A map to the crypto landscape

A 30,000 foot view of crypto, broken down by category, with key definitions and resources.

The crypto landscape is deceptively large. People ask what I recommend they read to get familiar with the space. Invariably, I point them to Dan Romero's list of 30 key crypto articles.

But as valuable as these articles are, they don't provide a useful mental map to categorize the broad spectrum of crypto projects and activities.

Today we're going to take a 30,000 foot view of crypto generally, broken down by category, and with key definitions and links to additional resources.

Bitcoin

Digital, programmable gold (BTC)

Bitcoin is a decentralized global cooperative that provides a long term store of value monetary platform for the world.

To understand Bitcoin, you must understand gold. A useful primer is my article Analysis of Gold as a Product. Bitcoin does a number of gold's jobs-to-be-done, and does them 10x better. However, there are jobs gold does that bitcoin does not do, and may never do. You can read more in my article Analysis of Bitcoin as a Product.

Despite the fact that understanding gold is important to understanding bitcoin, thinking about bitcoin in the context of gold is like thinking about Uber in the context of taxis. For a long time, bitcoin has looked like a toy. But in the same way that the SONY walkman did not compete with high-end speaker systems, bitcoin does not compete with gold. It competes with non-consumption. Bitcoin is software, a multi-sided network with increasing returns. And so it gets better at an increasing rate. This is why bitcoin will be bigger than you think.

That said, there are some people who believe bitcoin will replace all money. They are referred to as bitcoin maximalists. If bitcoin were to replace all money, it would cause more problems than bitcoin maximalists claim "sound money" would solve. I talk about this in Can Bitcoin Compete with the Dollar?

You can read How to Value and Invest in Money for my in-depth analysis of bitcoin as an investment. Other good introductory resources include:

- Case Bitcoin: macro metrics, charts and key papers.

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money: Good book for insights into early bitcoin.

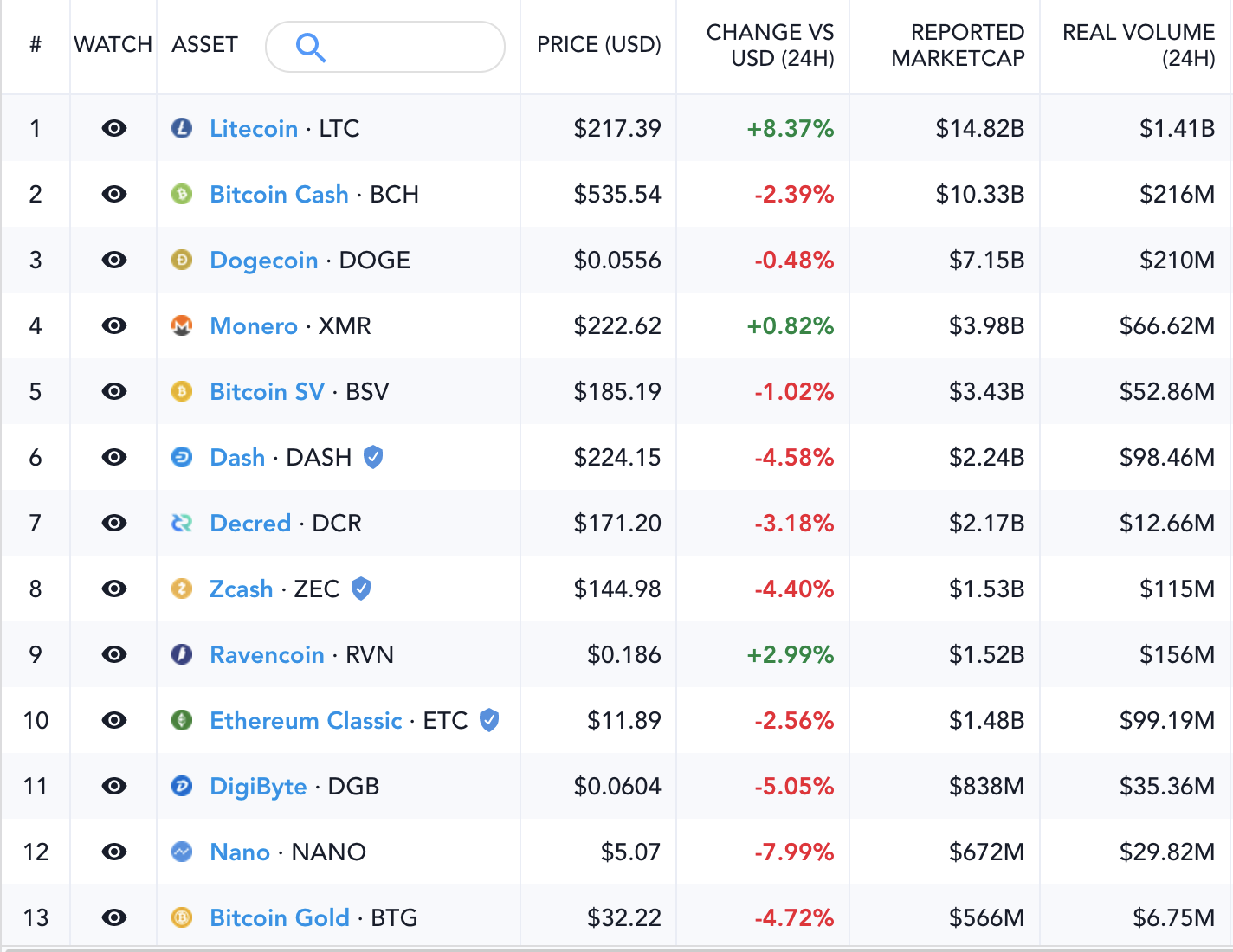

Bitcoin stands alone in the store of value money category. The only potential competition it has is from Ethereum, which we will come to in a minute. Beyond ETH, the native asset of Ethereum, there are countless other crypto monies trying to compete with bitcoin. Aside from a few privacy focused-coins like Monero and Zcash, none are worth paying attention to at this time, despite their market caps:

Unfortunately for Zcash and Monero, their impressive technical innovations are more likely to become features of the Bitcoin ecosystem than to be a moat or sufficient reason to switch.

Ethereum

The parallel financial system and so much more

Whereas Bitcoin is a single decentralized global cooperative that provides a long term store of value monetary platform for the world, Ethereum is a protocol for decentralized global cooperatives.

