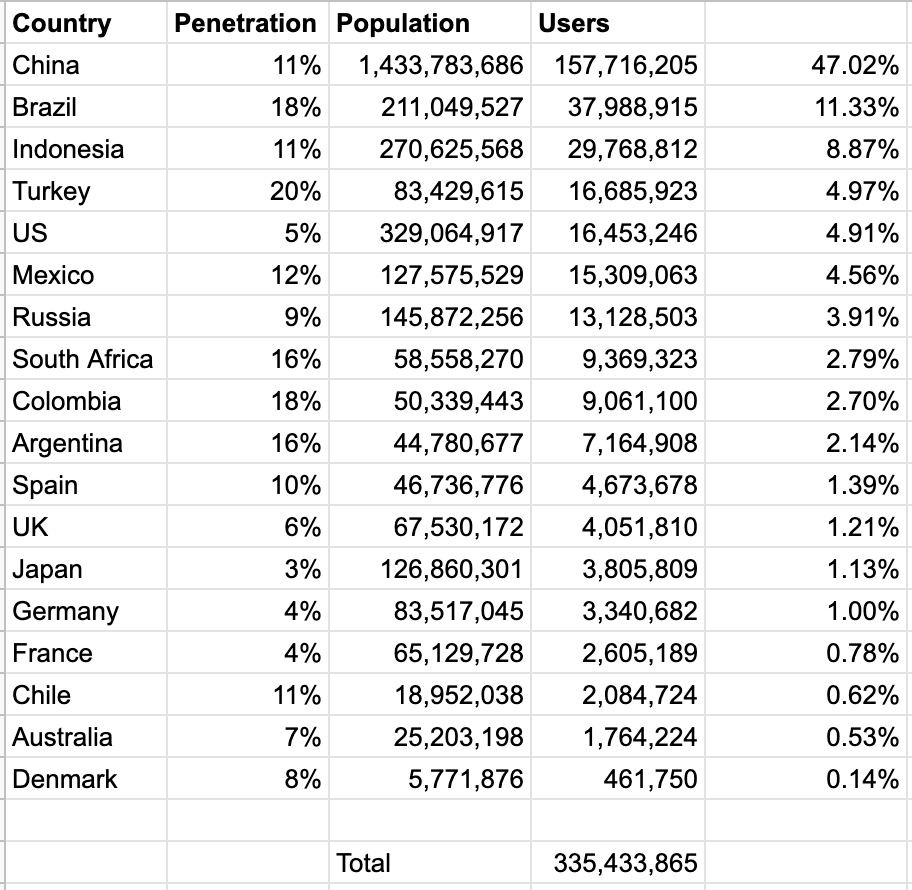

While the penetration numbers are interesting, it’s more useful to translate penetration numbers into estimated user bases. We’ve done this below using mid-July, 2019 UN population data.