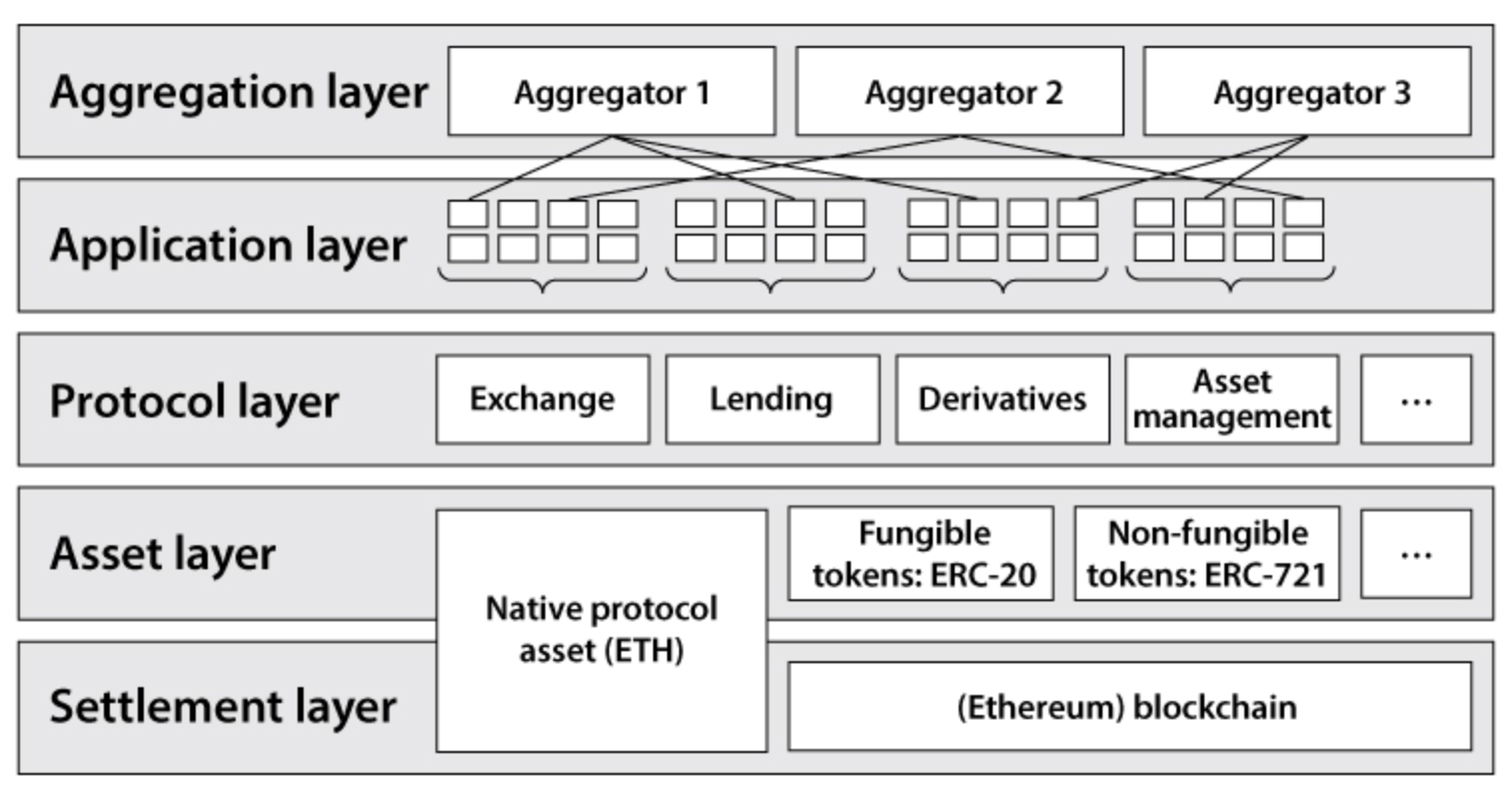

Most interesting applications in crypto are built on Ethereum, including decentralized finance, stablecoins, NFTs, synthetics and Web3. It's important to note that these applications are completely dependent on Ethereum to operate, in the way the Internet is dependent on TCP/IP to operate.

Most people couldn't explain what TCP/IP does or how it works, and the same is true for Ethereum. Bitcoin has a simple narrative about digital gold. Ethereum has a much more complicated narratives, and so is harder for people to understand.

In What is a crypto asset, anyway?, I talked about how it's important to categorize crypto assets by their asset superclass in order to know how to value them. After the upgrade to Ethereum 2.0, ETH, the native asset of Ethereum, will be the only asset that fits into all three asset superclasses: capital asset, consumable / transformable asset, and store of value asset. This is why ETH is sometimes called the triple point asset. Unfortunately, this narrative does not make Ethereum easier to understand for most people.

Another narrative describes Ethereum as the protocol sink, or the place of convergence that orders independent, chaotic things into a singular and ordered pattern of dependable and predictable outcomes.