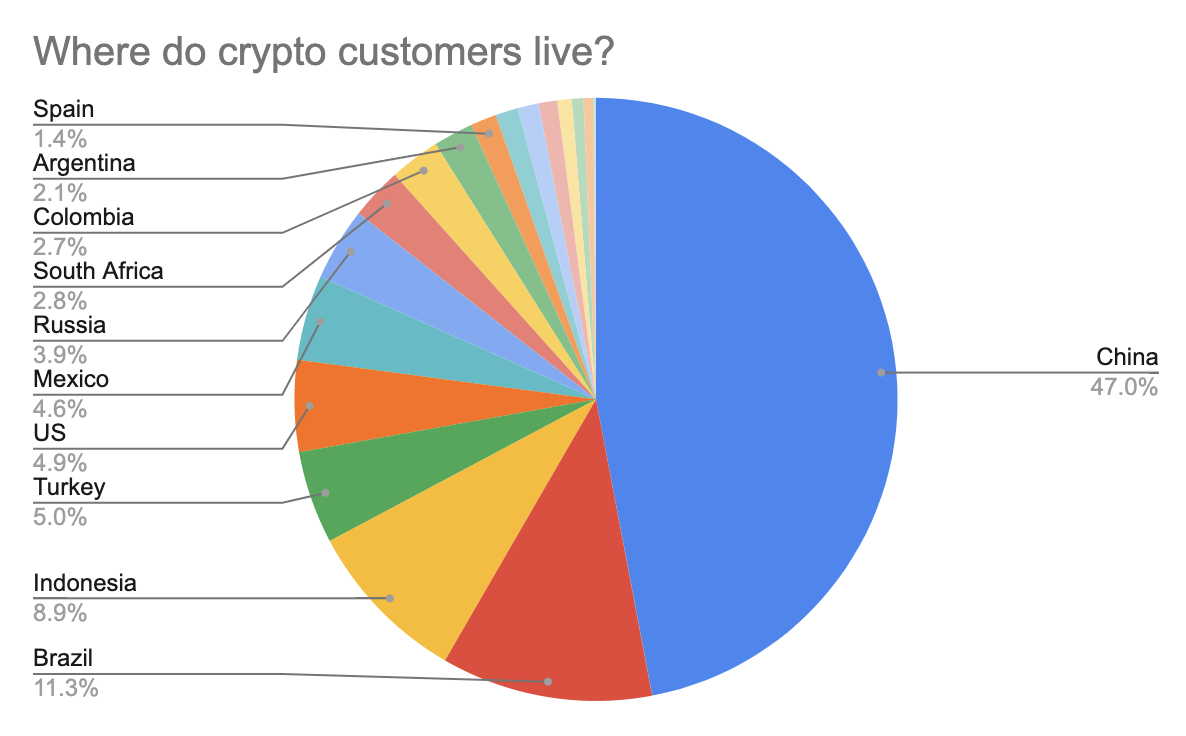

Though the Statista data shows only 18 countries (noticeably missing India), it still represents 3.2 billion people—almost half the world’s population. Here are some important takeaways:

First, there are over 335 million crypto users worldwide. For perspective, Instagram had 30 million users when Facebook bought them for $1B. And Whatsapp had 450 million users when Facebook bought them for $19B.

Second, half of all crypto users are in China. This is four times as many as Brazil, the country with the next largest crypto user base.

Third, despite the lower penetration rate, the US still makes it into the top 5 overall because of its large population.

While this data focuses on cryptocurrency generally and does not specify Bitcoin, given that bitcoin is two thirds of the market cap of all crypto currencies and it’s common for altcoin owners to also own bitcoin, these results are likely directionally correct for bitcoin.

So why do people buy bitcoin?

There are two main groups of individual’s buying bitcoin, and they’re buying bitcoin for very different reasons.

The first group is looking for safety (risk off). They are hoping to future-proof their financial security. The second group is looking for yield. They are hoping for a high-return investment (risk on).

Let’s look at each in turn.

Job to be done: future-proof financial security

In many parts of the world, people look to bitcoin to preserve wealth and hedge risk—jobs people have traditionally looked to gold for.

Why?

Bitcoin and gold are similar in a lot of ways.

Like gold, bitcoin is not an investment. An investment is putting capital at risk in return for the promise of dividends, interest or appreciation. But since the capital is at risk, it’s possible to get back less than you invested—or nothing at all.

If you buy bitcoin and lock it in a vault, you are not investing it. You don’t receive interest or dividends. You are simply storing it.

The bitcoin you store is no one else’s liability or promise of performance, so there is no counter-party risk. If you remove your bitcoin from storage, there is no risk that you receive less bitcoin than you started with.

Unlike traditional fiat money, bitcoin is money that bankers and politicians cannot contract or expand. This is what makes it a hedge against inflation (or deflation)—or portfolio insurance against disaster or failed government policies.

While gold and bitcoin are similar, they are not simple substitutes. There are very important differences between them.

Being digital, bitcoin has some significant advantages over gold, including:

- Ease of acquisition

- Divisibility

- Ease of transfer

- Being difficult to seize or steal

These advantages are why people choose to buy bitcoin to future-proof financial security instead of buying gold.

If it were as simple for anyone to buy and sell gold in any quantity at any time using only a cell phone, take actual possession of it, easily conceal it from theft, and instantly move it across national boundaries as it is with bitcoin, people would probably prefer to buy gold. But gold is not good at these things.

That being said, the physical nature of gold means that it has some significant advantages over bitcoin. Gold is deeply entrenched into the fabric of the world. There is $1.5 trillion dollars of industrial usage of gold, and individuals own almost $5 trillion of gold in the form of jewelry and adornment. For thousands of years, gold has been used to signal status, show confidence, and to provide connection when given as a gift (e.g. wedding bands). This is not going to change quickly, if ever.

You cannot wear bitcoin. Or make it into wedding bands.

With bitcoin, there’s not much more to see than a balance, transactions and a 34 character bitcoin address like 1XPTgDRhN8RFnzniWCddobD9iKZatrvH4.

So while many people choose to buy bitcoin to future-proof their financial security, today it is much riskier than gold because bitcoin has fewer alternative uses to maintain its price support.

Below are three jobs people hire bitcoin to do related to future-proofing financial security. Others will surely emerge over time.

Protect against financial instability and inflation

In situations of financial instability, it can be desirable to protect wealth outside the existing financial system with the objective of maintaining purchasing power with as little risk as possible. This is often why people seek to hold US dollars or other hard currencies when their local currency has systemic inflation.

But it’s not always possible to get hard currency when you want to. And even hard currencies have all had severe erosion of purchasing power over time.

In 2019, inflation in Argentina hit 53.8%, the highest it’s been in 30 years. Only 4 countries had worse inflation in 2019 than Argentina—Venezuela, Zimbabwe, South Sudan and Sudan. Argentina implemented restrictions on access to foreign currency in an attempt to put the brakes on the financial crisis. By October, Argentinians were allowed a maximum of $100 US dollars per month in cash or $200 US dollars per month in their bank account.

An Argentinian who bought bitcoin at its 2017 peak would have been better off today than an Argentinian who held Argentinian Pesos in their bank account—despite the 50% drop in the price of bitcoin.

If an Argentinian had bought Bitcoin at the highest point of the "biggest bubble in history", in 2017, he would have been better off than leaving his money in his Argentinian bank account. So tell me again how Bitcoin is a horrible store of value. pic.twitter.com/55YuAi9vD4

— Josu San Martin (@josusanmartin) May 19, 2019

This example of hyperinflation is not as rare as you might think. There have been 29 hyperinflations over the last 100 years. Venezuela continues to have the world’s worst hyperinflation—and Iran, Turkey and others have all struggled with inflation recently. There was even hyperinflation in the US in 1779 and between 1861 and 1865.

As seen in Argentina, when a country is in the middle of a financial crisis, it is often difficult or impossible to convert local currency to a foreign hard currency. Also, because so many people want gold in a situation like this, gold might not be available either. Especially since increased demand may mean gold must be physically moved into the country. Since bitcoin can be moved peer-to-peer electronically over the Internet, it doesn’t have this problem.

For someone worried about inflation who is not able to hold traditional hard currencies or gold, the job bitcoin does is provide an alternative store of value.

Protect against capital controls

Capital controls can take many forms and be implemented for many reasons. Common reasons include preventing capital flight, influencing the foreign exchange rate (i.e. competitiveness of exports), and providing domestic capital at rates lower than would otherwise be available.

The result for individuals is that—even if they are technically free to leave the country—it may be difficult or impossible to take their money with them. This effectively locks many people in place.