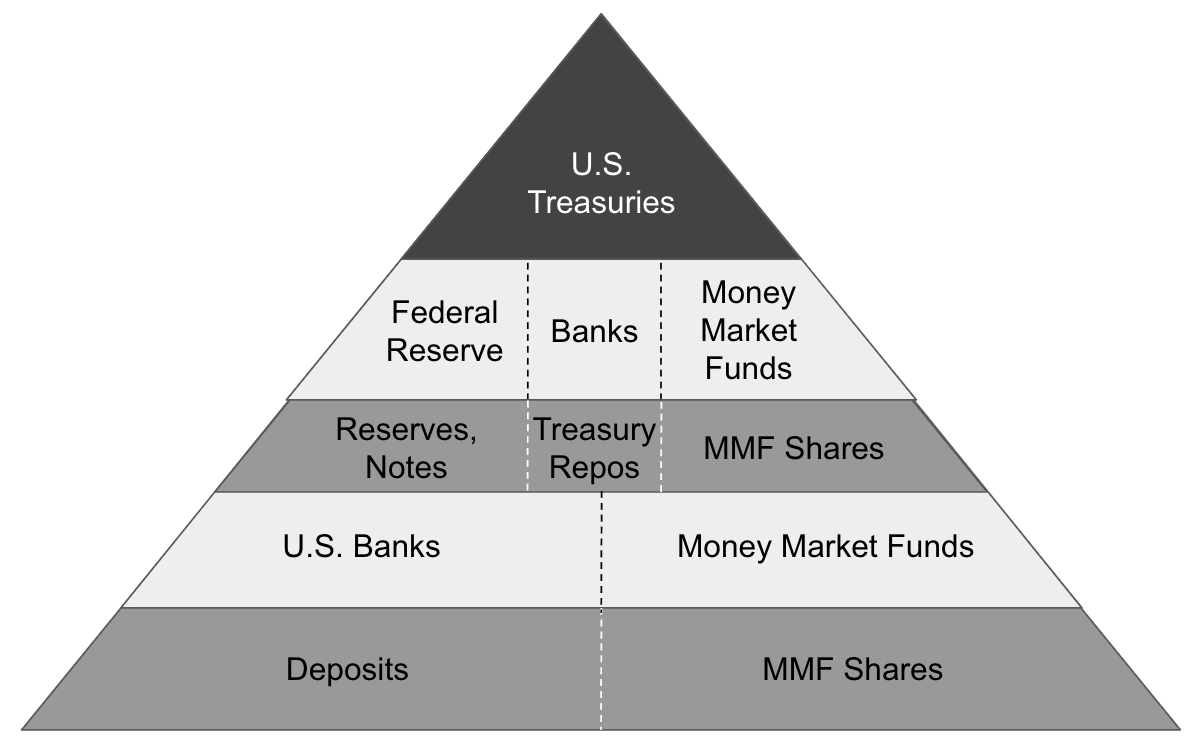

One good way to think about Ethereum is as the base layer of a protocol stack of financial primitives, with each layer dependent on the layer(s) above it, and all layers dependent on Ethereum. From this perspective, in many ways, it's not different conceptually than the current U.S. layered money pyramid I talked about in What everybody ought to know about money:

Ethereum is the layer one money in the virtual Ethereum global economy, just as U.S. treasuries are the layer one money in the U.S. economy. With the Ethereum 2.0 upgrade, ETH can be staked and will pay interest, just as Treasuries do. Subsequent layers in the Ethereum layered money pyramid will do everything and more that the current layers in the U.S. layered money pyramid do.

Which begs the question, will Ethereans quietly provide a real working parallel global financial system solution while Bitcoiners are noisily "opting-out" and trying to return to a variation of the gold standard that silently redistributes wealth to early adopters while punishing debtors with deflation?

Only time will tell.

As Ryan Selkis, CEO of Messari says, "Bitcoin holders have always been Spartans to Ethereum’s Athenians. They eat meat, they’re mean, and they’re specialists at war. The Ethereum community has more diversity and social awareness, I think, which is great for a platform. But that’s bad for weaponry like state-independent money." You might have noticed my map to the crypto landscape is loosely based on Greece, with Bitcoin where Sparta was and Ethereum where Athens was.

While maximalism might be great for memes, pumps and twitter, the real world is not black and white, and binary outlooks are usually naive and sophomoric. Vitalik Buterin, the primary founder behind Ethereum, explains as much when he talks about why he leans toward a concave rather than convex disposition.

Bitcoin's path towards digital gold makes sense and is achievable. Success there does not automatically translate into everyone being paid in bitcoin, stores pricing in bitcoin, or bitcoin securing the world economy. Bitcoin and Ethereum are more likely to coexist than cannibalize each other. The jobs they do are different.

A final thought on why over time people may buy and hold ETH more than BTC comes from Fred Wilson, partner at Union Square Ventures, who says, "I have come to believe that developer adoption is the single biggest value driver in software":

There is no question today that Ethereum has captured the imagination of developers and is the primary place new projects are being developed.

For a great history of how Ethereum came to be, I highly recommend Camilla Russo's book The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with Ethereum.

Decentralized Finance (DeFi)

Money Legos

A few years ago I wrote The Future of Finance is Self Driving Money, where I talked about what consumers want for their personal finances, even if they do not know it yet and might not be able to articulate it.

Unfortunately, banks won't give it to them because banks don't optimize for a metric that measures customer value, as I explained in How to beat the bank. This is the root cause behind the decentralized finance (DeFi) movement to build a separate and parallel financial system. This is distinctly different to what fintech companies do, which is really just innovating around the edges of the existing financial system, as I explained in How software eats money.

The result is a highly modularized stack of financial primitives for building virtually any financial service imaginable, often referred to as money legos.

This new ecosystem fundamentally changes financial services as we know them, and explain why the Wallet is the New Bank when we shift from today's centralized financial services to tomorrow's decentralized ones. This will happen because crypto networks collapse the cost of large scale network coordination, as I explained in The Shocking Truth About Crypto.

Of course, these changes do not impact just financial services companies, they impact all companies whose business model is based on monetizing proprietary data. This is why I wrote Wallets are Bigger than Money. This area of crypto is called Web3, which we'll come back to below.

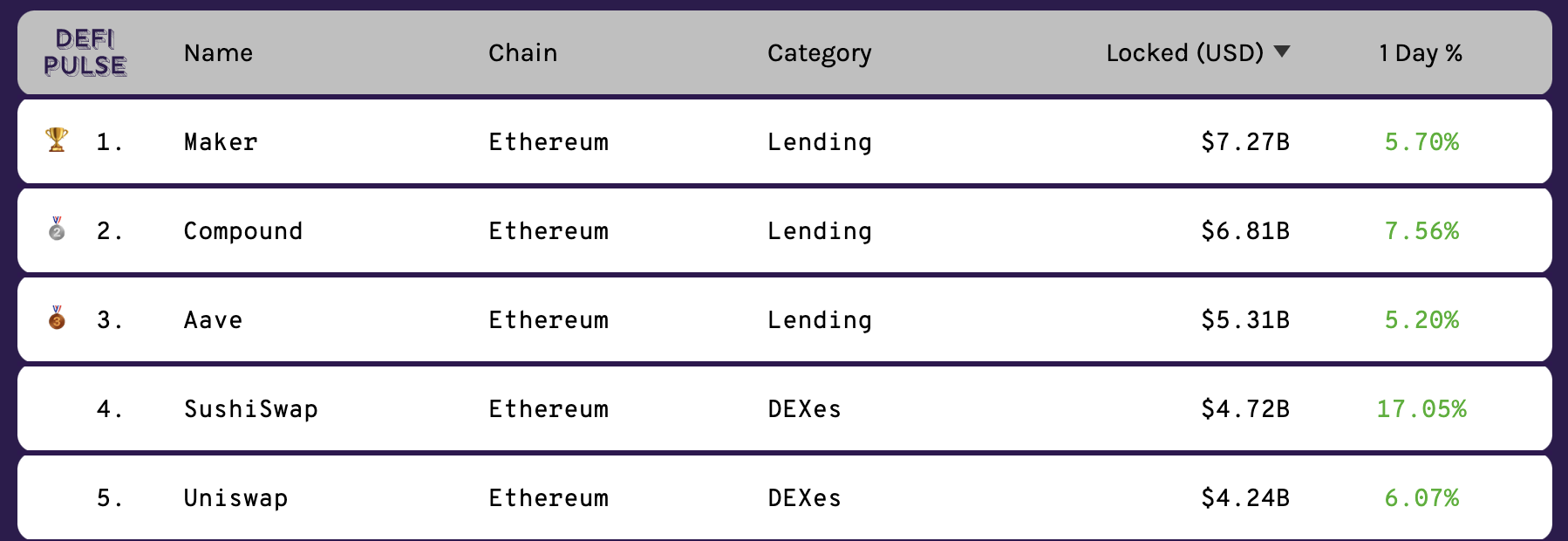

A great place to see top DeFi protocols and analytics is called DeFi Pulse:

For a quick beginner's overview of DeFi, I recommend this article and the excellent DeFi explainer videos from Finematics, especially this one. For a more thorough and technical overview, a surprisingly good overview of DeFi was published by the St Louis Fed. Finally, Multicoin Capital published a very detailed guide to the DeFi stack, though it assumes general familiarity with crypto and DeFi.

Most DeFi applications today are marketplaces, and marketplaces are hard. Here are 11 metrics for DeFi marketplaces to evaluate their health and to analyze their business performance and investment suitability.

Stablecoins

Reserve currencies for DeFi

In the same way the US economy wouldn't work well if the purchasing power of the dollar fluctuated like BTC or ETH, decentralized finance wouldn't work if you couldn't write contracts in stable currencies, called stablecoins.

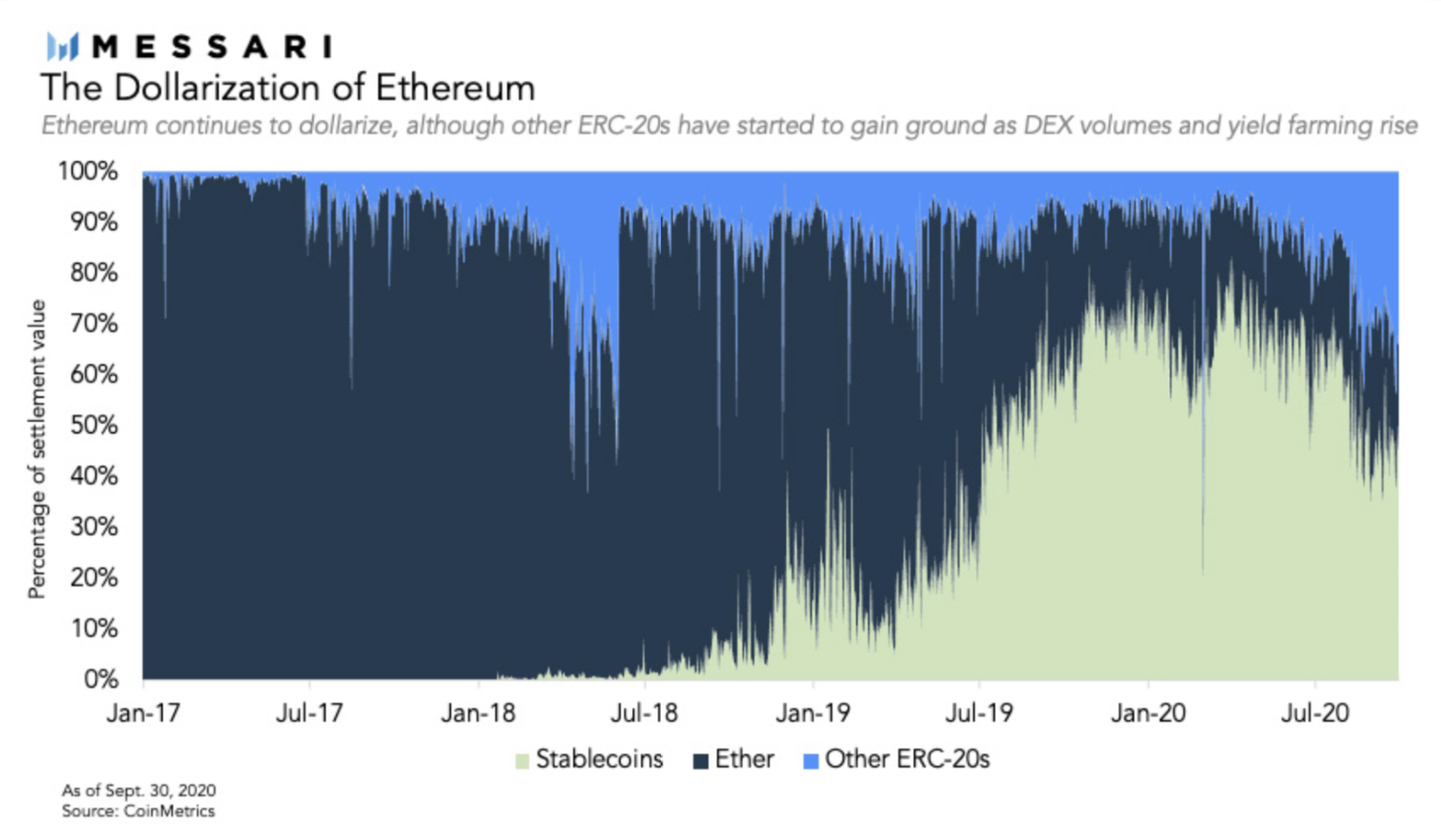

You can see this visually in the way Ethereum has dollarized over the last 18 months, coincident with the recent growth of DeFi:

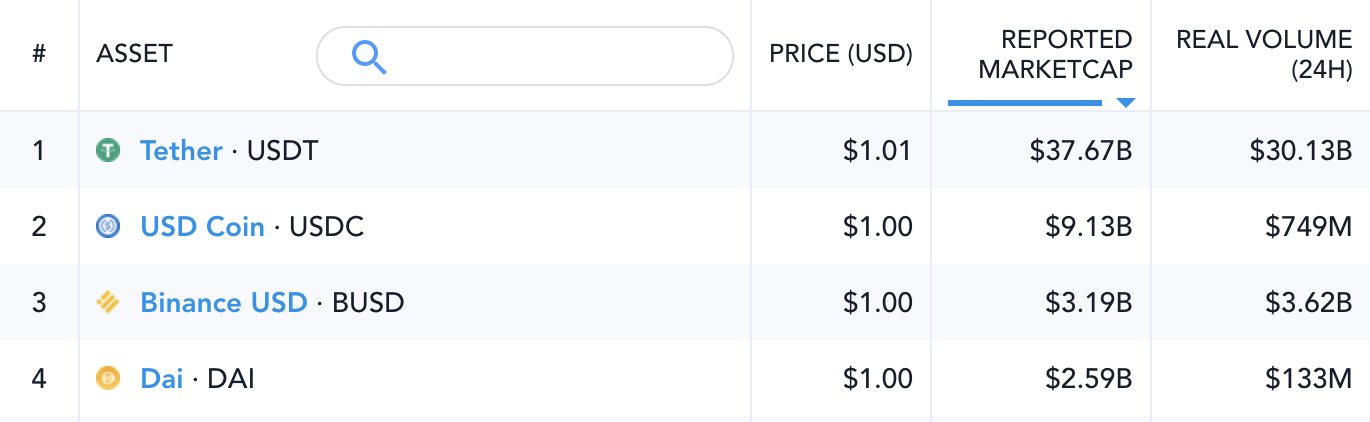

Most stablecoins are pegged to the dollar, and so are also called cryptodollars. The most common cryptodollars are Tether (USDT), USD Coin (USDC), Binance USD (BUSD) and DAI, though there are many others, and more are emerging all the time:

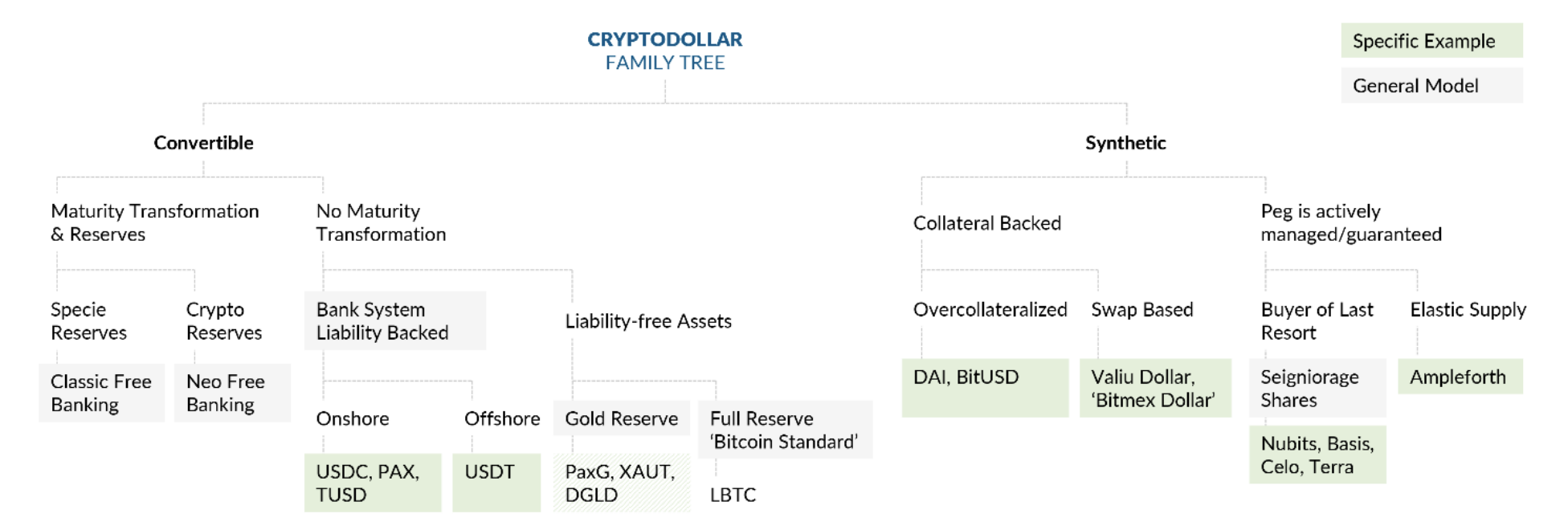

There are three main types of stablecoins: commodity backed, algorithmic / crypto collateralized, and non-collateralized. Nic Carter from Castle Island Ventures has an excellent report on cryptodollars, where he explains their taxonomy and how they're being used in detail.

Of course, the ultimate stablecoins could one day be central bank digital currencies (CBDCs). China is already running a large scale pilot of its CBDC, and the majority of central banks are exploring CBDCs as well.

CBDCs and similar large-scale changes to the monetary system have profound implications for not only banks and financial services, but individuals everywhere. This might be destabilizing. I explore this in my article The Internet of Money.

Synthetics

Derivatives and accessibility

Synthetic assets are financial instruments in the form of Ethereum smart contracts that track and provide returns of another asset without requiring you to hold that asset.

Synthetix is a protocol for issuing synthetic assets on Ethereum and supports trading synthetic gold, silver, crypto assets, and major fiat currencies and stock indexes. It also supports trading synthetic inverse crypto assets to take short positions in crypto assets. These synthetic assets are available to trade on a decentralized exchange called Kwenta.