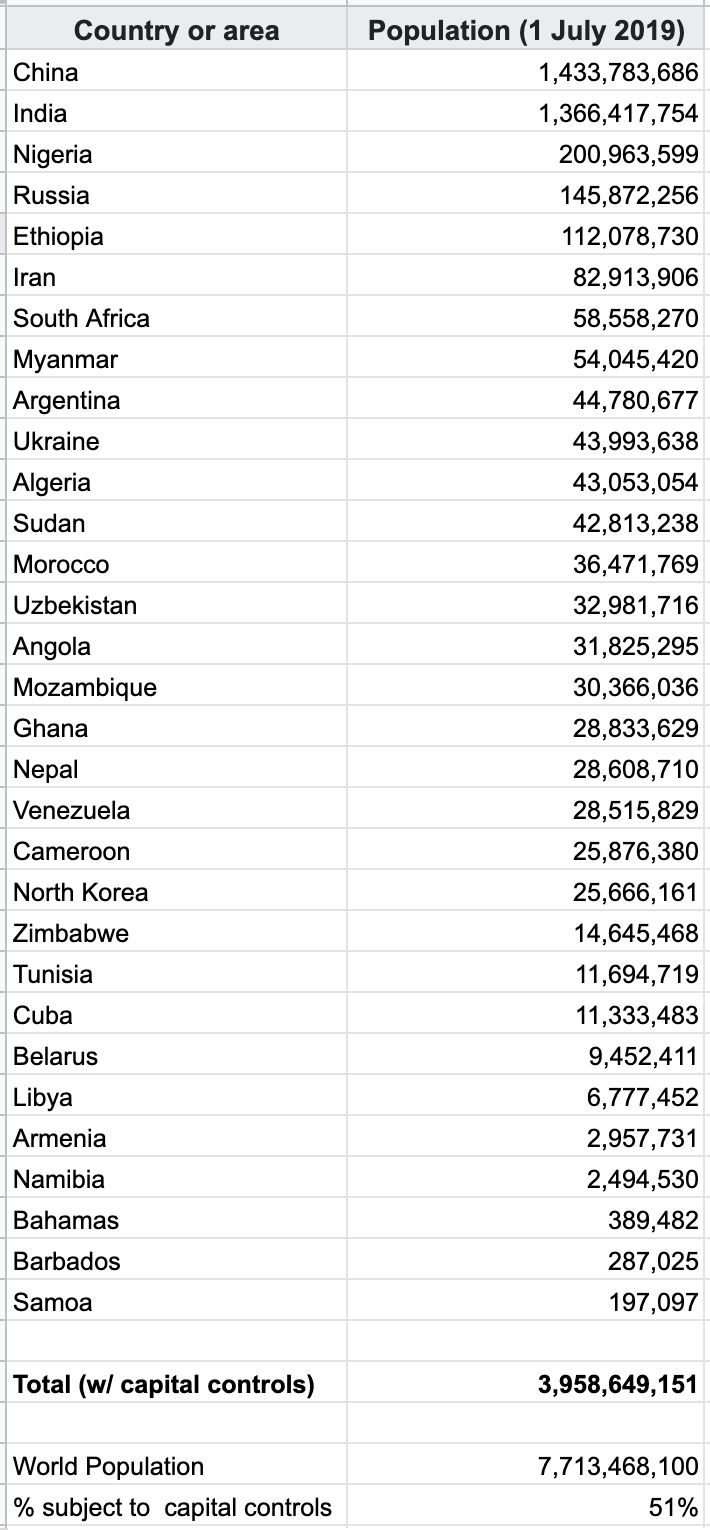

Below is a list of countries that currently have foreign exchange controls:

The above list is only 31 countries, but if you sum the populations of these 31 countries, you realize that capital controls impact 3.96 billion people today—more than half the world’s population. Below is the same list ranked by population.

Typical restrictions include banning the use of foreign currency within the country, banning locals from possessing foreign currency, restricting the amount of foreign currency that can be imported or exported, and fixed exchange rates.

Capital controls have a tendency to come and go—and often coincide with financial crises. Greece had capital controls from 2015 to 2019, Iceland had capital controls from 2008 to 2017, and the Republic of Cyprus had capital controls from 2013-2015.

Capital controls are not found only in places with political or financial instability. The UK had capital controls until 1979. China has in place some of the most strict capital controls, including a limit of $50,000 US dollars per year that Chinese citizens can take out of the yuan. In 1933, Franklin D. Roosevelt signed an executive order that forced all US citizens to sell their gold for US dollars. It remained illegal for US citizens to own gold bullion, bars or coins until 1974. Some believe the US may again implement capital restrictions if the US dollar is threatened or if the current political path toward protectionism continues.

For someone worried about being able to move wealth freely, bitcoin makes it as quick and easy to transfer value as the Internet makes it to transfer information. bitcoin does this job much better than gold, because gold is heavy and has to be physically moved. Bitcoin, by contrast, can be instantly moved from anywhere to anywhere so long as the participants can access the Internet.

Protect against crime and theft

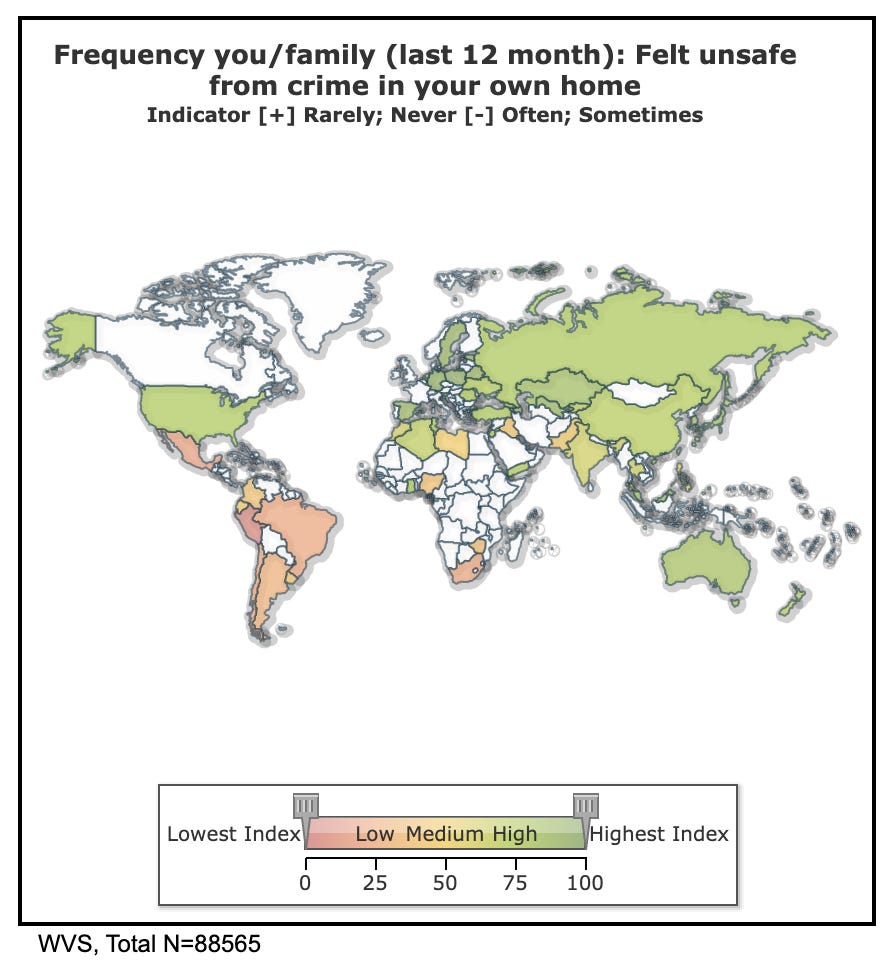

A question asked in the 2010 - 2014 World Values Survey was how often participants or their family felt unsafe from crime in their own homes. People in Latin America—and to some extent Africa—felt this frequently.

Below is a sampling of scores. 100 is feeling unsafe rarely or never and 1 is feeling unsafe sometimes / often:

- Germany: 92

- Japan: 84

- Turkey: 77

- USA: 76

- China: 74

- India: 63

- Argentina: 29

- Chile: 23

- Brazil: 23

- South Africa: 21

- Mexico: 17

- Peru: 4

- Rwanda: 3

Countries that scored below 30 in this survey also have very high unbanked populations. According to the World Bank’s 2017 Global Findex Database, 63% of Mexicans, 57% of Peruvians, and 51% of Argentinians are unbanked. These are among the highest unbanked percentages in the world—2x to 3x higher than China, India or South Africa.

For many Latin Americans, this means that not only do they not feel safe in their own homes, but they have to keep their savings in cash because they have no bank account.

If you’ve ever traveled to Mexico or other parts of Latin America and wondered why you saw so many half-finished houses—here’s why. It’s extremely difficult (and expensive) to get a real estate loan in Latin America. So what do you do if you’re saving to buy a home and you don’t have a bank account, but you don’t want to keep your savings in cash since you’re worried about it being stolen or inflated away? You build your house slowly, one brick at a time, over countless years.

It turns out no one is very interested in stealing foundations or cement bricks. And for many currencies in Latin America, the value of cement bricks holds up much better than cash. Plus, there’s no financing cost or risk. Given the choice, people might prefer to finance a home and be able to live in it right away. But given the circumstances, what’s actually happening is not surprising.