Cross-protocol swaps

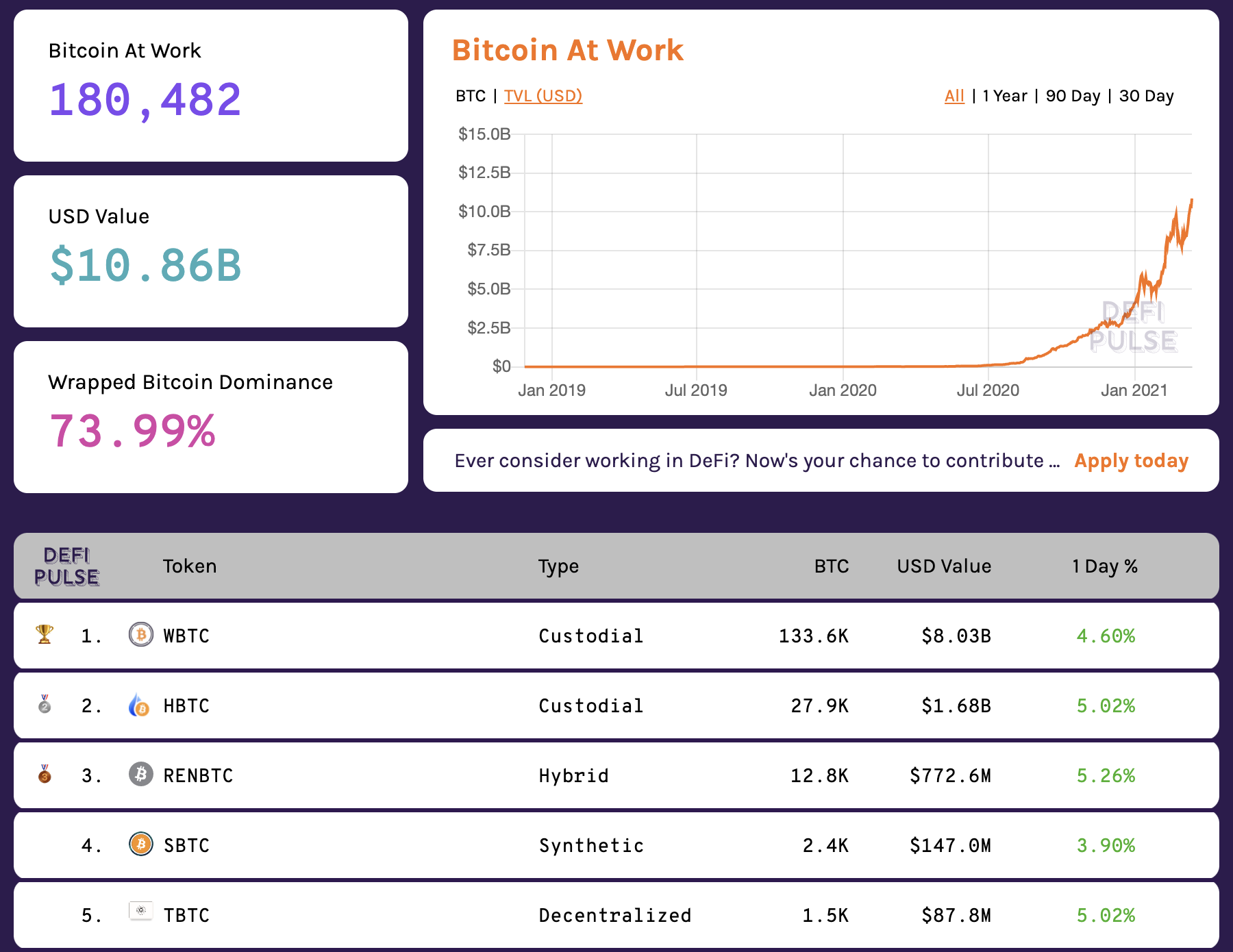

Another use for synthetics is in cross-protocol swaps. For example, a user holding BTC can "wrap" it using a variety of protocols and receive a "wrapped BTC" asset that can then be used on Ethereum or another blockchain. The reason someone might do this is because they want to use the value of their BTC in a DeFi application but don't want to sell their BTC and either reduce their BTC exposure or face the tax consequences. Here is a recent snapshot of BTC being used on Ethereum:

A good article to learn more is Tokenizing Bitcoin on Ethereum.

Prediction Markets

Prediction markets allow you to bet on the outcome of a future event. Crypto prediction markets have had a bit of a slow start, but may gain traction as they get easier to use and as crypto becomes more widespread. Interesting projects in this space are Augur, Gnosis, and Polymarket.

One of the best reads is Prediction Markets: Tales from the Election by Vitalik Buterin, where he talks about how he was able to take a large position against Trump winning in December, 2020, long after the election was over.

Exchange Tokens

Crypto infrastructure companies, like the centralized exchanges Binance (BNB), Huobi (HT), OKex (OKB), and FTX have created their own exchange tokens that provide discounts on trading fees and which the companies "buyback and burn" to boost the value of the token based on quarterly performance of the associated company:

Multicoin Capital has an interesting investment thesis around exchange tokens that's worth reading.

On-chain indices

It's never been easier to create an index and be an asset manager. Set Protocol's $DPI tracks a market cap weighted basket of "blue chip" DeFi stocks for a 1% annual fee. PieDAO operates another suite of DeFi indices, which charge similar fees. Enzyme Finance enables money managers to easily create and operate their own crypto hedge funds (I wouldn't do this without legal advice).

Non-Fungible Tokens (NFTs)

Securitized, digitized IP

A non-fungible token (NFT) is a digital file whose unique identity and ownership are verified on the public blockchain. NFTs are "one-of-a-kind" and are not mutually interchangeable the way other crypto assets are.

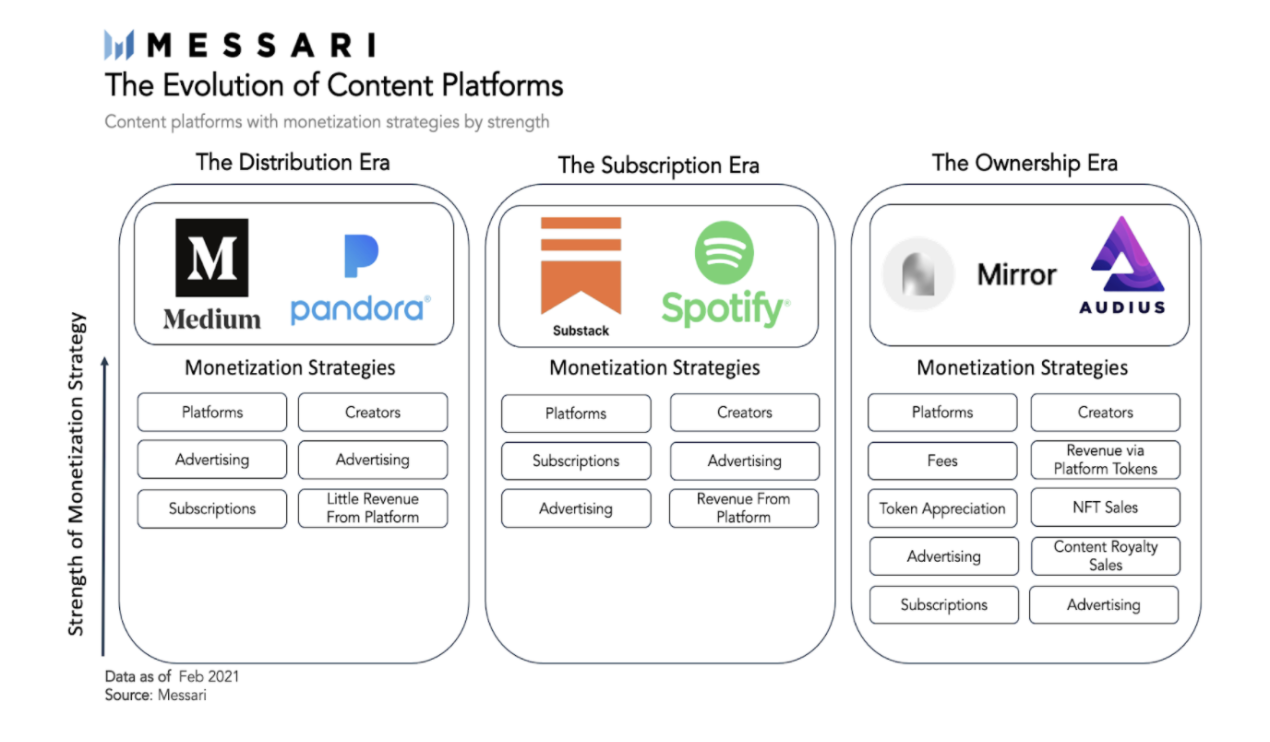

The reason NFTs are so important is that they enable and enforce business models that were previously unavailable to content creators:

NFTs have recently been picked up by mainstream media and are being talked about broadly, perhaps in large-part do to the popularity of NBA Top Shots and Beeble's eye-popping $69 million art sale at Christie's.

The Wall Street Journal did this explainer, and Mark Cuban, Internet entrepreneur and owner of the Dallas Mavericks, has recently appeared on several podcasts in support of NFTs and crypto generally.

Major categories of NFTs include:

- Art

- Digital trading cards and collectibles

- Gaming virtual goods

- Domain names and certificates of authority

- Content

- Financial products that are not interchangeable (e.g. your mortgage)

- Tokenized luxury goods

- Event tickets

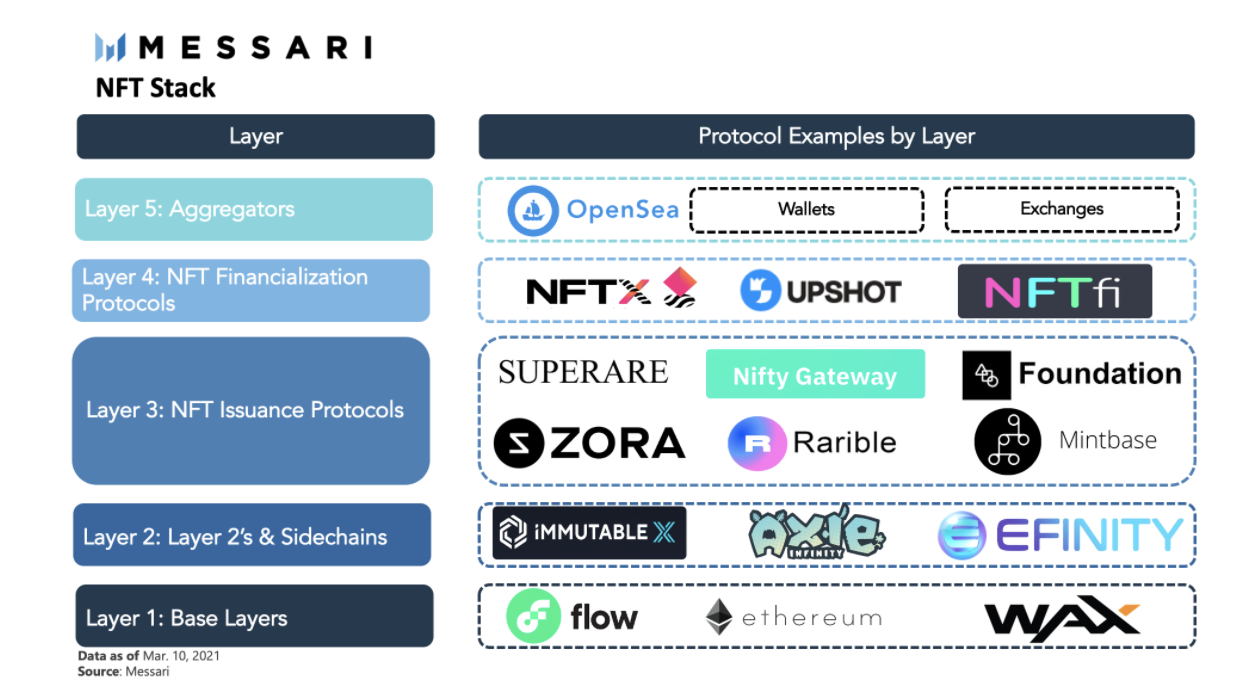

The NFT protocol stack looks like the following:

If you want to understand more about the basics of NFTs, here is a good introductory article: Explain It Like I Am 5: NFTs.

If you want to understand why NFTs are actually valuable, Albert Wenger has a short thought experiment that is helpful.

Web3

The Decentralized Web

Web3 may be the most nascent area of crypto, getting far less attention than Bitcoin, Ethereum and high profile DeFi projects. Naval Ravikant describes blockchains as the third epoch of the Internet, after web and mobile, but this might not capture the full gravity of a new technology market cycle that collapses Big Tech's proprietary data business model through the creation of minimally extractive cooperative marketplaces: emerging economies that only produce one service. I wrote about this in the Shocking Truth about Crypto.