For someone who is considering putting their wealth into cement bricks to protect it from theft or inflation, the job Bitcoin does is provide an alternative that is easy to buy, easy to transfer and harder to steal than gold or cash.

Job to be done: be a high-return investment

There’s another type of bitcoin customer—one who is primarily interested in bitcoin as a high-risk, high-reward opportunity.

These customers have seen how bitcoin has appreciated to date, and are hoping for it to continue. This type of customer typically lives in a country with a high average income, like the US, Japan or Europe.

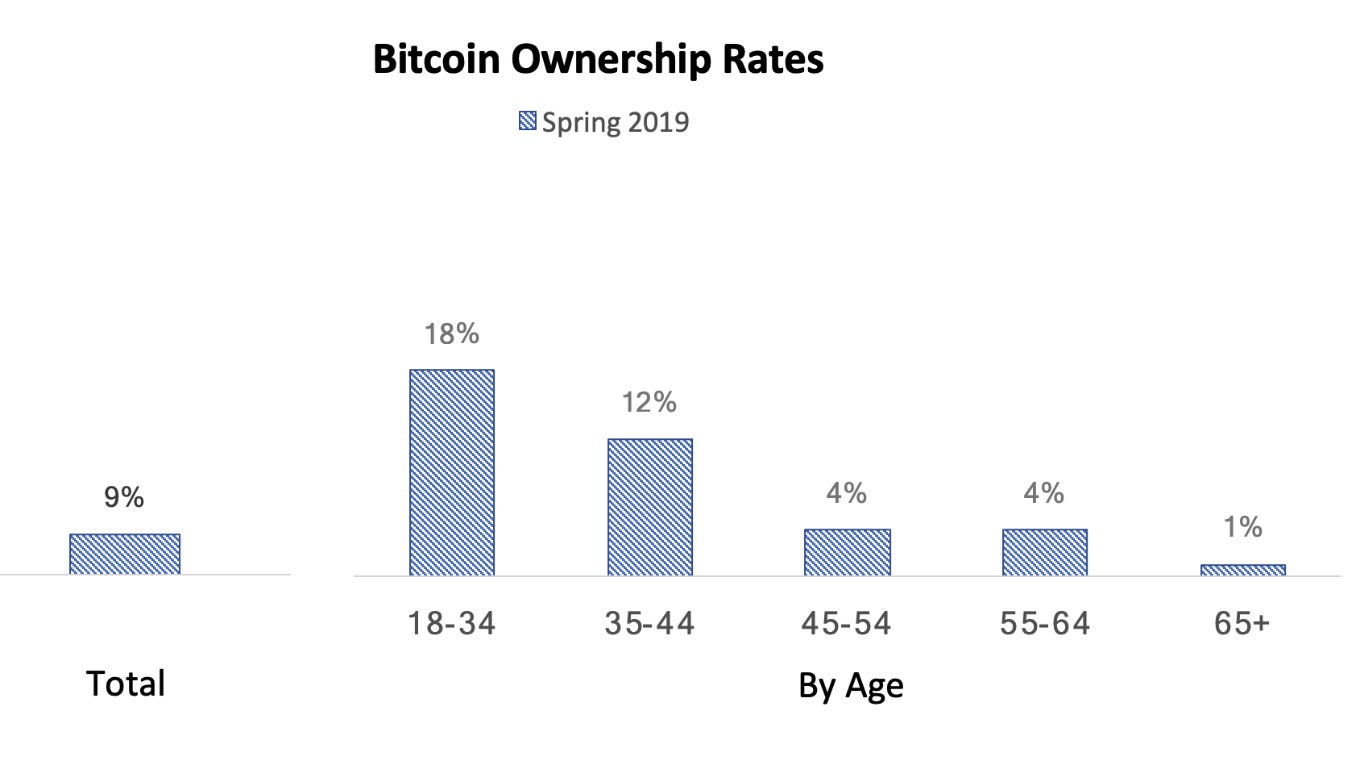

A survey sponsored by Blockchain Capital and conducted by The Harris Poll in April, 2019 shows that 18% of U.S. millenials own Bitcoin. This is an amazing statistic, because only 37% of U.S. millenials are invested in the stock market.

27% of respondents (42% of millenials) said they were likely to buy bitcoin in the next 5 years, and 33% of respondents (48% of millenials) believe that most people will be using bitcoin in the next ten years. The younger a respondent was, the more positive they were likely to be on Bitcoin.

A 2019 survey by Finder found that 61% of US cryptocurrency owners want to own it as an investment (the number one reason), followed by 29% who want to use it for transaction payments, 26% who want to store savings outside of traditional banks, and 18% who want to use it to send money overseas. They also found that men were twice as likely to hold crypto as women, and that the average US crypto account value was $5,447, with the median being $360.

Net-net, the typical profile of a bitcoin owner in the US today is a high income millenial male.

Why do millenials like bitcoin? It’s had extremely high returns—similar to a venture investment (but without requiring you to be an accredited investor). It trades 24/7—enabling round-the-clock instant gratification. It’s very easy to get started—especially using Robinhood or Coinbase. And it’s much simpler than trading stocks.

Professional investors

When Bitcoin started, its customers were exclusively individuals. But today, professional investors are increasingly Bitcoin customers as well. This category is made up of sophisticated “smart” money making large bets on bitcoin and other cryptocurrencies.

The job bitcoin does for these customers is provide the possibility of exceptional investment returns. They are evaluating Bitcoin and crypto networks as if the network were a venture investment, and investing in opportunities they believe have a venture-style upside. This is significantly different from traditional venture investing, where the focus is on investing in a company whose value is determined by the growth, scale and defensibility of recurring cash flows. Fred Wilson at Union Square Ventures and Chris Dixon at Andreessen Horowitz are both well known traditional venture capitalists that have taken deep interest in Bitcoin and cryptocurrency.

A few of the more active funds focused on investing in cryptocurrencies and crypto companies include a16z Crypto, Blockchain Capital, Coinbase Ventures, Digital Currency Group, Galaxy Digital, Pantera Capital, Polychain Capital and Winklevoss Capital.

Funds like the above group are even beginning to attract institutional investors like pension funds and university endowments interested in exposure to Bitcoin as part of a portfolio allocation strategy. The job bitcoin does for these customers is increase diversification.

In October, 2019, the Police Officer’s Retirement System and the Employees Retirement System—both of Fairfax County, Virginia—invested $55M (1% of their assets) with Morgan Creek Digital, which invests in cryptocurrencies.

The endowments of Harvard, Stanford, MIT, Dartmouth, and University of North Carolina are also reported to have made investments in at least one cryptocurrency fund. Yale’s endowment has invested in two cryptocurrency funds, including a16z Crypto.

Is bitcoin digital gold?

Thinking about bitcoin as digital gold is useful if you keep in mind that bitcoin and gold are not perfect substitutes. There are very important differences between them.

The growth and resilience of bitcoin is strong validation that what bitcoin provides is wanted in the world and is not currently being provided by physical gold.

That said, bitcoin’s status as a risk-off asset like gold remains unproven. Bitcoin still tends to follow the stock market more than it follows gold.

Is digital gold better than physical gold?

For some jobs, digital gold is much better than physical gold. For other jobs, physical gold is much better than digital gold.

Physical gold is not going away. But over time, digital gold will continue to get better while physical gold will remain exactly the same. This is how software works.

Not only is bitcoin software, but it is also a network—and networks have some very interesting properties. Metcalfe’s law says that the value of a network is proportional to the square of the connected users of the system. While the exact calculation as it applies to Bitcoin is debatable, the key result is that the Bitcoin network has increasing returns. This means that the bigger the network gets, the more value it provides to each individual participant. This positive feedback loop creates a natural monopoly that over time is virtually impossible to compete with.

If this is true, how did we get to where we are today? And what will happen to the markets for gold and bitcoin over time? Will bitcoin replace gold? Will another cryptocurrency replace bitcoin?

We'll answer these questions and more in our next and final post in the series.

Did you like this article? Subscribe now to get content like this delivered free to your inbox. Learn more about what I do: https://andyjagoe.com/services/

What everybody ought to know about gold and bitcoin

- Part 1: Gold as a product

- Part 2: Bitcoin as a product (this post)

- Part 3: The future for gold and Bitcoin

—

Photo: Ajay Suresh

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, Software Eats Money has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.