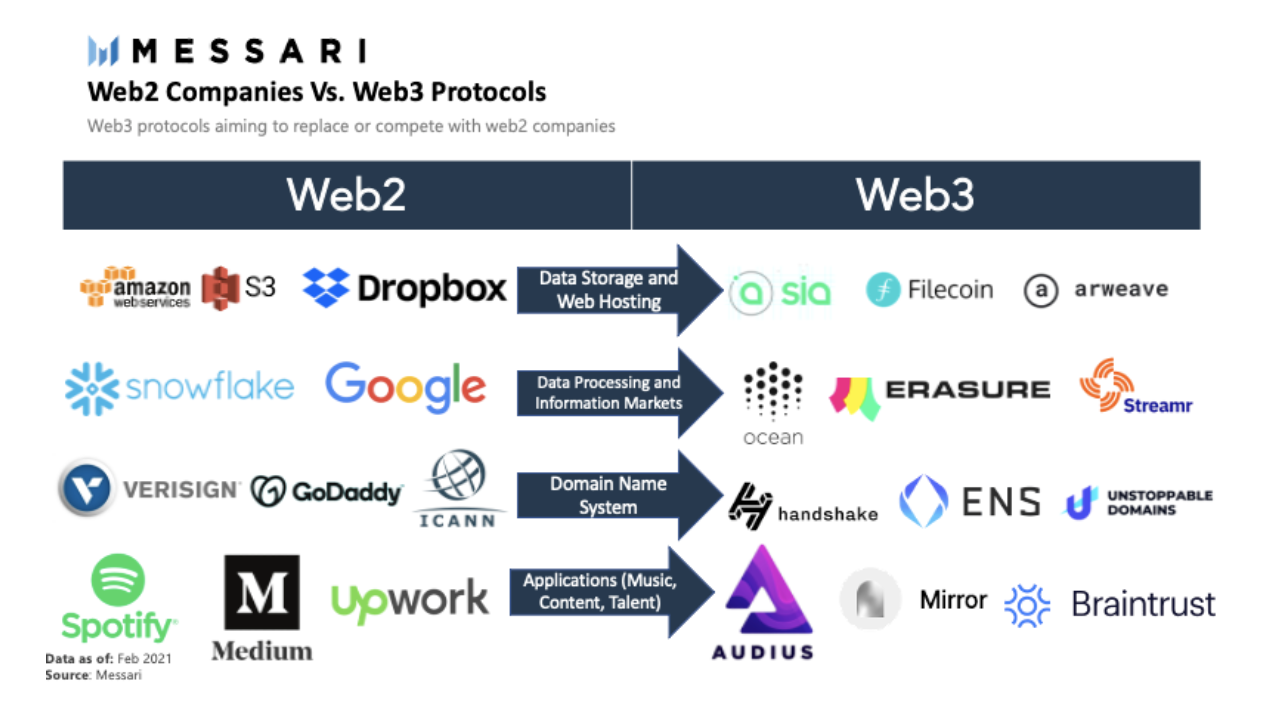

Early examples of web3 equivalents to web2 companies are:

A good read to understand the basics of what's emerging in Web3 is Messari's Explain it Like I am 5: What is Web3?

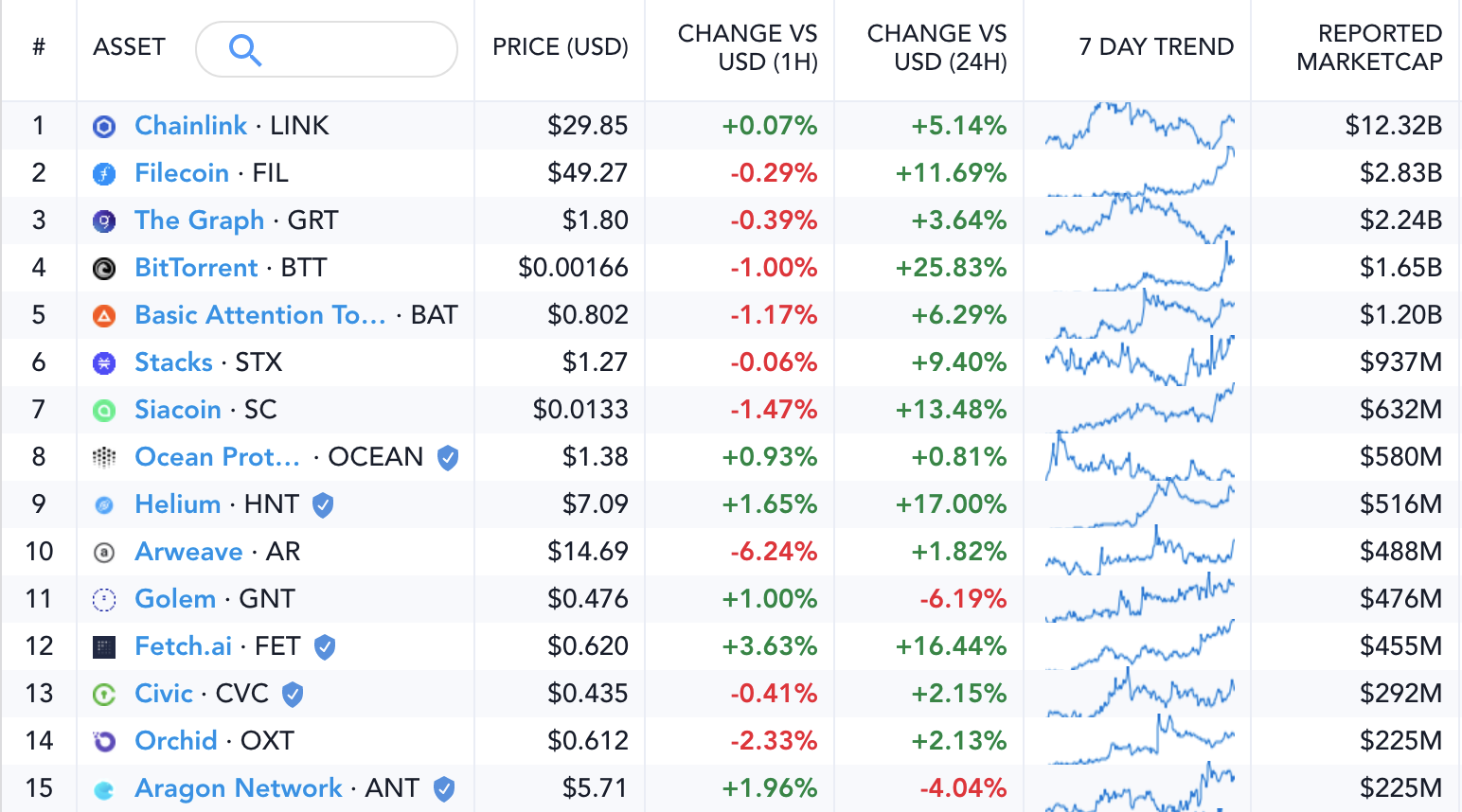

Below is a list of top Web3 projects by market cap:

Some of the more interesting ones include:

- Chainlink: a decentralized oracle network that provides real-world data to smart contracts on the blockchain

- Filecoin: a decentralized cloud storage network based on blockchain technology

- The Graph: a decentralized and open-source indexing protocol for blockchain data

- Aragon Network: a decentralized governance protocol for public blockchain projects

This said, most companies in Web3 are still in the very early days and have limited traction.

Did you like this article? Subscribe now to get content like this delivered free to your inbox. Learn more about what I do: https://andyjagoe.com/services/

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, Software Eats Money has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.